Fed, FDIC, OCC update guidance on third-party risk management

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

Abrigo

MAY 20, 2022

Meet Model Risk Management Expectations Updates to the FDIC Risk Management Manual should steer institutions toward a model that manages risk and drives growth. Takeaway 1 Aside from meeting examiner expectations, proper model risk management can protect your institution from unnecessary risk. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

FEBRUARY 25, 2025

Each step of back-end loan processingfinancial spreading, risk assessment, document gatheringrequires significant effort just to make incremental progress. Among large banks, 42% currently use financial technology in small business lending, compared to 30% of small banks, according to the FDIC. The results?

Gonzobanker

OCTOBER 31, 2024

Vendor management is risky business. The FDIC issued a consent order against Discover Bank last year for lacking oversight into third-party risk management and a compliance vendor management program. Smart leaders use performance scorecards to keep the board informed.

Abrigo

FEBRUARY 12, 2025

Reduce approval layers According to the FDIC, 73% of banks have at least three levels of approval for small business loans. Simplify underwriting criteria and eliminate unnecessary documentation. 62% even require board approval. Removing excessive approval layers can significantly speed up loan decisioning.

Perficient

APRIL 2, 2021

The five federal agencies are: the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve Board (Fed), the National Credit Union Administration (NCUA) and the. Risk Management. AI may be used to augment risk management and control practices.

Banking Exchange

NOVEMBER 22, 2021

OCC, Board, FDIC will require banks to report incidents within 36 hours Compliance Compliance Management Compliance/Regulatory Cyberfraud/ID Theft Security Mobile Online Core Systems Risk Management Technology Feature Feature3.

Perficient

JULY 12, 2023

Perficient provides risk management to more than 500 financial services organizations, many of whom have multiple bank regulators. Often an organization will have a state-charted non-member bank, which has the FDIC as its primary federal regulator. Introduction It’s not you. It’s the guidance.

PYMNTS

JANUARY 7, 2021

FDIC) and the Treasury Department are looking to see if American Express Co. A representative for AmEx told WSJ, “We have robust compliance policies and controls in place, and do not tolerate misconduct.” Representatives of the Fed, FDIC and Treasury inspectors general offices would not comment on the matter, the paper reported.

Perficient

DECEMBER 1, 2023

In various press releases, the Federal Deposit Insurance Corporation (FDIC) has highlighted that an estimated $16.3 billion of the total cost incurred from the failures of Silicon Valley Bank (SVB) and Signature Bank was designated for safeguarding uninsured depositors. Commencing with the first quarterly assessment period of 2024 (i.e.,

Celent Banking

DECEMBER 13, 2016

But the slew of banking regulatory requirements for third party risk management is proving to be complex, all-consuming and expensive for both institutions and the third parties involved. In a nutshell, institutions are liable for risk events of their third and extended parties and ecosystems. " www.fdic.gov.

Abrigo

APRIL 12, 2016

The FDIC is offering a fresh take on how a bank’s board of directors should understand and manage risk. The core principles for directors have not changed materially since 1988, the FDIC said. Risk management culture What exactly is a risk management culture? Evaluating risk management.

Abrigo

MARCH 18, 2025

Financial institutions are responsible for not only facilitating payments but also managing risksincluding fraud, compliance, and operational challenges. Regulatory agencies, like the Federal Reserve or CFPB, act as traffic controllers, ensuring everything operates smoothly and securely. consumers lost over $12.5

Perficient

AUGUST 16, 2023

A rather small bank, as of the end of its first quarter, the bank reported $139 million in total assets and $130 million in total deposits in its FDIC Call Report. Mr. Herndon named the Federal Deposit Insurance Corporation (“FDIC”) as receiver, allowing the FDIC to take control of the Heartland Tri-State’s operations.

Perficient

NOVEMBER 17, 2023

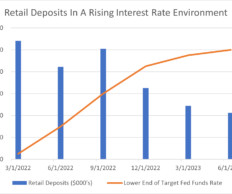

In our previous article, “ Transaction Accounts: Analyzing Deposit Stickiness in the Current Interest Rate Environment ,” Perficient’s Financial Services Risk Management and Regulatory Capabilities Center of Excellence (CoE) explored the sharp decline in transaction account balances over an 18-month period.

