Unlocking the Power of Azure Integration Services for the Financial Services Industry

Perficient

AUGUST 4, 2024

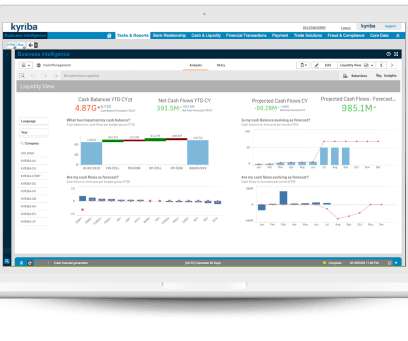

Improved Security and Compliance With stringent regulatory requirements in the financial sector, security and compliance are paramount. Regulatory Reporting and Compliance Automation Compliance reporting is often a resource-intensive process.

Let's personalize your content