Where Challenger Banks & Incumbents See The Next Digital Banking Opportunity

CB Insights

JANUARY 5, 2021

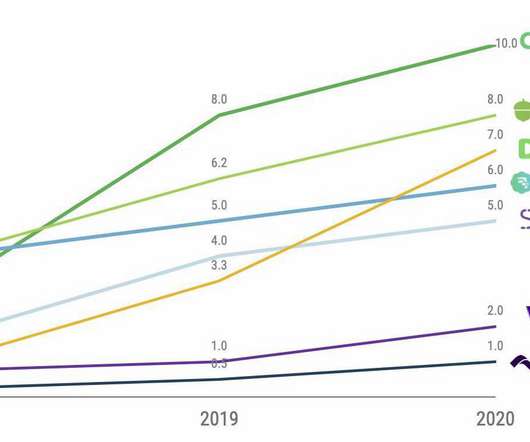

High fees, poor customer experiences, and archaic technology have historically blocked many from accessing financial services. . get the state of challenger banks report. Below, we dive into how the Covid-19 pandemic has accelerated the shift to digital banking among these populations. Source: FDIC.

Let's personalize your content