Cleveland Fed Pulls P2P Lending Report for ‘Revision’ Over Questions on Data

Bank Innovation

NOVEMBER 21, 2017

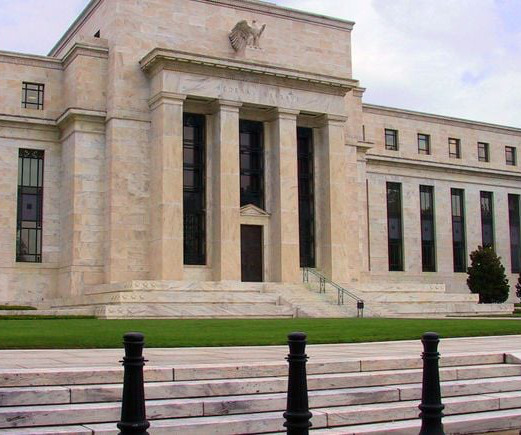

The Federal Reserve Bank of Cleveland has taken a report on P2P lending offline due to questions regarding the report’s underlying data.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Cleveland Related Topics

Cleveland Related Topics

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

JULY 7, 2020

The Cleveland Indians unveiled credit and reimbursement options for fans along with their new schedule for this year in an announcement. As the pandemic continues to disrupt everyday life the world over, consumers might want refunds on things they have already paid for but may not be able to use.

Payments Dive

JUNE 19, 2018

As consumers become more conscious about which companies they share sensitive information with, a Cleveland-based company has launched a mobile person-to-person app that adds a level of anonymity its co-founder and CEO believes is missing from the market.

PYMNTS

MAY 6, 2020

The Cleveland Cavaliers are offering refund options for fans who hold single-game tickets for a 2019-2020 season that is suspended as of now, Cleveland.com reported. The Jets said per the report that single tickets will not be available for sale Thursday when the league’s schedule comes out due to the uncertainty around COVID-19.

PYMNTS

AUGUST 7, 2020

Levy, 50, of Bedford, Ohio; and Abdul-Azeem Levy, 22, of Cleveland, Ohio. 46, of Cleveland, Ohio; and Bern Benoit, 44, of Burbank, California. Augustin, 51, of Coral Springs, Florida; Wyleia Nashon Williams, 44, of Fort Lauderdale, Florida; James R. Stote, 54, of Hollywood, Florida; Ross Charno, 46, of Fort Lauderdale, Florida; Deon D.

Bank Innovation

FEBRUARY 27, 2018

With these branches, the bank will also move into Cincinnati, Cleveland, and Columbus, Ohio. Bank of America will open 500 new branches in the United States over the course of the next four years, the bank announced today. It will continue to make investments for both physical and digital growth, according to CNBC, and will.Read More.

Perficient

JANUARY 14, 2021

Cleveland Food Bank. Chattanooga Community Kitchen. Atlanta Food Bank. Acton Food Pantry. The Hunger Coalition. Bridge Under the Bridge. Hunger Free Colorado. Food Lifeline. Nourish the Neighborhood. Mid Day Meal Program. Safe India Organization. Northville Civic Concern. Houston Food Banks. Gullotta House. Forgotten Harvest.

Bank Innovation

AUGUST 18, 2017

Cleveland-based KeyBank announced a partnership with cloud-based payment cycle management firm BillTrust, with KeyBank taking an equity stake in the firm, the companies said yesterday in a statement. Terms of KeyBank’s equity investment were not disclosed.

PYMNTS

SEPTEMBER 25, 2020

Cleveland Federal Reserve President Loretta Mester said in a speech this week that a digital dollar could conceivably be a form of money transfer that would enable the Fed to disburse money to all individuals in America. Digital dollars could make the leap from concept to reality, but there might be a few ways to get there.

PYMNTS

DECEMBER 18, 2020

Cleveland Federal Reserve President Loretta Mester said in a speech in September that a digital dollar could conceivably be a form of money transfer that would enable the Fed to disburse money to all individuals in America (seemingly taking the approach that we are seeing in the Bahamas).

PYMNTS

OCTOBER 9, 2020

Last month, Cleveland Federal Reserve President Loretta Mester said in her speech “Payment and the Pandemic” that laying the groundwork for digital currency has been a priority since before COVID-19. . The Fed also launched an instant payment initiative in August.