Perficient

NOVEMBER 10, 2023

This being the first blog post in a series of blogs by Perficient’s Financial Services Risk Management and Regulatory Capabilities Center of Excellence (CoE), we will be investigating the deposit structures of non-client banks over time.

Abrigo

JANUARY 24, 2024

Account for the details before your FDIC bank acquisition Consider these tips for assessing your institution and a to-be-acquired institution for a smooth integration You might also like this webinar, "Valuation and purchase accounting: Navigating the changing M&A landscape."

Abrigo

DECEMBER 22, 2023

Takeaway 3 Updates on interest rate forecasting and best practices for managing CRE risk were among the most-read blogs. Abrigo's most popular risk management blogs over the last 12 months cover topics that continue to catch the attention of professionals and regulators. Which credit areas need routine "maintenance"?

Independent Banker

SEPTEMBER 25, 2014

This is particularly true for community banks preparing to undergo their next regulatory safety and soundness or compliance examination. As David Barr, spokesperson for the FDIC, points out, “a vast majority of community banks remain well-rated and exhibit satisfactory corporate governance programs and compliance management systems.”.

CFPB Monitor

AUGUST 4, 2022

The FDIC has issued an “Advisory to FDIC-insured institutions Regarding Deposit Insurance and Dealings with Crypto Companies ” to address the agency’s concerns regarding misrepresentations about FDIC deposit insurance by certain crypto companies. The first portion of the advisory addresses risks and concerns.

Abrigo

AUGUST 7, 2023

Applying model risk management to CECL What's involved in CECL model validation? Learn what banks, credit unions, and others subject to CECL accounting can expect from this risk management process. Model validation is a crucial aspect of model risk management.

Independent Banker

DECEMBER 31, 2022

The FDIC approved a final rule to increase initial base deposit insurance assessment rates by 2 basis points until the Deposit Insurance Fund (DIF) achieves the FDIC’s long-term goal of a reserve ratio of 2% of insured deposits. The FDIC’s long-term goal for the reserve ratio of insured deposits. Source: FDIC.

Abrigo

JUNE 28, 2024

Navigating interest rate management in today's environment As regulators focus on interest rate risk management, read about what financial institutions can do to be ready for a rate drop. You might also like this on-demand webinar, "Navigating uncertain times: Strategies for effective risk management and compliance."

CFPB Monitor

JULY 15, 2021

The Federal Reserve, FDIC, and OCC have released proposed guidance for banking organizations on managing risks associated with third-party relationships, including relationships with financial technology-focused entities such as bank/fintech sponsorship arrangements. Ongoing monitoring. Termination.

Abrigo

MAY 19, 2023

WATCH Takeaway 1 Loan review officers must figure out how to adhere to the FDIC’s guidance on loan review and credit risk review systems. Takeaway 2 Examining the following objectives and evaluating your loan review system based on them can ensure regulatory compliance.

American Banker

OCTOBER 25, 2024

and Texas banking regulators issued consent orders against Industry State Bank, Fayetteville Bank, and Citizens State Bank requiring major overhauls of their management, capital, and risk controls. The Federal Deposit Insurance Corp.

Gonzobanker

JUNE 14, 2023

Cross River Bank recently found itself in hot water with the FDIC when the agency declared that the bank engaged in unsafe or unsound banking practices in relation to its compliance with fair lending laws and regulations, specifically the Equal Credit Opportunity Act and the Truth-in-Lending Act. In effect, Cross River is in time out.

Perficient

AUGUST 15, 2024

– These are the exact words (with a couple of expletives, that I cannot quote here) – a senior fund administrator from a large investment firm uttered when we were presenting about environment aware financial risk management. How does it impact me?

American Banker

MARCH 20, 2024

How the FDIC, the Federal Reserve and other regulators are working to keep banks in compliance through 2024.

American Banker

DECEMBER 18, 2024

is considering suing former Silicon Valley Bank executives over risk management decisions, imprudent dividends, and billions in losses that fueled a banking crisis in 2023. The Federal Deposit Insurance Corp.

