Connecticut moves to regulate EWA

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

Payments Dive

JANUARY 5, 2024

The earned wage access company said the Connecticut Department of Banking determined it doesn’t need a state lending license.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFPB Monitor

SEPTEMBER 20, 2023

The Connecticut Department of Banking (the “Department”) issued a guidance letter on September 11, 2023 (the “Guidance”) providing its position regarding the amendments to Connecticut’s Small Loan Lending and Related Activities Act (the “Act”) that become effective on October 1, 2023.

CFPB Monitor

OCTOBER 9, 2018

Last week, the Connecticut Fair Housing Center, Inc. filed a complaint against Liberty Bank in Connecticut federal district court alleging that the Bank engaged in discriminatory mortgage lending in violation of the federal Fair Housing Act. ” Discrimination in extending credit.

Abrigo

MAY 20, 2017

Earlier this month, John Holt, CEO of Nutmeg State Financial Credit Union appeared on Better Connecticut to discuss how Nutmeg FCU was fulfilling its commitment to helping small businesses in their community by implementing a new digital loan application process.

PYMNTS

DECEMBER 28, 2020

Headquartered in Stamford, Connecticut, and privately held, cxLoyalty said it serves some 70 million people across 19 countries. This investment demonstrates our commitment to deliver exceptional travel benefits at-scale to our large and rapidly growing customer base,” Marianne Lake, CEO of Consumer Lending at J.P.

CFPB Monitor

MAY 19, 2022

The Order also directs SoLo to stop enforcing loans made to Connecticut residents and make restitution of any amounts it obtained in connection with such loans together with interest. To lend or borrow using the Platform, lenders and borrowers are required to set up a special account at a designated bank.

Abrigo

JANUARY 15, 2015

In the spirit of the go local movement, new data from Sageworks Bank Information peeked in on 10 cities to see which community banks were making an impact on local mortgage lending. • Hartford, Connecticut – United Bank ($1.19 Another home lending specialist, about 61 percent of the bank’s total assets ($1.56

CFPB Monitor

NOVEMBER 1, 2018

While the pace of the CFPB’s fair lending activities has slowed under its new leadership, significant fair lending developments are occurring elsewhere. In this week’s podcast, we discuss several of those developments and their broader implications.

American Banker

OCTOBER 2, 2024

New Canaan-based Bankwell's digital solution relies on software designed by Lendio to compress the application-to-funding interval and appeal to speed-conscious small business owners

American Banker

FEBRUARY 8, 2024

It's early days in the Connecticut bank's testing of Cascading AI, but one clear benefit has emerged: The software can handle the many inquiries that come in on Friday nights, after loan officers have gone home.

CFPB Monitor

JULY 5, 2023

Under the current law, the APR is calculated under the provisions of the federal Truth-in-Lending Act and associated regulations. . The primary changes are as follows: New APR calculation (Section 1, subdivision (2), Revising 36a-555(2)). Continue Reading

American Banker

JANUARY 23, 2024

Several regional banks have projected minimal growth or even a decline in lending this year. But Connecticut-based Webster is bullish based on its pipeline of nonoffice commercial real estate, public finance and other credits, CEO John Ciulla says.

Abrigo

JANUARY 7, 2021

The most important thing is to get your financials prepared,” Catherine Marx, District Director for the SBA’s Connecticut District Office, said during a webinar hosted Jan. 5 by Connecticut’s Small Business Development Center. Lending & Credit Risk. SBA Lending. Lending & Credit Risk. SBA Lending.

Banking Exchange

AUGUST 17, 2020

Individuals without access to basic banking services can now open accounts through a state-wide initiative being rolled out across Connecticut Community Banking People Covid19 Customers Fair Lending Feature3 Feature.