PYMNTS

JUNE 15, 2020

The companies said all the kitting will be done in Cleveland. CLEANLIFE and D & S are both in Cleveland, Ohio. Vending operators will be able to buy six PPE kits at first to sell via their snack machines that are meant to work with current coils, according to an announcement.

PYMNTS

AUGUST 5, 2020

Gilbert, owner of the Cleveland Cavaliers and founder of Quicken Loans will retain 79 percent of the voting power of the company’s common stock through controlling entities, the SEC filing shows. If approved, Rocket would be listed on the New York Stock Exchange, under the ticker “RKT.”.

PYMNTS

DECEMBER 9, 2020

locations recently added for Uber Connect include Atlanta, Boston, Charlotte, Charleston, Cincinnati, Cleveland, Columbus, Connecticut, Detroit, Fort Myers-Naples, Hampton Roads, Honolulu, Indianapolis, Jacksonville, Kansas City, Las Vegas, Milwaukee, Minneapolis-St. They can track the delivery just like an Uber trip, the blog post indicated.

PYMNTS

NOVEMBER 13, 2017

The Federal Reserve Bank of Cleveland issued new research on the online lending market showing that borrowers end up in more debt than consumers who don’t utilize this method of borrowing. The Philadelphia and Chicago Federal Reserve recently conducted a more granular study and reached the opposite conclusion as this Cleveland Fed research.”

PYMNTS

JANUARY 14, 2020

On that score, online lenders have been successful, according to a just-released study from the Cleveland Federal Reserve. That, according to the Cleveland Fed, is the good news. But speed was just as critical a factor. APR equivalents there run much higher, from 80 percent into the triple digits.

Abrigo

JANUARY 15, 2015

• Cleveland, Ohio – First Federal Savings and Loan Association ($955 million). Cleveland’s top community bank for mortgages, First Federal Savings and Loan, headquartered in Lakewood, Ohio, offers a $300 closing cost credit. • Charlotte, North Carolina – Park Sterling Bank ($263 million). Blog Bank'

Perficient

OCTOBER 7, 2020

Cleveland Clinic saw 10 times the increase in volume from consumers. With the government bringing reimbursement for telehealth on par with in-person visits, the need for telehealth just continues to grow. One study indicated a 500% increase in the use of telehealth within the first two weeks of the outbreak.

PYMNTS

JANUARY 14, 2020

On that score, online lenders have been successful, according to a just-released study from the Cleveland Federal Reserve. That, according to the Cleveland Fed, is the good news. But speed was just as critical a factor. APR equivalents there run much higher, from 80 percent into the triple digits.

PYMNTS

AUGUST 30, 2020

The changes apply to standard economy and premium tickets for travel within the U.S., Puerto Rico and the U.S. Virgin Islands. In addition to dropping fees, United said it rolled out United CleanPlus to put health and safety first.

PYMNTS

NOVEMBER 14, 2017

The recent release of a study by the Cleveland Federal Reserve has managed to increase the decibel level of that debate. Cleveland’s Dark Outlook. According to the Cleveland Fed survey, the online lending customers also showed lower credit scores on average, more delinquent debt and more total debt outstanding. The verdict?

Banking Exchange

JANUARY 12, 2022

Archie Brown has been president and CEO of First Financial Bank since 2018 Community Banking Feature3 Feature Human Resources Management.

American Banker

MAY 29, 2024

Beth Hammack, who stepped down as the bank's co-head of global finance earlier this year, will take the helm as President of the Federal Reserve Bank of Cleveland later this summer following the retirement of longtime President Loretta Mester.

BankInovation

MARCH 2, 2022

The Cleveland-based bank had a digitally driven calendar year, partnering with Laurel Road for an online lending platform in March 2021 and acquiring payments fintech XUP Payments in November 2021. Technology investment at KeyBank is nothing if not dynamic.

American Banker

NOVEMBER 19, 2024

The Cleveland-based bank now has commercial lending teams in both markets, including a team it recently hired away from Huntington Bancshares.

Payments Source

NOVEMBER 24, 2019

The Cleveland Fed president dismissed concerns about the central bank's faster payments system competing with The Clearing House's network, while saying that a national digital currency is less of a necessity in the U.S. than in other countries.

American Banker

JANUARY 21, 2021

The Cleveland company will launch the service in March to broaden relationships its Laurel Road student loan refinancing unit has built with health care professionals.