Abrigo

AUGUST 8, 2021

As regulators described “practices generally considered consistent with safety-and-soundness standards,” they revised loan review guidance to reflect the broader importance of credit review to risk management. It also monitors compliance with applicable regulations and laws. Lending & Credit Risk. Learn More.

American Banker

JUNE 10, 2024

All eyes are on the FDIC's toxic workplace scandal and the resultant resignation of its longtime director. However, another problem not being discussed is the agency's "problem bank list."

Abrigo

JULY 26, 2021

Our dedicated risk management experts are ready to help you transition to CECL with confidence. They also said it doesn’t ensure compliance with U.S. Portfolio Risk & CECL. Portfolio Risk & CECL. 4 Steps for Integrating CECL and Other Risk Management Models. Portfolio Risk & CECL.

Independent Banker

SEPTEMBER 25, 2014

Saving money by conducting inside risk management and compliance reviews. As a group, community banks spend substantial funds hiring outside consultants to help with various management functions, and a substantial share of dollars are spent to help oversee their risk management and compliance activities.

American Banker

MARCH 22, 2024

The FDIC Office of Inspector General attributed the downfall of Citizens Bank in November 2023 to lax lending practices and risk mismanagement by the Lange family, causing a $14.8 million loss to the regulator's Deposit Insurance Fund. The OIG saw no grounds for a more extensive review.

Independent Banker

OCTOBER 1, 2022

Federal regulatory groups are drawing more attention to how cyber insurance is a critical part of broader risk management strategies. The FDIC and the OCC also issued an interagency statement on heightened cybersecurity risk that focuses on ways banks can reduce the risk of a cyber attack and minimize business disruptions.

Jack Henry

JULY 2, 2014

The stakes of this game are rising, however, because of increased sophistication of cyber-attacks, regulatory scrutiny around how banks are managing IT environments, and the growing number of governing entities with their fingers in the compliance pie. I would be remiss to discuss outsourcing today without mentioning vendor management.

CFPB Monitor

AUGUST 31, 2021

The OCC, FDIC, and Federal Reserve Board have issued a guide that is intended to assist community banks in conducting due diligence when considering relationships with financial technology (fintech) companies (Guide). Legal and regulatory compliance. Risk management policies, processes, and controls.

Abrigo

AUGUST 6, 2021

according to FFIEC and FDIC data. Technology can help streamline and automate many manual lending processes, reduce compliance costs, and enhance risk management. Even though community banks make up a small share of total assets and deposits, 13.5% In the recent publication, Community Banks’ Ongoing Role in the U.S.

American Banker

OCTOBER 4, 2024

The proposed FDIC guidelines would impose stricter governance and risk management standards on banks with over $10 billion in assets, drawing concern over potential regulatory overreach and conflicts with state laws.

CFPB Monitor

NOVEMBER 2, 2020

The CFPB, OCC, Federal Reserve, FDIC, and NCUA have issued a proposed rule on the role of supervisory guidance. In September 2018, the agencies issued an “ Interagency Statement Clarifying the Role of Supervisory Guidance.” In response to the Statement, the agencies received a petition requesting a formal rulemaking on the subject.

Abrigo

MARCH 2, 2023

Experts have highlighted numerous lessons from Southwest’s experience, many of which can benefit bank and credit union executives, regardless of their institution size, as they manage competing priorities for spending and growth initiatives on banking solutions.

CFPB Monitor

APRIL 1, 2021

In what could be an important step towards needed regulatory updating to accommodate the growing use of artificial intelligence (AI) by financial institutions, the CFPB, FDIC, OCC, Federal Reserve Board, and NCUA issued a request for information (RFI) regarding financial institutions’ use of AI, including machine learning (ML). Uses of AI.

CFPB Monitor

NOVEMBER 29, 2021

The 2022 clarity promised by the “roadmap” presumably will supersede, once issued, Interpretive Letter #1179, which appears to function as a general stop-gap until the 2022 publications hopefully provide more detail regarding exactly how banks can attain compliance. Federal banking regulators have been busy in this space.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content