Banking is what we do and technology is how we do it

Chris Skinner

FEBRUARY 13, 2020

A decade ago, we talked about the financial crisis, technology, regulations and compliance.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Chris Skinner

FEBRUARY 13, 2020

A decade ago, we talked about the financial crisis, technology, regulations and compliance.

Perficient

DECEMBER 18, 2023

In the fast-paced realm of finance, the significance of regulatory risk and compliance management practices cannot be overstated. By adopting a proactive stance and leveraging technological advancements, financial entities can navigate the regulatory landscape with greater resilience and efficacy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

MARCH 17, 2021

However, companies within certain industries may be more hesitant to incorporate a nearshore delivery model into their software development projects due to federal regulations around information and data security. based companies in a variety of regulated industries. Compliance Considerations. Traceability. Secure Passwords.

Abrigo

JUNE 14, 2021

Create an effective sanctions program Considering the current economic and political environment, it is crucial that financial institutions maintain a strong sanctions compliance program (SCP). Takeaway 1 OFAC has issued new guidance on the essential components of a strong compliance program. learn more.

Perficient

OCTOBER 30, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Abrigo

NOVEMBER 14, 2024

These actions can result in costly civil penalties and reputational damage, so banks and credit unions should take proactive steps to ensure their BSA compliance programs are robust and effective. Key strategies to prevent BSA enforcement actions To prevent BSA enforcement actions, banks must prioritize proactive compliance measures.

PYMNTS

NOVEMBER 26, 2019

Regulation is perhaps the strongest driver of Lithuania’s FinTech-friendly environment. But financial regulatory compliance can be a headache for any market. For traditional banks, compliance experts agree that it’s all about data — and the ability to share information with regulators. Resuming Operations.

Perficient

NOVEMBER 30, 2021

Recognizing that regulated and non-regulated financial institutions seek to engage in cryptocurrency and crypto asset activities, the three largest federal bank regulators, the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, recently issued a joint statement on crypto assets.

Perficient

MAY 27, 2022

For those wanting to start their own cryptocurrency fund, it’s important to be well informed about cryptocurrency regulations. Regulatory cryptocurrency regulations are most fluid at the state level. State Regulations. SEC Regulation. Central Bank Digital Currency (CBDC) ).

Perficient

NOVEMBER 6, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Bank Innovation

MAY 26, 2017

The next big thing in financial services won’t make it very far off the ground if FIs don’t innovate with an eye towards compliance.

Perficient

OCTOBER 28, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility. Fraud screening.

Perficient

MAY 30, 2024

The world’s leading financial institutions and regulators come together at XLoD to discuss the future of non-financial risk and control. Comey as well as topical discussions spanning regulatory risk, market abuse, and leveraging technology in automation (RPA), data analytics and ML/AI.

Bank Innovation

APRIL 24, 2017

The rise of insurtech is running parallel to the rise of regtech, as financial firms and startups apply artificial intelligence, blockchain, and other technologies to the dizzying world of financial regulation.

PYMNTS

NOVEMBER 4, 2020

Trade finance players, including corporates, banks and regulators, are finally ready to embrace modernization and technology. As a highly regulated area of financial services, trade finance has struggled to enter the digital age. Previously, regulation was very slow in adapting and approving of different technology," he said.

Perficient

OCTOBER 24, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Perficient

NOVEMBER 1, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Chris Skinner

FEBRUARY 15, 2020

The main blog headlines are … Banking is what we do and technology is how we do it A decade ago, we talked about the financial crisis, technology, regulations and compliance.

PYMNTS

SEPTEMBER 23, 2020

Banks in the EU have been racing to comply with the General Data Protection Regulation ( GDPR ) and the revised Payment Services Directive ( PSD2 ) since both measures were enacted in 2018. He explained that the cloud can help FIs swiftly respond to compliance and security challenges during the pandemic.

Abrigo

FEBRUARY 8, 2022

What NBFIs Should Know About Their AML Programs NBFI AML compliance requirements are top of mind in today's regulatory environment. Takeaway 2 NBFIs should ensure their AML programs are sound and pass the scrutiny of FinCEN and their primary regulators. NBFIs’ AML compliance requirements. DOWNLOAD . Competing with Banks.

PYMNTS

SEPTEMBER 24, 2020

Reducing fees for remittances might push price points low enough that more consumers could resume sending money home, though, and some researchers believe that money transfer service providers could make such price adjustments if they are able to reduce their own expenses through more robust and cost-effective regulatory compliance measures. .

Perficient

APRIL 2, 2021

Finally, views are sought for compliance with applicable laws and regulations, including those related to consumer protection. AI technologies, such as voice recognition and natural language processing (NLP), are being used to improve customer experience and to gain operational efficiencies. Personalization of Customer Services.

PYMNTS

MARCH 2, 2020

Andrew Zwicker (D-Hunterdon), chairman of the Assembly’s Science, Innovation and Technology Committee and lead sponsor of the legislation. The California Consumer Privacy Act went into effect in January, and the European Union’s General Data Protection Regulation ( GDPR ) went into effect in 2018.

Abrigo

JULY 27, 2023

Would you like other articles on fraud and AML/CFT compliance in your inbox? Takeaway 1 Regtech uses new technologies such as AI and machine learning to streamline processes that keep organizations compliant. Of course, banks and credit unions are highly regulated industries, and this is increasing. What is regtech?

Abrigo

JULY 27, 2023

Would you like other articles on fraud and AML/CFT compliance in your inbox? Takeaway 1 Regtech uses new technologies such as AI and machine learning to streamline processes that keep organizations compliant. Of course, banks and credit unions are highly regulated industries, and this is increasing. What is regtech?

