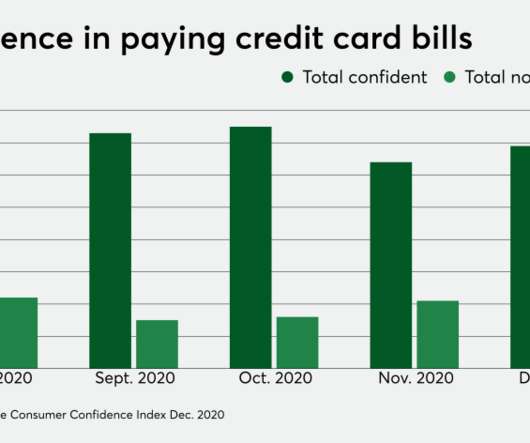

Visa: Real-Time Settlement, Online Marketplaces Help Put SMBs Back On The Road To Recovery

PYMNTS

SEPTEMBER 18, 2020

Online marketplaces are the digital storefronts helping small to mid-sized businesses survive — but adding real-time settlement into the mix can help them thrive. And 60 percent of surveyed firms selling across online marketplaces would take their business to one that offers real-time settlement.

Let's personalize your content