Using Cloud to Solve Healthcare Pain Points

Perficient

JUNE 16, 2020

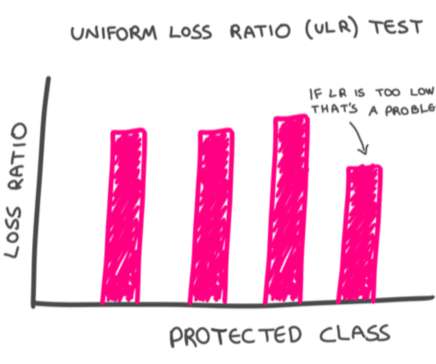

Data Integration and Compliance. GCP enables you to stay compliant with HIPAA and FedRAMP regulations with their built-in standards. University of Colorado Anschutz Medical Campus found that partnering with Perficient helped them find the right resolution to scale and save on costs. Cloud Adoption and Collaboration.

Let's personalize your content