Community Bank Loan Performance Analysis

South State Correspondent

JULY 15, 2024

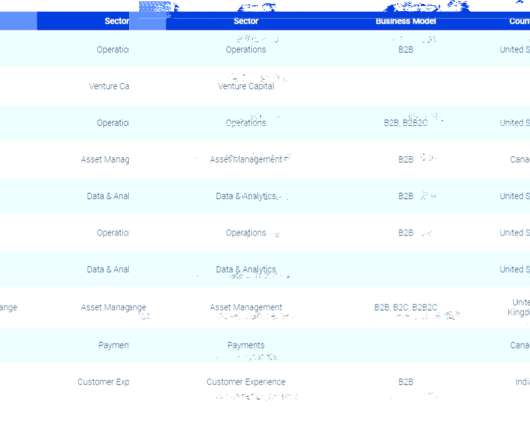

We conducted a loan performance analysis for over 5,000 individual hedged commercial loans originated by almost 400 community and regional banks across the country. Universe of Banks We analyzed the performance of hedged loans at community and regional banks with a total principal outstanding of approximately $12B.

Let's personalize your content