Perficient

NOVEMBER 4, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Perficient

NOVEMBER 8, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Abrigo

NOVEMBER 2, 2021

Culture of compliance is crucial to BSA/AML programs Culture of compliance within the BSA/AML framework is not new and was first introduced by FinCEN in 2014. Takeaway 2 Poor culture of compliance will result in shortcomings in a financial institution's BSA/AML program. A strong culture of compliance is crucial.

PYMNTS

SEPTEMBER 22, 2020

Consumers pivoting to online banking are also more concerned over the privacy and security of their data, especially as fraud volumes creep up —and financial regulators are taking notice. Digital-only challenger bank Varo has partnered with third-party cloud technology provider Temenos to bring its core banking to the cloud, for one example.

PYMNTS

NOVEMBER 25, 2020

The age of digital currencies might be fully upon us, but key questions swirl about how to issue and regulate cryptos – especially stablecoins. Regulators and lawmakers, however, can latch onto digital currency efforts as they must monitor and also supervise such stablecoins. In a paper that debuted Tuesday (Nov. The Value Of CBDC .

Perficient

NOVEMBER 14, 2024

Artificial intelligence (AI) is poised to affect every aspect of the world economy and play a significant role in the global financial system, leading financial regulators around the world to take various steps to address the impact of AI on their areas of responsibility.

Perficient

MARCH 30, 2023

However, due to their sensitive and regulated natures, some industries – especially the financial services industry – have had more complicated cloud transformation journeys than others. Institutions should implement cloud technologies in a way that makes sense for their needs.

PYMNTS

NOVEMBER 9, 2020

Here’s the latest news from the technology industry, which is coming under increasing global scrutiny from governments and consumers. Regulation. EU Gears Up To Propose New Big Tech Regulations. Australian Regulator Looks Into Merger Law Changes.

Payments Dive

JANUARY 4, 2018

New mobile technologies make it possible for payments companies to leverage consumers' smartphones as an identity device, enabling compliance with AML and KYC regulations while maintaining the superior user experience that consumers expect.

PYMNTS

JULY 8, 2019

and compliance teams would manually check onboarding customers to make sure their records were clear. Wiping out the manual process and handling compliance in an automated fashion can propel companies forward,” Meier said. A client who passed through compliance checks on day one might not be compliant on day 500, for example.

Abrigo

JUNE 9, 2020

Technology has enabled financial institutions to operate more quickly and efficiently, creating a better experience for customers. Compliance is at the center of the lending process at financial institutions. Without the right tools and processes in place, however, compliance can be monotonous and inefficient. Learn more.

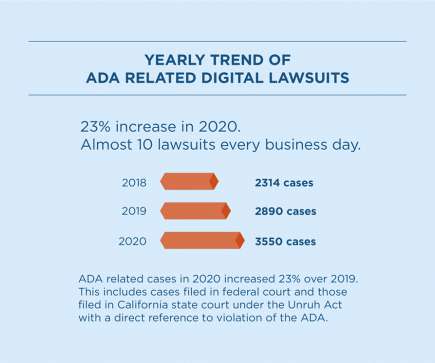

Perficient

FEBRUARY 4, 2021

By having an inaccessible site, you are turning away 26% of your overall potential market and expose the organization to compliance violations. According to the Web AIM million accessibility evaluation study , the top five compliance errors are low color contrast, missing alternative text, empty links, missing form labels, and empty buttons.

PYMNTS

DECEMBER 10, 2020

Thousands of other cryptocurrencies began circulating on crypto exchanges in recent years, such as Ethereum, Monero and Ripple, many of which leverage blockchain technology to serve as a transaction database. Enforcing AML/KYC Compliance At Cryptocurrency Exchanges. in 2015 and a staggering $13,421.44 The same year saw $2.8 or the U.S.,

Perficient

NOVEMBER 27, 2023

In the dynamic environment of highly regulated industries like healthcare and financial services, leaders often balance competing goals to delight customers while cutting costs. Imagine a technology that can precisely pinpoint where a process bottlenecks, track where inefficiencies are, AND offer ideas for automation opportunities.

PYMNTS

NOVEMBER 2, 2020

Here’s the latest news from Google and the technology industry, which is coming under increasing global scrutiny from regulatory watchdogs, consumers and organizations. Regulation. The Digital Markets Act is a second set of regulations. Pew Survey: 47 Pct Of Americans Believe Big Tech Should Face Greater Regulation.

Bank Innovation

APRIL 30, 2018

EXCLUSIVE— As open banking sweeps through Europe with the launch of PSD2, GDPR, and other regulations focused on transparency, North American financial institutions might want to consider looking to blockchain or artificial intelligence for their own compliance challenges.

Abrigo

AUGUST 27, 2020

Regulators have determined there are five top hot topics that institutions should expect during their next exam. Early communication with your regulator is key to understanding the struggles and successes of managing a BSA/AML program during a global pandemic. Tap into technology to help prevent and detect financial crime.

Abrigo

AUGUST 27, 2020

Regulators have determined there are five top hot topics that institutions should expect during their next exam. Early communication with your regulator is key to understanding the struggles and successes of managing a BSA/AML program during a global pandemic. Tap into technology to help prevent and detect financial crime.

PYMNTS

JUNE 11, 2020

Social distancing restrictions implemented to curb the virus’s spread are preventing compliance professionals from obtaining physical identification documents and holding in-person meetings that typically enforced anti-money laundering/know your customer (AML/KYC) compliance. Compliance Enforcement Goes Remote With Biometrics.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content