China’s blood on the carpet in P2P lending

Chris Skinner

SEPTEMBER 12, 2018

The reason I raise it is that I … The post China’s blood on the carpet in P2P lending appeared first on Chris Skinner's blog.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Chris Skinner

SEPTEMBER 12, 2018

The reason I raise it is that I … The post China’s blood on the carpet in P2P lending appeared first on Chris Skinner's blog.

South State Correspondent

JANUARY 20, 2020

We work on thousands of lending transactions every year with hundreds of community banks across the country.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

JANUARY 17, 2023

Automating SMB and commercial lending elevates your customer's experience From making it easier to apply to speeding up loan closings, automation can helps make business lending customers and staff happier. APIs and digital doc prep ease the workload on your SMB and commercial lending staff, too. . Digital lending.

Abrigo

OCTOBER 22, 2024

Jay Blandford is Chief Executive Officer of Abrigo, a leading provider of risk management, financial crime prevention, and lending software and services that help more than 2,500 U.S. Keep fighting the good fight—because your work matters more than ever. financial institutions manage risk and drive growth in a rapidly changing world.

Advertisement

Discover First Mid Bank's Expansion Success with Our Case Study! This case study reveals their journey from facing challenges in Texas' complex legal landscape to achieving rapid market entry with GoDocs' innovative commercial closing platform.

South State Correspondent

MARCH 4, 2025

Step 2: Structure Choosing a Problem-Solving Approach When Solving Strategic Challenges Different problems lend themselves to various forms of solutions. This would lend itself to more of an issue-driven or, more likely, a design-thinking approach. The clarity here is that you want to make sure you are solving the right problem.

Abrigo

FEBRUARY 6, 2025

Case study: Enhancing investment oversight & compliance A regional bank with a diversified investment portfolio needed a solution to streamline compliance with risk-based capital requirements.

Abrigo

JULY 13, 2017

Here are the 2016 Summit Takeaways.

Celent Banking

APRIL 7, 2017

Lending Product. Each of the award winning initiatives is published as a case study and available to Celent research clients by following the links above. In the meantime, enjoy the case studies and let's celebrate the Model Bank winners of 2017! Emerging Technology for Businesses. CBW Bank, USA. Open Banking.

Advertisement

Want to see how theLender transformed its commercial lending process, tripled loan volume, and saved millions annually? Our case study reveals how this rapidly growing wholesale mortgage company partnered with GoDocs to automate commercial loan document preparation, scale operations nationwide, and slash legal fees by over $300,000 per month.

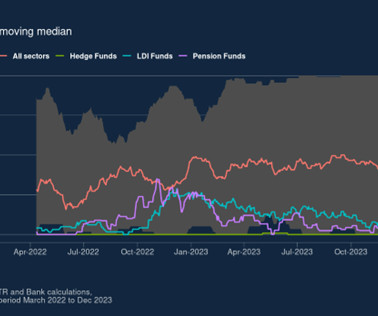

BankUnderground

JULY 20, 2022

In a recent paper we explore the effect on bank lending by combining data on exposure to negative rates with banks’ balance sheets, the Spanish credit register and firms’ balance sheets. This effect was especially strong for undercapitalised banks and lending to risky firms. Why might negative rates work differently?

Perficient

DECEMBER 2, 2020

The other is a credit union that I signed up with because they offered a particular lending product. We will discuss a few outside-the-industry case studies that can give financial services firms ideas for focusing on the customer and propelling growth. I have savings and checking accounts with two institutions.

Gonzobanker

DECEMBER 8, 2021

Mark Cuban is tweeting about Jill Castilla’s fintech efforts with lending system startup Teslar. Chime, Square, and Rocket’s methods are case studies in how to grow a business (fintech or otherwise) now. Fintech investing has gained near sport status. Bank CEOs are looking at fintech investment rounds. OK, me neither.

PYMNTS

MARCH 27, 2019

It’s what makes sellers feel comfortable with lending their personal properties to buyers whom they have never met. The Outdoorsy platform enables America’s approximate 18 million RV owners to lend their vehicles during the 97 percent of the time that they sit unused on the front lawn. Trust keeps the sharing economy afloat.

