Mastercard aims to cancel manual card entry by 2030

Payments Dive

NOVEMBER 15, 2024

The card network has documented a spike in online fraud, and contends that numberless cards will reduce such wrongdoing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

NOVEMBER 15, 2024

The card network has documented a spike in online fraud, and contends that numberless cards will reduce such wrongdoing.

PYMNTS

JANUARY 25, 2021

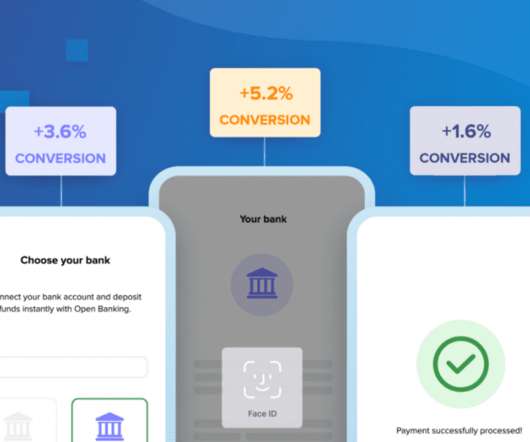

According to Ossama Soliman , chief product officer at open banking provider TrueLayer , the very fact that there are so many payment options pushes new entrants to differentiate themselves from the pack. “It But actually, it raises the bar for what it takes to add a new payment method into the checkout.”. 26) in the U.K.,

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 7, 2023

The gunman in a 2019 attack at an El Paso Walmart store likely used a credit card to buy his gun online. This story is one in a series of pieces tracking payment methods for guns used in mass shootings.

Payments Dive

JANUARY 4, 2021

general manager at Paysend and has nearly 30 years of financial services experiences, most recently serving as president of Catalina Card Services. He founded and led AccountNow, the first online D2C prepaid debit card company in the U.S., Matt Montes is U.S. which was acquired by Green Dot Corporation.

Payments Dive

MARCH 28, 2023

Global credit card transaction value rose both online and in stores last year, despite an earlier FIS projection of a decline.

Payments Dive

APRIL 12, 2019

Mobile payment acceptance is leading to rapid change in the restaurant industry, impacting everything from credit card use to delivery and online ordering as well as customer loyalty.

PYMNTS

NOVEMBER 23, 2020

23) that they have entered a strategic partnership to launch Visa Commercial Pay, billed as a suite of B2B payment solutions for enterprises making the shift to digital transactions, and, specifically, virtual cards — and away from paper-based manual processes. The shift to digital payments has been gaining momentum.

Payments Dive

AUGUST 2, 2024

“In the aftermath of the CrowdStrike outage, Congress and state lawmakers should look for opportunities to build backups and redundancies into critical online systems,” writes a payments consultant.

PYMNTS

DECEMBER 4, 2020

Morgan Merchant Services’ combined in-store and eCommerce payments were up 15 percent over last year’s Black Friday weekend, “a sign that the pandemic did little to curtail spending as the holiday shopping season began,” Doug Smith, executive director of J.P. 1 eCommerce payment processor in the U.S. As the No. trillion, J.P.

PYMNTS

JANUARY 19, 2021

Corporate buyers are quickly shifting their purchasing habits online, and seeking more efficient experiences from product sourcing through to checkout. With B2B eCommerce proliferating, the market is rapidly evolving to make way for new business and payment models in response to customer demand. Tying Payments With Loyalty.

PYMNTS

SEPTEMBER 18, 2020

Online marketplaces are the digital storefronts helping small to mid-sized businesses survive — but adding real-time settlement into the mix can help them thrive. And 60 percent of surveyed firms selling across online marketplaces would take their business to one that offers real-time settlement.

PYMNTS

OCTOBER 2, 2020

Amazon India has introduced a way for customers to pay their credit card bills through Amazon Pay , the eCommerce company’s payments arm. The feature allows making payments for any credit card bill via UPI or internet banking. “As Today, it offers a credit card and processes payments for customer bills.

Payments Dive

JUNE 23, 2023

The online broker said it agreed to acquire the credit card business for $95 million. X1 doesn’t charge card holders annual or late fees, but does charge interest.

