Cash use persists in US beyond pandemic

Payments Dive

JUNE 11, 2024

Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

PYMNTS

SEPTEMBER 18, 2020

Online marketplaces are the digital storefronts helping small to mid-sized businesses survive — but adding real-time settlement into the mix can help them thrive. And 60 percent of surveyed firms selling across online marketplaces would take their business to one that offers real-time settlement.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

JANUARY 28, 2021

It is well known that shoppers tend to behave differently online than they do in brick-and-mortar stores — and this extends to how they choose to pay at checkout. One of the more notable differences is their tendency to favor credit cards online and other options such as digital wallets over debit cards.

PYMNTS

DECEMBER 10, 2020

It has been suggested that millennials are averse to having and using credit cards. Millennials are in fact as likely as other generations to have credit cards, with nearly nine out of 10 having at least one card, according to PYMNTS’ latest research. consumers, that were conducted in March and September.

PYMNTS

SEPTEMBER 29, 2020

A new Mastercard initiative aims to improve online transaction clarity so that customers can know exactly who they purchased from, according to a press release Tuesday (Sept. A study commissioned by Ethoca showed that 96 percent of U.S. A study commissioned by Ethoca showed that 96 percent of U.S.

PYMNTS

NOVEMBER 16, 2020

They have paid down their credit cards. Several studies have validated various spending trends that could make this scenario tenable. The main one centers on the drop in credit card spend. Additionally, total card balances fell to $723 billion, a decline of more than 10 percent year over year and the lowest since Q2 2017.

PYMNTS

SEPTEMBER 30, 2019

A recent study about how people respond to scammers shows that consumers are more likely to become victims on social media and online marketplaces than over the phone, The Wall Street Journal reported on Sunday (Sept. The gift cards are sold at a discount in exchange for cryptocurrency.

Bank Innovation

DECEMBER 12, 2017

The total number of card payments across the globe will reach 483 billion by 2022, more than double the rate that card numbers will grow, a study by London-based research firm RBR found. Card payments will more than double by that time with a growth of 56%, according to the study, which was released yesterday. […].

PYMNTS

DECEMBER 7, 2020

Most are encouraging employees to work from home while also moving their back-office operations online, and payments operations are no exception. RLJ Financial On Managing B2B Spend With Virtual Cards. Businesses are doing more than encouraging their employees to continue working remotely, however.

PYMNTS

DECEMBER 10, 2020

With providers such as Bill Me Later / PayPal Credit, Afterpay, Affirm, Klarna and FuturePay all vying for a larger slice of the BNPL pie, as well as further availability through retailers online and in-store, it's no wonder why this payment choice is on the rise. The fact is, shoppers frequently choose BNPL because they like it.

Bank Innovation

SEPTEMBER 6, 2017

Mobile wallet usage is increasing across the globe, but for countries with more fleshed-out credit card networks, that growth is still slow. The study of 6,035 consumers around the […].

Bank Innovation

APRIL 24, 2018

A group that often feels underserved by traditional banks, non-prime consumers are six times more likely to bank at an online-only financial institution compared with […].

PYMNTS

NOVEMBER 27, 2020

More consumers than ever are turning to online shopping channels to meet their needs during the pandemic, but many are also aware that cybercriminals are looking to capitalize on this stepped-up online activity to steal their card data. Firms are also prioritizing security as they transact online more heavily as well.

PYMNTS

NOVEMBER 16, 2020

In Beyond the Card: Toward the Cardless and Contactless Future , a PYMNTS and i2c Inc. Physical cards are changing form, as some NFC-capable mini-cards are being embedded in rings and other wearables. This development is fitting, considering the degree to which commerce has shifted online since the pandemic.

Perficient

MARCH 23, 2021

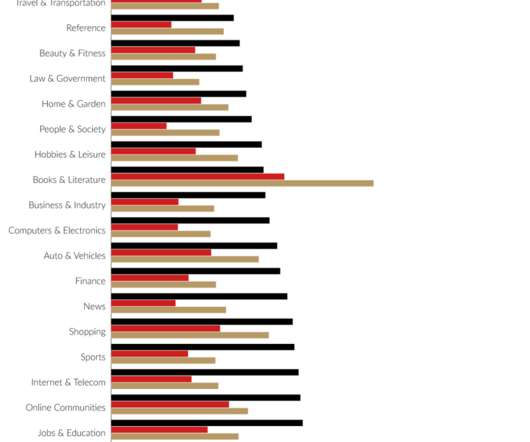

This study is a comprehensive review of mobile versus desktop usage on the web. In this year’s study, we compare 2019 and 2020 traffic patterns in the U.S. The data in this study was pulled from Google Analytics’ Benchmarking feature , which provides aggregated industry data from companies who share their data.

