Juniper Research sees digital banking poised for growth

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

PYMNTS

AUGUST 4, 2020

The past several years have been good times for digital banking players popping up to challenge traditional brick-and-mortar financial institutions for market share, but recent months have accelerated that trend into overdrive. All of this will help to build long-lasting, engaged relationships.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Bank Innovation

MARCH 12, 2020

Fintech startups looking to upend how Americans do their banking are facing their first major test as interest rates fall and fearful consumers seek safety at traditional banks. mobile payments companies founded after the 2008 financial crisis, and digital banks including Chime Inc. Square Inc. and Stripe Inc.,

Chris Skinner

APRIL 3, 2018

BTW, I’ve also heard a lot of people have been frustrated that Amazon cancelled their pre-orders of the new … The post Digital banks are 35+ times more productive than traditional banks appeared first on Chris Skinner's blog. If you would like to get a signed copy of the book, just register here.

Payments Dive

OCTOBER 4, 2019

The successful transition to mobile banking requires a seamless, intuitive user experience built into a mobile app. But the evolution from bricks-and-mortar to digital requires so much more in terms of how you deal with legacy systems, how you listen to customers and how you deal with the challenges of modern day neobanks.

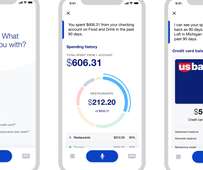

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

PYMNTS

AUGUST 7, 2020

Whatever nomenclature you prefer — neobank, challenger bank, digital bank — the common denominator is app-based convenience and the power of algorithms to help manage and save that has people downloading these apps like mad. The latest PYMNTS Provider Ranking of Digital Banking Apps shows how the players are stacking up.

PYMNTS

JUNE 29, 2020

Bank branches are either closing outright or slashing their business hours to help customers maintain social distancing guidelines — but fortunately, the growing familiarity of digital banking has allowed customers to meet their financial needs online and has kept financial institutions (FIs) in business.

Payments Dive

NOVEMBER 14, 2019

The blockbuster agreement for Citi to integrate its Google Pay wallet with Citi and Stanford Federal Credit Union's mobile checking accounts represents an evolution of Big Tech and traditional banking to offer a mutually beneficial expansion of their digital banking and payments businesses.

PYMNTS

SEPTEMBER 4, 2020

Migration to mobile and digital banking ramped up during the pandemic. It’s one of numerous revelations in PYMNTS’ Leveraging The Digital Banking Shift Report , a collaboration with Feedzai , based on a survey of nearly 2,200 U.S. percent of online banking customers using digital channels more. “Our

PYMNTS

JUNE 16, 2020

Branch , the digital bank startup, is branching out. The Minneapolis-based company has partnered with Mastercard to offer consumers access to their funds through their Branch Mastercard debit cards by adding it to mobile wallets, including Apple Pay, from the Branch mobile app. .

Payments Dive

OCTOBER 19, 2018

Digital channels are being widely accepted by today's consumers, but with this adoption comes the increase in impersonal transactions through online and mobile banking, drastically impacting the traditional model of building relationships

PYMNTS

SEPTEMBER 17, 2020

“Pandenomics” may usher in a new age for mobile check capture and deposits. In an interview with Karen Webster, Mike Diamond , general manager of digital banking at Mitek , said it’s unlikely that customers will revert back to their branch-intensive, pre-pandemic banking behaviors.

Bank Innovation

SEPTEMBER 12, 2019

As digital banking goes mainstream, banks are recognizing that a mobile app that lets customers carry out day-to-day tasks isn’t enough. Bank has been preparing, especially as it reports that 72% of its customers are considered “digital-active” and 50% are using mobile channels.