PYMNTS

NOVEMBER 16, 2020

Now comes the work of embedding touchless payments anywhere and everywhere people might want them. In Beyond the Card: Toward the Cardless and Contactless Future , a PYMNTS and i2c Inc. Physical cards are changing form, as some NFC-capable mini-cards are being embedded in rings and other wearables. told PYMNTS.

PYMNTS

JANUARY 12, 2021

Historically, corporate travel and expense ( T&E ) management has been viewed as an entirely separate function from other B2B payment workflows. As a result, the lines that once separated T&E from other B2B payment workflows are blurring, according to Conferma Pay CEO Simon Barker and Barclays President of Payments Marc Pettican.

PYMNTS

SEPTEMBER 29, 2020

New payment rails are once again in the spotlight as real-time payments and cryptocurrency emerge as the top focuses for innovators. In this week’s look at payment rails innovation, the European Union begins paving the way for greater crypto adoption, while Mastercard expands its own crypto accelerator initiative.

PYMNTS

SEPTEMBER 23, 2020

That left FIs scrambling to “rapidly figure out how to get that same emotional and engagement outcome when the possibility of face-to-face is virtually nonexistent,” Randy Piatt , head of product solutions at card technology firm Ondot Systems , told PYMNTS in a recent conversation. Simple: Start with the cards.

PYMNTS

DECEMBER 14, 2020

The 2020 holiday shopping season is picking up, and consumers are heading online or to reopened brick-and-mortar stores to shop and pay for gifts. They are using everything from cash to mobile wallets to complete these transactions, requiring retailers to race to accommodate a wide variety of payment methods.

Perficient

JANUARY 24, 2023

When a non-financial firm offers embedded banking, they offer a branded checking account to hold funds and make payments for the betterment of the company and its clients or workers. As a baseball card collector since childhood, I remember when eBay opened its URL back in 1995. Baseball card heaven for both buyer and seller.

PYMNTS

AUGUST 6, 2020

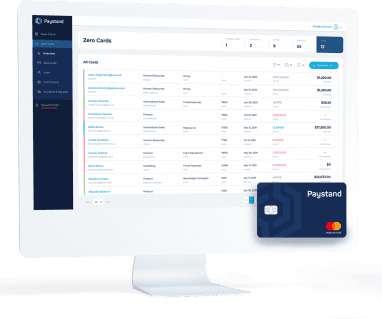

Goodbye, corporate expense cards and hello, “Zero Card?”. 6) rolled out its new Zero Card , a touchless, pre-paid, digital corporate expense card that the California FinTech is hoping will give the traditional corporate expense card a run for its money. Paystand on Thursday (Aug.

PYMNTS

AUGUST 14, 2020

“Prior to COVID-19, we were telling people that over the next five years, remote-commerce, card-not-present transactions will exceed in-store, card-present transactions,” Mendlowitz said. The Challange With Card-Not-Present Transactions . The card networks have also confirmed that 3DS 2.0

PYMNTS

SEPTEMBER 23, 2020

23) announcement that the card is now available in France, Austria, Italy, Ireland and Spain beyond its current availability in the United Kingdom, Germany and the United States. percent cash back on all of their eligible spending with the debit card. The companies said in a Wednesday (Sept. In the U.S.,

PYMNTS

DECEMBER 11, 2020

Digital has certainly advanced further and faster than anyone predicted at this time last year, and the ground that’s been taken is unlikely to ever be surrendered back, Helena Mao , vice president of global product strategy for payment solutions at Blackhawk Network , told PYMNTS in a recent conversation. “I Digital Gift Cards ’ Growth.

PYMNTS

DECEMBER 15, 2020

Barclaycard is launching a new program, Barclaycard Precisionpay Go, to let companies issue virtual cards for employees' online purchases, according to a press release. Visibility will be available as soon as a payment is made, as well, and users can upload receipts alongside the transactional information in the SNAP reporting program.

PYMNTS

DECEMBER 16, 2020

Digital sports entertainment and gaming industry platform DraftKings — known for its top-rated daily fantasy sports and mobile sports betting apps — today announced an agreement with InComm Payments , a global leading payments technology company, to launch an industry-first retail gift card. .

