Q2 helps Community Bank of Louisiana advance digital banking adoption

The Paypers

DECEMBER 19, 2024

Community Bank of Louisiana has selected Q2 , a provider of digital transformation solutions, to help accelerate its digital banking offering.

The Paypers

DECEMBER 19, 2024

Community Bank of Louisiana has selected Q2 , a provider of digital transformation solutions, to help accelerate its digital banking offering.

Independent Banker

DECEMBER 31, 2021

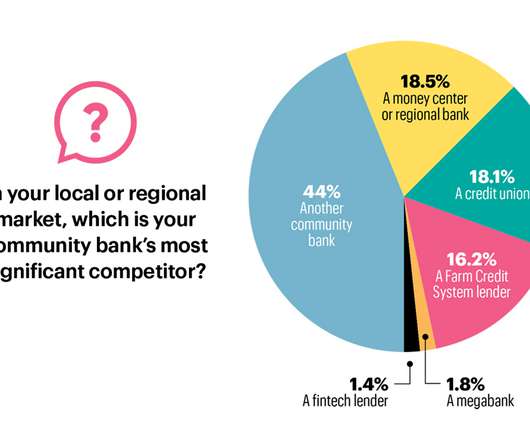

Independent Banker ’s annual Community Bank CEO Outlook survey reveals how community bank leaders plan to leverage today’s deposit-laden banking environment to grow this year. Janet Silveria, Community Bank of Santa Maria. So, what’s at the top of community bank leaders’ to-do lists?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Banking Exchange

JUNE 3, 2020

Banks based in California, Michigan, Ohio, Louisiana and Florida have been added to the Nasdaq index of community institutions Community Banking Feature3 Feature Management M&A Financial Trends ABA News Nasdaq.

ABA Community Banking

JULY 21, 2022

The latest issue of the FDIC Quarterly explores loan performance at community banks in five manufacturing-concentrated states: Indiana, Kentucky, Louisiana, Michigan and Wisconsin. The post FDIC Quarterly highlights community bank performance in manufacturing states appeared first on ABA Banking Journal.

ABA Community Banking

MARCH 18, 2025

Planters Holding has agreed to buy BSJ Bancshares in Louisiana. The post Bank acquisitions announced in Georgia, Louisiana appeared first on ABA Banking Journal. MetroCity Bankshares has agreed to buy First IC Corp. in Georgia.

Banking Exchange

AUGUST 2, 2021

While Finward Bancorp announces merger with Royal Financial Management Feature M&A Feature3 Community Banking.

BankDeals

APRIL 21, 2021

CLB The Community Bank (central Louisiana) has been offering competitive Kasasa Cash Checking, Kasasa Cash Bank, and Kasasa Saver accounts for almost one year.

Let's personalize your content