SWBC's LenderHub

JANUARY 9, 2020

In February 2018, Heritage Federal Credit Union (FCU) launched a new program to encourage healthy competition, foster internal recognition, improve upon member service, member impact, and increase non-interest income with SWBC loan protection products—GAP, Payment Protection, and MMP.

South State Correspondent

SEPTEMBER 19, 2024

Case Study: SBA Lending – The Traditional Approach Small Business Administration (SBA) loan production is the perfect example of a business line that screams for digitization. Banks will tend to transform consumer lending instead of tackling all of lending or all of onboarding.

Abrigo

SEPTEMBER 16, 2016

For example, if your bank specializes in commercial lending to small businesses (like C&I), it might not make sense to benchmark yourself against banks that may be the same size but focus on Commercial Real Estate Lending (CRE).

BankUnderground

FEBRUARY 11, 2021

Our case study of French banks operating in London – part of a broader international initiative – suggests prudential policies have a much bigger offsetting effect on French banks’ lending out of the UK’s financial centre than on their lending out of headquarters in France. Our findings suggest it does.

PYMNTS

SEPTEMBER 19, 2019

The Brexit saga is a case study in uncertainty ever since then-British Prime Minister David Cameron stepped down June 24, 2016, the day after the referendum vote unexpectedly ruled in favor of leaving the European Union. Bank lending to business has hit its l owest level in two years. With Brexit’s Oct.

Abrigo

MAY 31, 2017

The implementation of lending software, like that provided by Sageworks to community banks and credit unions, requires a similar, systematic approach for onboarding. This could include case study preparation, onsite training, web-conferencing, workshops with other institutions and ongoing User Groups.

FICO

JANUARY 5, 2017

I recently had the chance to speak with Chris Miller, VP of Decision Analytics at Ascentium, on how the company makes quick lending decisions for its small business customers. If you’d like to learn more of the story and how the SBSS solution makes those tough lending decisions, read the full case study.

South State Correspondent

FEBRUARY 12, 2023

Lending Habitats Banks’ cost of funding is best correlated to shorter-term rates, and banks generally want to generate loans with shorter interest rate duration – fixed rates of up to one to two years. We want to highlight this option with a case study.

The Emmerich Group

JULY 16, 2020

I’m always astonished how difficult we make the chief lending officer’s job. A Chief Lending Officer Case Study [VIDEO] appeared first on The Emmerich Group. Continue Reading. The post Are You Properly Utilizing Your Team’s Skills?:

FICO

JUNE 30, 2021

Lending Improved With Data-Driven Decisions. Using FICO’s advanced AI-powered optimization , the bank will develop data-driven lending strategies to systematically improve results. “We For a complex lending market like the one today, optimization has become an essential tool.”. Slovenská sporite??a Slovenská sporite??a,

PYMNTS

MARCH 10, 2020

What instant lending innovation have shoppers fallen in love with? For an important BNPL case study, we look to Australia, where Sydney-based market leader Afterpay has made such a splash that it’s changing the economy (sort of). Here’s a hint: We’ll tell you now … and you can thank us later. It’s a bona fide phenomenon.

Independent Banker

AUGUST 25, 2016

This month Independent Banker focuses on information and trends, processes and strategies, and case studies. Higher-volume lending has become more important to profitability. Higher-volume lending has become more important to profitability. Calculated Lending. on profitability in community banking. Rolling Along.

FICO

FEBRUARY 16, 2022

One promising route is transactional analytics for SME lending. As a result, there's a tendency to over-compensate with risk management when lending to SMEs, due to a lack of viable application information, lack of industry knowledge, gaps in financial performance, or missing collateral guarantees. by Richard Lagerweij.

Gonzobanker

FEBRUARY 26, 2019

Recent fintech deals across digital, lending, payments and infrastructure are telling a big story. Lending: Mashing Up Analytics & Digital. From commercial to consumer lending, the credit process is one that banks have been re-working to reflect the shift to digital self-service buying. Money talks.