PYMNTS

JULY 28, 2020

consumers did at least some shopping online as of April 11 — a figure that had risen to 35.7 Consumers are also changing how they pay for their purchases, with a recent study finding that debit card spend was up 11.7 Debit cards are also being used to more quickly pay workers who need fast compensation now more than ever.

PYMNTS

DECEMBER 2, 2020

In a year that’s been filled with lifestyle changes, personal pivots and business adaptations, 2020 may also go down as the year of the gift card as studies show an outsized increase in sales leading up to the busy holiday season. InMarket’s data also showed customers were spending about 17 percent more on gift cards in 2020.

PYMNTS

JANUARY 1, 2021

PYMNTS has tracked those changes every step of the way via exclusive research , Tracker reports and studies, starting on March 6, a full 10 days before the country – or large swaths of it – were locked down. And they’re also “the most likely to say they will keep shopping online once daily life returns to normal.”.

PYMNTS

NOVEMBER 22, 2019

It’s been said cybercriminals look for the path of least resistance when they target businesses or online marketplaces to steal data or money. And, increasingly, online gaming platforms — attractive to the bad guys due to their scale and relative anonymity — are in the crosshairs. The tools are there, but mindset matters.

PYMNTS

DECEMBER 29, 2020

Consumers have more heavily leaned on debit during the pandemic, with the economic downturn making shoppers more cautious than ever about the prospect of taking on credit card debt. A recent study even estimates that shoppers could ultimately shift $100 billion worth of annual spending from credit cards to debit cards.

PYMNTS

APRIL 25, 2019

However, according to the Remote Payments Study conducted by PYMNTS in September 2018, behavior habits are shared by consumers based on income, age and gender. The most popular method of discovery by those who paid using mobile was online (13.9 percent) and credit cards (28.7 mCommerce isn’t one-dimensional. More women (54.3

PYMNTS

DECEMBER 22, 2020

Italian consumers are embracing a new government program aimed at boosting retail sales while tamping down on tax evasion that allows buyers to receive a 10% refund on card payments made in stores. Studies have also indicated that the days of businesses using “petty cash” to pay for transactions could be coming to an end.

PYMNTS

JANUARY 30, 2020

Virtual credit cards are one of the more flexible electronic payment methods available, and the world continues its steady march toward greater digital payment use. Virtual cards can improve accounts payable (AP) processes, benefiting both buyers and suppliers by streamlining day-to-day payments, and providing greater control over cash flows.

PYMNTS

FEBRUARY 11, 2019

Consumers won’t be walking up to a cashier after standing in a checkout line to swipe a card when they visit a store. In a world where, as the Census says, 90 percent of retail sales still happen in the physical store, cards rule. It also purchased online pharmacy PillPack , and owns Zappos and fashion eTailer Shopbop.

PYMNTS

MAY 4, 2020

Nearly 50 million credit card customers in the U.S. said they have had their credit limit slashed or their card closed in the past month as lenders move to minimize their risk amid the COVID-19 shutdown, a new study revealed. The sample size was 2,552 adults, including 1,230 adults with personal credit card debt.

PYMNTS

JULY 22, 2020

“People want to be able to pay however they want, including with cards, digital wallets, alternative payment methods and rewards points. A 2018 Ipsos study found that 25 percent of people have abandoned a transaction because their preferred payments provider wasn’t available,” said Jim Magats , senior vice president, omni payments, PayPal.

PYMNTS

DECEMBER 11, 2020

The physical stores still lead, but as the latest PYMNTS latest Omnichannel Grocery Report demonstrates, a growing majority of consumers buy at least some of their groceries online. percent make at least one of their routine grocery purchases online. percent of respondents buy items like cleaning products online, and 28.4

PYMNTS

JANUARY 15, 2021

Brick-and-mortar merchants and online retailers alike often rely on end-of-year sales to generate up to 40 percent of their annual revenues and start the new year on a positive note. consumers were expected to spend more than $190 billion online this season, up 36 percent from 2019, while in-store commerce was predicted to fall by 4.7

BankBazaar

NOVEMBER 29, 2019

Unlike baby boomers who aren’t much open to borrowing credit, recent studies have revealed that millennials are avid borrowers and spenders. They are more open to taking loans or relying on Credit Cards to fund their online purchases, holidays, weddings and more. Your Credit Score is the secret to a smooth financial life.