PYMNTS

OCTOBER 3, 2016

“The court said the rules had not been shown to be harmful, because the government failed properly to define the market in which Amex competes,” Chris Sagers, a law professor at Cleveland State University, said in his NYT piece. The opinion is striking on many levels.

American Banker

OCTOBER 17, 2024

The Cleveland lender sold some $7 billion in bonds at a loss, leading to the fall in the bottom line. Excluding that hit, KeyCorp's profits rose 9%.

PYMNTS

JUNE 11, 2020

The company was started by Dan Gilbert , a Detroit billionaire and now the chairman and majority owner of the NBA’s Cleveland Cavaliers. Gilbert has been credited with revitalizing Detroit, and joined Warren Buffett and Bill and Melinda Gates’ “Giving Pledge” to donate most of their wealth to charity.

PYMNTS

JUNE 21, 2019

New investors Atrium Health, Cleveland Clinic and MemorialCare Innovation Fund joined McKesson Ventures, Novartis, Philips, ResMed, Threshold Ventures (formerly DFJ Venture), Providence Ventures, UPMC and Froedtert and the Medical College of Wisconsin health network as participants in the round. . ”

Celent Banking

OCTOBER 9, 2014

KeyBank , based in Cleveland, announced at Open World that it intends to use non-core systems components of Oracle Banking Platform (“OBP”) to enhance and modernize its mobile and online channels. Suncorp in Australia has started the process of moving off its Hogan core by focusing on unsecured lending; its next stop will be secured lending.

American Banker

JANUARY 3, 2025

million in performance-based equity awards that will vest in two years, as long as the Cleveland-based company meets certain capital requirements and earnings goals. Chris Gorman and four other high-ranking KeyCorp executives have been granted a combined $16.7

American Banker

AUGUST 12, 2024

Cleveland-based KeyCorp wasn't seeking capital but saw the benefits of Scotiabank's minority stake. The deal would enable the Canadian lender to step into the U.S. consumer market.

PYMNTS

MARCH 15, 2020

The only lone dissenter in lowering the rate was Cleveland Fed President Loretta Mester. . “… The Committee will continue to closely monitor market conditions and is prepared to adjust its plans as appropriate.”. She was in favor of a more conservative reduction to rates of 0.5 percent to 0.75

American Banker

JANUARY 21, 2025

The Cleveland parent company of Key Bank reported a net loss of $279 million for the fourth quarter, reflecting a one-time charge of $657 million from the sale of bonds.

PYMNTS

MAY 7, 2020

Additionally, news had recently surfaced that Cleveland Cavaliers were providing fans with refund options for single-game tickets for a 2019-20 season that is suspended for the moment.

PYMNTS

NOVEMBER 25, 2020

As noted in this space , for example, Cleveland Federal Reserve President Loretta Mester said in a recent speech that a digital dollar could conceivably be a form of money transfer that would enable the Fed to disburse money to all individuals in America. The Value Of CBDC .

PYMNTS

JULY 28, 2020

Gilbert, who also owns the National Basketball Association (NBA) team the Cleveland Cavaliers , controls 79 percent of the voting power for the company’s common stock. The company filed the initial IPO prospectus covertly, in what was speculated to be one of the bigger IPOs of the year. His net worth is sitting at $7.8

PYMNTS

JULY 16, 2020

Walgreens and DoorDash intend to expand the selection to over 5,000 products and bring the service to customers in other markets such as Seattle and Cleveland, among others, by the conclusion of this summer. Customers in Atlanta, Chicago and Denver can currently choose from over 2,300 products for delivery, according to an announcement. .

PYMNTS

MARCH 15, 2020

The only lone dissenter in lowering the rate was Cleveland Fed President Loretta Mester. . “… The Committee will continue to closely monitor market conditions and is prepared to adjust its plans as appropriate.”. She was in favor of a more conservative reduction to rates of 0.5 percent to 0.75

Banking Exchange

OCTOBER 13, 2021

Report by the Federal Reserve of Cleveland studied whether bank consolidation had impacted customer access Retail Banking Financial Trends Duties Branch Technology/ATMs Customers Feature3 Feature Financial Research.

Payments Source

APRIL 9, 2019

A Cleveland startup’s play in the crowded and noisy P2P market is to nudge the transaction as close to digital version of paper money as possible — without Venmo’s social tools or Zelle’s email model.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content