South State Correspondent

JANUARY 16, 2024

Conclusion The BSBY case study highlights one of the often-overlooked risks of derivatives. Banks need to consider the index’s liquidity and longevity when indexing loans or hedge instruments.

American Banker

SEPTEMBER 24, 2020

Now they're becoming a case study for potential trouble from a sudden downturn in the Big Apple's property sector. Before the pandemic emptied the city, few lenders benefited from the heady local real estate market as much as regional players New York Community Bancorp and Signature Bank.

CFPB Monitor

OCTOBER 19, 2015

According to the agenda , the workshop will include case studies on how lead generation is used in the lending industry and education marketplace and a discussion of consumer protection issues raised by lead generation. on lead generation.

PYMNTS

DECEMBER 2, 2020

“Before I ship the goods to you [as an SMB], I make sure that I get paid because I don’t know if you’re ever going to pay, and I don’t know your credit file in terms of being able to access how much credit [in] short-term lending I could give you,” he said.

Abrigo

APRIL 7, 2022

Consultants Garver Moore, Baker Eddraa, and Neekis Hammond addressed common CECL implementation risks and myths and answered questions in real-time while walking through a CECL case study. What if our lending footprint is very small and not affected by macroeconomic factors such as unemployment?

BankUnderground

JULY 10, 2024

Dealers include prime brokers and other banks that typically extend cash lending to NBFI clients that rely on the bilateral gilt repo market for their liquidity and collateral operations. Flows of the same (different) colour as the sector in the outer ring show cash lending (borrowing) by (from) that sector.

South State Correspondent

JANUARY 30, 2024

Unfortunately, this strategy has all the underpinnings of a credit problem case study, and we do not have to search for a hypothetical example. Regardless of how the loan is priced, we do not know the lending environment in two years, never mind in five years.

South State Correspondent

AUGUST 22, 2022

Commodore’s demise is a case study of how NOT to care about your customers and why business intelligence through proper data architecture is critical. When applied across all lending categories, this is no small number and is the difference between staying in business or needing more capital in the next downturn.

South State Correspondent

MARCH 23, 2022

If your bank struggles to create a clear value proposition and brand differentiation, then we have a case study for you. Nubank started with a credit card offering, followed by deposit accounts, then lending, and then payments, investing, and insurance. In December 2021, a Brazilian bank, Nubank, went public in the U.S.

South State Correspondent

JULY 11, 2022

For example, based on the engagement model above that was created around a lending product, we know with some level of accuracy that an email about a new lending product will be opened by 21% of our target customers, clicked on to learn more by 9% and almost 2.2% will take us up on the product within the next 90 days.

Celent Banking

JANUARY 23, 2017

Lending Product – for the most impressive consumer or business lending or collections initiative. For the time being, only the nominees will know if they won any of these awards, as we begin working with them to distill their achievements into a series of case studies.

BankInovation

JULY 6, 2020

Muthukrishnan will take part in a panel titled, “Case studies on getting digital transformation back on track.” “Now more than ever, digital transformation is mission critical […].

PYMNTS

MARCH 11, 2016

CASE STUDIES. Schrimpff and Webster walked the webinar attendees through a number of case studies that highlight PayU’s ability to accommodate various preferences. Cash on Delivery : PayU has done pilots integrating cash on delivery into its platform.

CFPB Monitor

AUGUST 11, 2020

In May 2019, the FTC held a forum , “Strictly Business,” that explored small business lending practices, regulations, and policies. The forum consisted of three panels: (1) Overview of the Small Business Financing Marketplace, (2) Case Study on Merchant Cash Advances, and (3) Consumer Protection Risks and the Path Ahead.

South State Correspondent

MARCH 7, 2024

A CoE community should allow for employees to share usage tips, experiences, concerns, case studies and techniques. The fintech lending firm Klarna released a case study of how generative AI has changed the job responsibilities of 700 full-time customer service agents. AI handled 2.3

Insights on Business

SEPTEMBER 27, 2017

What’s more, we can offer them even better advice about which counterparties to lend to – enabling them to make the best decisions for their businesses. Read the case study for more details about eSecLending. Learn more about IBM Risk Service on Cloud.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content