Registration deadline approaching - Risk management summit 2017

Abrigo

MARCH 22, 2017

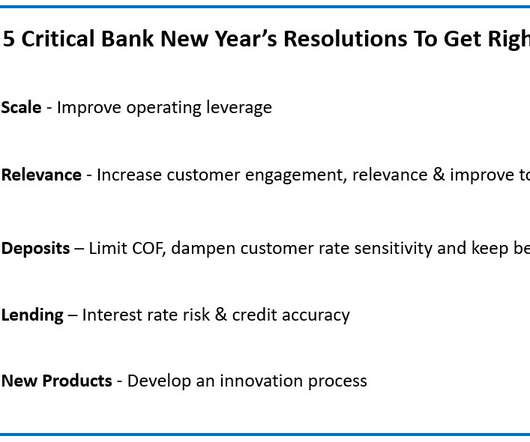

The 2017 Risk Management Summit presented by Sageworks is set for September 25-27th in Denver, CO. The Summit is the industry’s leading life-of-loan conference, spanning business development through portfolio risk management in a CECL - current expected credit loss - world.

Let's personalize your content