Putting the "Community" Into Community Banking

Jeff For Banks

OCTOBER 14, 2024

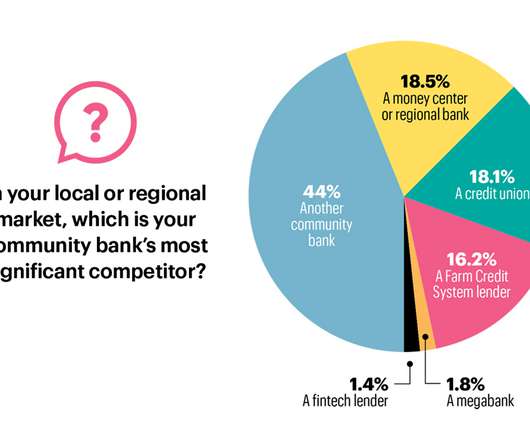

Community banking has almost achieved Kleenex or Xerox fame, being generalized to the point of meaninglessness. And the dilution of what it means to be a community bank has been diminished not just by interlopers pretending to be sheep in wolf's clothing, but also regulators, and unfortunately, community banks themselves.

Let's personalize your content