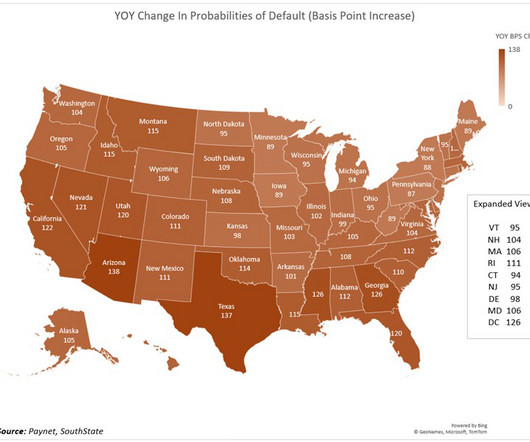

South State Correspondent

MAY 23, 2023

Lending is getting riskier. As can be seen, the consumer is starting to feel the credit shock first while commercial lending is still performing. Minnesota, North Dakota, and Iowa were the least risky states to lend into. Banks are more leveraged than the average hedge fund, and lending decisions have outsized consequences.

CFPB Monitor

APRIL 11, 2022

A Connecticut federal district court has refused to dismiss claims filed by the CFPB against a mortgage company and three of its principals for alleged Truth in Lending Act (TILA), Mortgage Act and Practice (MAP) Rule, and Consumer Financial Protection Act (CFPA) violations.

American Banker

NOVEMBER 21, 2022

(..)

Independent Banker

AUGUST 25, 2016

Higher-volume lending has become more important to profitability. Calculated Lending. Budgeting for expanded lending starts with a strategic plan. Connecticut bank mobilizes hands-on teams to boost branches. Minnesota bank makes high-volume SBA lending a profitable specialty. Crank Up the Volume. Income Guarantee.

PYMNTS

AUGUST 8, 2019

The New York State Department of Financial Services (NYDFS) has announced it will lead a multi-state investigation into alleged violations of state regulations of the short term lending industry, specifically in the area of payroll advances.

American Banker

MAY 11, 2016

First Connecticut Bancorp in Farmington has committed to making $5 million in small-business loans over the next year.

American Banker

APRIL 3, 2020

billion-asset Liberty Bank in Middletown had set aside $5 million to make small-dollar loans to customers affected by the coronavirus pandemic.

American Banker

MAY 11, 2022

(..)

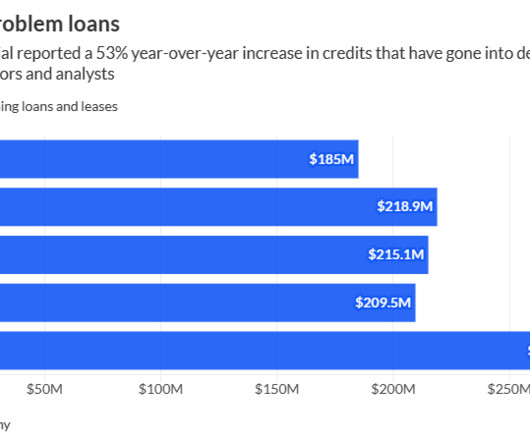

American Banker

APRIL 23, 2024

The Connecticut bank —a regional traditionally regarded as a cautious lender — said nonperforming loans and leases rose 53% year-over-year. The uptick was in mostly the commercial-and-industrial loan space, although there was one nonperforming commercial real estate loan, executives said.

CFPB Monitor

OCTOBER 31, 2018

HMDA data was recently used by a Connecticut fair housing advocacy groups to support redlining claims in a lawsuit filed in Connecticut federal district court alleging that a bank had engaged in discriminatory mortgage lending in violation of the federal Fair Housing Act.

American Banker

JANUARY 22, 2020

The company acquired ResX Warehouse Lending from People's United Financial.

American Banker

DECEMBER 11, 2024

The bank has hired an advisory firm to assess a potential sale, a capital raise or a strategic partnership after a prior merger fell through.

CB Insights

MARCH 13, 2019

Collectively, these startups have raised over $5B, with leading companies such as Butterfly Network (Connecticut, $350M in total disclosed equity funding), Welltok (Colorado, $339M), and InsideSales.com (Utah, $264M). Connecticut. Using the CB Insights database, we mapped out the top-funded AI startup in every US state. California.

