Will Customer Experience Ever Rule the World?

Perficient

NOVEMBER 10, 2020

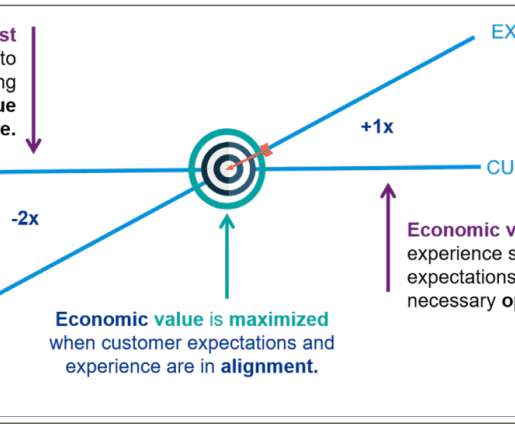

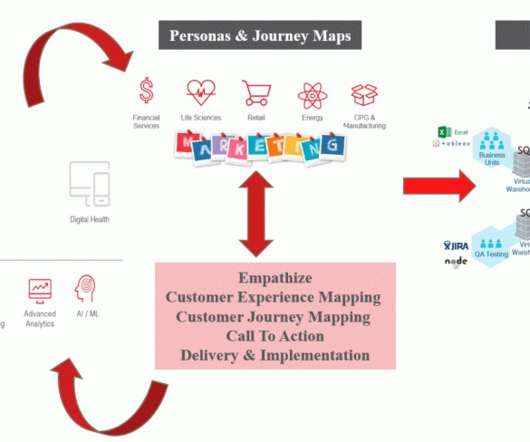

I talk with a lot of companies who want to up their game in delivering a better customer experience. ” There’s no doubt that many efforts to improve customer experiences is very difficult and is a lot of effort. But isn’t the value of achieving the desired experience worth it? Source: KPMG.

Let's personalize your content