PYMNTS

JULY 1, 2020

A group of big European banks is planning to challenge Visa ’s and Mastercard ’s positions as the world’s two largest payment processing networks, Electronic Payments International reported. . A so-called “scheme manager” will be the central governing body, the online news service reported.

PYMNTS

DECEMBER 7, 2020

Most are encouraging employees to work from home while also moving their back-office operations online, and payments operations are no exception. Around The B2B Payments For The Virtual Workforce World. The benefits of using digital B2B payments solutions extend far beyond their ability to support a decentralized workforce.

Payments Dive

OCTOBER 4, 2022

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

PYMNTS

SEPTEMBER 29, 2020

A new Mastercard initiative aims to improve online transaction clarity so that customers can know exactly who they purchased from, according to a press release Tuesday (Sept. With greater digital dependency, having real-time purchase details is critical for consumers, merchants and card issuers alike,” he said, according to the release. “We

Bank Innovation

MAY 18, 2017

Consumers can now use their Google credentials to make online and mobile payments via a stored credit card. The tech giant unveiled the tool yesterday, during its annual I/O developer conference in Mountain View, Calif.

PYMNTS

JULY 26, 2020

India has embraced its model for digital payments so much that it intends to take it global. Since its debut four years ago, India’s Unified Payments Interface (UPI), the instant payment system developed by the National Payments Corp. There are people in villages needing assistance payments.

PYMNTS

SEPTEMBER 20, 2020

Cape , a new Australian FinTech made up of professionals in finance, is debuting its new “recession fighting” credit card, powered by open banking and intended to allow access to new functions like buy now, pay later (BNPL), according to a report from AltFi. Common plans offer four-installment payments as ways to buy items.

PYMNTS

DECEMBER 10, 2020

It has been suggested that millennials are averse to having and using credit cards. Millennials are in fact as likely as other generations to have credit cards, with nearly nine out of 10 having at least one card, according to PYMNTS’ latest research. consumers, that were conducted in March and September.

PYMNTS

NOVEMBER 16, 2020

Real-time payments continue to gain traction around the world. The country’s banking system is giving an upgrade to its instant payments system. Called PIX , the new payment rails have been in the works for some time and launched last week. Case in point: Brazil. It will be fully operational starting Monday (Nov.

PYMNTS

JULY 15, 2020

Apple Card — the iPhone-based credit product launched last summer by Goldman Sachs , Apple and Mastercard — is expected to be a hot topic on Goldman’s earnings call Wednesday (July 15). To use Apple Pay, customers tap the card icon in the Afterpay app, which then activates the Afterpay card in the Apple wallet.

PYMNTS

SEPTEMBER 23, 2020

As demand increases for digitally-driven money management solutions, Mastercard has expanded its Digital-First Card Program in North America. Consumers also have fast digital access to card information, including the 16-digit number, CVC2, expiration date and customer service information. and increasingly, also for commerce.” .

PYMNTS

OCTOBER 1, 2020

The great digital shift is transforming credit cards into money management tools. Consumers want cards, and they want them quickly, and they want those cards [delivered] in a digital way," said Turner. The company said that through the expansion of its Digital-First Card Program, which was announced last Wednesday (Sept.

PYMNTS

NOVEMBER 6, 2020

COVID-19 has shifted consumers away from card-based payments experiences, while P2P has accelerated a change enabling merchants to own the payments experience itself, Debbie Guerra , executive vice president of merchant and payments intelligence solutions at ACI , told PYMNTS in a recent interview. Payments Flexibility

PYMNTS

SEPTEMBER 22, 2020

For small, mom-and-pop retailers, complex or proprietary procurement platforms simply aren't in the cards. With the pandemic accelerating businesses' digital shift , small retail buyers have shifted their buying operations to the B2B eCommerce realm, and for many, the online marketplace operates in lieu of a procurement solution.

South State Correspondent

OCTOBER 16, 2024

While there are many overlooked products in banking, the debit card is perhaps the greatest. The product generates significant fees and helps drive deposit balances, yet debit cards rarely get a mention in strategy, marketing, or customer profitability circles. Debit Card Profitability We will start with debit card profitability.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content