Bank Innovation

AUGUST 14, 2017

Wells Fargo has been going through a rough patch lately, but the bank itself is focused on moving forward. This is especially true when it comes to digital banking. The San Francisco-based bank is looking at partnerships as a way of improving banking experience for its current digital users (including mobile). “We

PYMNTS

MARCH 6, 2020

San Francisco-based Empower Finance, a mobile banking app aimed at helping millennials save wealth, has raised $20 million in a Series A funding round led by Defy Ventures and Icon Ventures, according to a report. The digital banking field is fraught with competition. billion after recently closing a financing round.

PYMNTS

DECEMBER 29, 2020

“Banking services need to adapt to this [eCommerce] operational model, to be able to allow them to connect with their clients, with their payments service providers and with their partner. That is where digital banking and the virtual IBANs come in,” she said.

PYMNTS

APRIL 27, 2020

Banks do not always have the budgets or resources to craft cutting-edge online and mobile experiences, although they can no longer afford to put off digital transformations. The number of online banking customers is growing worldwide, and FIs’ consumers are coming to expect seamless digital experiences as a result.

PYMNTS

OCTOBER 6, 2020

We’re a mobile app, and that’s how we deliver our services.”. Of course, the pandemic has forced banks – like all businesses – to rethink their priorities and make adjustments to how they interface with customers. billion people – will likely be using online and mobile banking services by 2024.

Payments Dive

MARCH 14, 2024

Consumer Reports Senior Director Delicia Hand said preventing fraud and scams is "crucial" for traditional and digital banks alike, as more of their customers use their mobile apps.

Accenture: Banking

APRIL 7, 2020

Underpinned by mobile, digital and open data, established brands and new entrants alike are redefining banking for customers who will seldom set foot in a physical branch. Instead, retail customers and small- and medium-sized enterprise (SME) clients will use digital ecosystems to help….

Bank Innovation

JANUARY 10, 2018

EXCLUSIVE—With mobile banking services offered at the majority of financial institutions, innovating the digital space is becoming more important in the fintech ecosystem, especially for smaller players like regional banks or credit unions.

PYMNTS

APRIL 23, 2020

More banks are therefore moving away from legacy core systems to embrace cloud-native architectures to power automation and meet the speed expected by consumers, securely. The bank is working with technology giants Google and Microsoft to create new cloud-based tools that will use their cloud computing software. About The Tracker.

PYMNTS

JANUARY 21, 2021

One common theme amid bank earnings — beyond lofty trading revenues gleaned from Wall Street — has been the increased uptake of mobile banking. Stats from banks, pretty much across the board, have given evidence that consumers have been pivoting to their mobile devices to attend to their everyday financial needs.

South State Correspondent

JUNE 14, 2024

You might need a new digital banking platform. Chances are your bank chose your current digital platform because it was easy. The Problem with Most Digital Banking Platforms The problem is architecture. Banks often lack a technology architecture plan and are channeled down dead-end streets.

PYMNTS

DECEMBER 4, 2020

PSCU company Lumin Digital is partnering with Jax Federal Credit Union (JAXFCU) to provide mobile and online banking services for over 23,000 users, which comprises around 60 percent of JAXFCU's membership, when the credit union goes live with Lumin in April of next year, according to a press release.

PYMNTS

APRIL 28, 2020

These shifts have made digital banking and debit transactions more important than ever. Pandemic Puts Digital Banking in the Spotlight. Consumers complying with stay-at-home orders are turning to digital banking services to help them manage their finances while avoiding public spaces like bank branches.

PYMNTS

JUNE 12, 2020

As the use of mobile banking apps surges due to the limited access to banks amid the COVID-19 pandemic, the FBI is warning users to beware of cyber attacks.

South State Correspondent

JUNE 14, 2024

You might need a new digital banking platform. Chances are your bank chose your current digital platform because it was easy. The Problem with Most Digital Banking Platforms The problem is architecture. Banks often lack a technology architecture plan and are channeled down dead-end streets.

Payments Dive

JANUARY 18, 2019

Fintech companies, mobile banks and others are granting waivers, extended payments and other services to help workers impacted by the government shutdown.