CFPB Monitor

AUGUST 7, 2019

In its press release, the DFS claims that the investigation will look into “allegations of unlawful online lending” and “will help determine whether these payroll advance practices are usurious and harming consumers.” .” Rather, they argue that the advances are payments for compensation already earned.

Jeff For Banks

APRIL 25, 2014

At the same time, our legal lending limit will be much larger, which will help us to make larger investments in the local communities." - Dick Baker, Chairman of Ohio Heritage Bancorp of Coshocton on the bank''s sale to Peoples Bancorp, Inc. Read: You have to make lots and lots of little loans when you only have $25 million in capital. “I

American Banker

JANUARY 17, 2020

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

CFPB Monitor

JANUARY 21, 2021

The CFPB recently filed a complaint in the United States District Court for the District of Connecticut alleging violations of various federal consumer protection laws by 1 st Alliance Lending, LLC (1 st Alliance), a former mortgage lender. The complaint also names several principals of 1 st Alliance as defendants.

American Banker

JANUARY 14, 2021

She is currently the chief lending officer. Diane Arnold, who will succeed the retiring Gregory Shook in July, has been with the bank since 2002.

CB Insights

NOVEMBER 6, 2019

Collectively, these startups have raised over $9.5B, with leading companies including lending startup Avant (Illinois, $655M in total disclosed equity funding), next-gen auto insurer Root Insurance (Ohio, $509M), restaurant finances management system Toast (Massachusetts, $503M), and small business lending startup Kabbage (Georgia, $490M).

CFPB Monitor

FEBRUARY 6, 2020

The relevant states are Arizona, Arkansas, Colorado, Connecticut, Illinois, Indiana, Kentucky, Massachusetts, Minnesota, Montana, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, and South Dakota (“Subject States”). The loans in question were made by companies owned by Native American tribes.

American Banker

MAY 24, 2016

CenterState in Florida and Union Savings in Connecticut are adding specialists to their retail locations at a time when many other banks are cutting back or have been relying heavily on universal bankers.

CB Insights

OCTOBER 26, 2017

California-based lending unicorn SoFi is the most well funded fintech company with just over $2B raised since 2011. Connecticut. Unicorns on the map include SoFi in California, Oscar in New York, Avant in Illinois, Kabbage in Georgia, and AvidXchange in North Carolina. Click on the image below to enlarge. Total Equity Funding ($M).

American Banker

FEBRUARY 22, 2021

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

American Banker

MAY 31, 2016

Arjun Sirrah takes great pride in his company's national-level success as a community bank in Connecticut competing against digital lending startups in student loan refinancing. billion in loans in the last couple of years. …

American Banker

MAY 31, 2016

Arjun Sirrah takes great pride in his company's national-level success as a community bank in Connecticut competing against digital lending startups in student loan refinancing. billion in loans in the last couple of years. …

CFPB Monitor

SEPTEMBER 25, 2015

The joint complaint filed by the CFPB and DOJ in federal district court in New Jersey states that the action resulted from a joint investigation by the agencies of the bank’s lending practices following the CFPB’s referral of the bank to the DOJ pursuant to the ECOA. The proposed consent order requires the bank to pay a $5.5

Independent Banker

AUGUST 31, 2022

When two executives at Woodforest National Bank noticed a dearth of affordable housing options in southeast Texas, they decided to do something about it, partnering with several housing and community groups to launch an innovative mortgage lending product aimed at underserved clients. Aileen McDonough is a writer in Connecticut.

American Banker

MARCH 17, 2016

A small Connecticut bank takes the plunge into mobile-friendly mortgages in a bid to turn an attractive pool of student-loan borrowers into lifetime customers.

Filene

SEPTEMBER 21, 2017

Local Host: Credit Union League of Connecticut. QCash - An omni-channel lending solution that offers relationship based underwriting (without credit check) to members in search for small, short-term unsecured loans. 2:00 p.m. - Filene Host: Tansley Stearns. Click the arrow below to REGISTER for this event: WHAT IS AN IMPACT ROADSHOW?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content