PYMNTS

NOVEMBER 13, 2020

Multifactor authentication (MFA) and biometric scans are quickly becoming the norm in numerous fields, including online accounts for banks and other businesses. One study found that these apps will outnumber phy sical identity cards by 2023, with this trend being driven largely by national ID programs in emerging markets.

Perficient

FEBRUARY 17, 2023

Embedded Payments A 2022 study published by the Federal Reserve Bank of San Francisco noted that app payments increased as a percentage of total consumer purchases from 11% in 2019 to 15% in 2020, to 29% in 2021. At just 4 cents per transaction, the fees to the merchant are far less than the 2% to 3% fees charged by credit cards.

PYMNTS

NOVEMBER 19, 2020

Today in B2B payments: Visa collaborates to open up small business banking data, while Mastercard drives commercial card adoption across the MEA region. Mastercard, Network International to Introduce Commercial Cards in MEA. Amex Study: Social Media Shout-Outs Could Pump $197B Into SMB Economy. 18) press release.

PYMNTS

OCTOBER 27, 2020

While contactless payment methods in the form of mobile wallets and contactless cards are both becoming more common features, our consumer-survey data strongly indicates while that’s better than making consumers dip their cards, it’s not quite the gold standard when it comes to giving consumers hands-off options for payments.

PYMNTS

NOVEMBER 12, 2020

There’s also the safety of using debit in contactless payments, he said, where issuers had, fortuitously from a timing perspective, accelerated their issuance of contactless cards coming into 2020 and before the age of COVID-19. Card and digital transactions account for the remaining 40 percent, representing a greenfield opportunity (i.e.,

PYMNTS

JUNE 1, 2020

Capturing and then enabling card-on-file payments when consumers buy the products or services they consume in the physical world. Part of that includes reminding consumers to use their contactless cards when they check out in their stores (if they have one) or their mobile wallets (if they choose). Uber and Starbucks pioneered it.

PYMNTS

DECEMBER 2, 2020

“Consumers are increasingly concerned about protecting their payment details from fraud when shopping online,” according to PYMNTS’ November 2020 Next-Gen Debit Tracker ® done in collaboration with PULSE , a Discover company. Virtual cards are expected to facilitate $1.6 Merchants Align Behind V-Cards.

PYMNTS

DECEMBER 15, 2020

December’s Buy Now, Pay Later Report , the ‘Millennials and the Shifting Dynamics of Online Credit’ edition, provides illuminating new numbers to quantify BNPL’s impact. The report points out that, counter to prevailing views, millennials are more likely to own and use credit cards than any other cohort right now.

PYMNTS

APRIL 8, 2020

Consumers have the potential to grow impatient if it takes more than a single click or tap on a screen to complete a purchase when they shop online. The Playbook focuses in particular on two types of innovations: virtual cards and eInvoices.

PYMNTS

DECEMBER 31, 2020

This study showed that the home had become the consumer’s commerce command center as they changed their daily routines to do more of their work and more of their once-physical errands from home. This study showed that consumers display significant interest in real-time payments once they fully understand them. 31 percent bank via app.

PYMNTS

AUGUST 24, 2020

Online classes are also gaining the attention of workers who have been laid off during the economic downturn and want to refresh their skills or build new ones and attracting employees who may be seeking to polish their know-how while working from home. . These demands are not always met, however. Mobile money service M-Pesa is used by 24.5

PYMNTS

OCTOBER 14, 2020

When the chips are down, consumers love and trust their debit cards. Debit cards remain the payment method of choice among U.S. consumers, regardless of whether they are shopping online or in stores, according to recent reports,” notes PYMNTS October Next-Gen Debit Tracker® done in collaboration with PULSE , A Discover Company. “One

PYMNTS

JANUARY 15, 2021

A year ago, as 2019 was turning over into 2020, the distinction between card-present transactions and card-not present transactions was highly relevant in the world of commerce. Friction that digitization for the card space can overcome, if done correctly in line with consumer convenience and need. Piatt asked. But in the No.

PYMNTS

SEPTEMBER 22, 2020

One recent study estimated that roughly 44 million Americans would tap food delivery apps by the end of this year, up from 38 million in 2019, and another survey predicted that the number of smartphone delivery app users will climb 25.2 One recent study reported that chargebacks rose 179 percent in the past two years. percent to 45.6

PYMNTS

OCTOBER 21, 2020

For SMBs, what’s in the cards … are more card readers. Chase has also said that its new SMB offering will enable firms to take card payments within minutes. In terms of the economics of QuickAccept, beyond the card readers, the company will charge 2.6 To that end, the banking giant J.P. and, by extension, the U.S.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content