PYMNTS

DECEMBER 30, 2020

Digital banking took off this year as pandemic lockdowns and disrupted routines led people to seek better, faster, more personalized forms of banking. There are two notable changes atop this new Provider Ranking of Digital Banking Apps. 4, pushing challenger bank Monzo to No. The Top 10. Still at No.

Chris Skinner

JULY 2, 2019

An interesting report came out this week saying that UK consumers would access mobile banking apps more often than branches in the next two years. It just shows … The post Mobile first is a no brainer, but what is digital first? appeared first on Chris Skinner's blog.

PYMNTS

FEBRUARY 23, 2020

JPMorgan Chase is taking steps to open a digital bank in the U.K. The banking firm has been talking with London regulators about the idea, according to The Financial Times on Saturday (Feb. bank Goldman Sachs launched a digital bank called Marcus in the U.K. by the end of the year.

PYMNTS

SEPTEMBER 24, 2019

Digital banks , for one, are teaming up with technology providers to accelerate settlement times for payments collected at the point-of-sale (POS). Legacy banks are similarly at work, with one major FI seeking to beat out FinTech competition by offering same-day access to credit card deposits. Find the full story in the Tracker.

PYMNTS

NOVEMBER 24, 2020

The pandemic is reshaping banking. As more banking has shifted online, an increasing amount of that online activity is occurring across mobile conduits. Generationally, we’re seeing individuals who maybe weren’t accessing their card accounts or their banking accounts on a regular basis through digital,” he said.

PYMNTS

JUNE 26, 2020

Many banks braced themselves for an oncoming surge in the number of consumers accessing their financial accounts online or via mobile banking apps, but safely and seamlessly providing that access remained tricky for many in the space. How N26 Is Using Cloud Core Banking for Nimble Mobile Innovation.

PYMNTS

NOVEMBER 18, 2020

Chime , a mobile-based startup delivering banking services that has gained strength during the pandemic, is here to stay, according to CEO Chris Britt , CNBC reports. There’s an increasing willingness to provide and manage your finances through a mobile app. Chime’s transaction volume has more than tripled this year.

Bank Innovation

MAY 4, 2017

Consumers are becoming more comfortable with biometrics in banking—most are now actively asking for the capability to be included in their mobile and online banking experience. consumers released today by biometric identity solutions […].

PYMNTS

MAY 28, 2020

Hispanic immigrants access digital banking services, according to a press release. Hispanic immigrants have access to actual banking services, the release states, citing an FDIC survey. Less than half of U.S. We are challenging the status quo to ensure immigrant communities get fair and secure financial options.”.

PYMNTS

NOVEMBER 17, 2020

Not only are many account holders visiting brick-and-mortar branches less often than they did before the pandemic, but many are also more reliant on digital banking channels — particularly mobile banking apps — than they have ever been. percent more likely to use mobile banking apps now than they were in 2019, and 51.1

PYMNTS

NOVEMBER 17, 2020

Lumin Digital announced today (Nov. 17) that it will provide Los Angeles Federal Credit Union (LAFCU) with its cloud-based online and mobile digital banking platform, according to a press release emailed to PYMNTS. At LAFCU, we continuously want to improve the products and services we offer.

PYMNTS

NOVEMBER 20, 2020

April was also the month that financial institutions (FIs) and Big Tech firms alike learned that mobile banking had become a much bigger, more important channel, virtually overnight. It took crashing the websites of a string of major banks and credit unions for the sector to grasp what happened. Mobile Experience Can Do More.

PYMNTS

OCTOBER 7, 2020

But by and large, with branch activities curtailed and lingering public health fears in place, banks have to offer a uniform, consistent and safe experience to all users, across all types of (online) interaction.

PYMNTS

FEBRUARY 2, 2021

In Pakistan, and elsewhere, the stars are aligning for greater use of digital banking and payments to improve financial inclusion. told PYMNTS CEO Karen Webster in an interview that the pandemic and the rise of mobile infrastructure have set the stage to bring people living in developing and emerging economies into the digital realm.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content