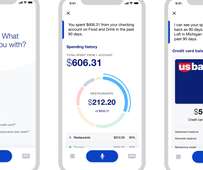

US Bank deploys smart assistant to boost digital banking

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

Bank Innovation

JANUARY 10, 2018

EXCLUSIVE—With mobile banking services offered at the majority of financial institutions, innovating the digital space is becoming more important in the fintech ecosystem, especially for smaller players like regional banks or credit unions.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Chris Skinner

APRIL 3, 2018

BTW, I’ve also heard a lot of people have been frustrated that Amazon cancelled their pre-orders of the new … The post Digital banks are 35+ times more productive than traditional banks appeared first on Chris Skinner's blog. If you would like to get a signed copy of the book, just register here.

PYMNTS

SEPTEMBER 17, 2020

“Pandenomics” may usher in a new age for mobile check capture and deposits. In an interview with Karen Webster, Mike Diamond , general manager of digital banking at Mitek , said it’s unlikely that customers will revert back to their branch-intensive, pre-pandemic banking behaviors.

PYMNTS

APRIL 10, 2020

Intimidated by the scale and cost of a massive technological overhaul, large financial institutions (FIs) may approach their digital transformation (DX) journeys gradually, targeting various areas of operations to modernize one-by-one. “Banks are technology companies,” Rio Tinto recently told PYMNTS.

PYMNTS

APRIL 23, 2020

More banks are therefore moving away from legacy core systems to embrace cloud-native architectures to power automation and meet the speed expected by consumers, securely. Developments Around The Cloud Banking World. British FI Lloyds Bank is moving forward on its digital journey with the help of a few partners.

PYMNTS

APRIL 27, 2020

Banks do not always have the budgets or resources to craft cutting-edge online and mobile experiences, although they can no longer afford to put off digital transformations. The number of online banking customers is growing worldwide, and FIs’ consumers are coming to expect seamless digital experiences as a result.

PYMNTS

OCTOBER 6, 2020

We’re a mobile app, and that’s how we deliver our services.”. Of course, the pandemic has forced banks – like all businesses – to rethink their priorities and make adjustments to how they interface with customers. To be fair, it’s not as if banks have been ignoring the technological shift.

PYMNTS

SEPTEMBER 11, 2019

Make that leather wallet a mobile one, wielded on smartphones. As we noted in this space earlier in the summer, using apps to bank is markedly being embraced by the younger generation. As spotlighted in the Digital Banking Tracker , the global digital banking market is slated to grow by 16 percent, compounded annually.

South State Correspondent

JUNE 14, 2024

You might need a new digital banking platform. Chances are your bank chose your current digital platform because it was easy. The Problem with Most Digital Banking Platforms The problem is architecture. Banks often lack a technology architecture plan and are channeled down dead-end streets.

South State Correspondent

JUNE 14, 2024

You might need a new digital banking platform. Chances are your bank chose your current digital platform because it was easy. The Problem with Most Digital Banking Platforms The problem is architecture. Banks often lack a technology architecture plan and are channeled down dead-end streets.

PYMNTS

MAY 28, 2020

Welcome Technologies , which works to aid immigrants as they integrate into life in a new country, is partnering with Green Dot for the PODERCard, which will help U.S. Hispanic immigrants access digital banking services, according to a press release. Less than half of U.S.

PYMNTS

JUNE 26, 2020

Many banks braced themselves for an oncoming surge in the number of consumers accessing their financial accounts online or via mobile banking apps, but safely and seamlessly providing that access remained tricky for many in the space. Developments Around the Cloud Banking World. customers in late May.

PYMNTS

SEPTEMBER 24, 2019

Digital banks , for one, are teaming up with technology providers to accelerate settlement times for payments collected at the point-of-sale (POS). Legacy banks are similarly at work, with one major FI seeking to beat out FinTech competition by offering same-day access to credit card deposits.

PYMNTS

JULY 29, 2019

To accommodate this shift and the nation’s growing number of internet and smartphone users, tech giants like Amazon and Facebook are launching digital banking solutions focused on mobile devices. The following Deep Dive explores AI’s fraud-fighting uses and how the technology can offer more personalized services.

PYMNTS

NOVEMBER 24, 2020

The pandemic is reshaping banking. As more banking has shifted online, an increasing amount of that online activity is occurring across mobile conduits. Generationally, we’re seeing individuals who maybe weren’t accessing their card accounts or their banking accounts on a regular basis through digital,” he said.

PYMNTS

NOVEMBER 17, 2020

Lumin Digital announced today (Nov. 17) that it will provide Los Angeles Federal Credit Union (LAFCU) with its cloud-based online and mobile digital banking platform, according to a press release emailed to PYMNTS. At LAFCU, we continuously want to improve the products and services we offer.

PYMNTS

APRIL 24, 2020

Some banks have shuttered their branches during the pandemic and are relying on digital or mobile channels to fulfill customer needs, but others do not have that option. Digital Technologies Under COVID-19. Fifth Third Bank, KeyBank and PNC Bank are among those in the U.S. Several U.K.

PYMNTS

OCTOBER 7, 2020

But by and large, with branch activities curtailed and lingering public health fears in place, banks have to offer a uniform, consistent and safe experience to all users, across all types of (online) interaction. There's a lot of great technology out there, but it’s about applying the right tool to the right use case,” he told PYMNTS.

Bank Innovation

MAY 4, 2017

Consumers are becoming more comfortable with biometrics in banking—most are now actively asking for the capability to be included in their mobile and online banking experience. consumers released today by biometric identity solutions […].

PYMNTS

APRIL 24, 2020

Digital transformation is essential for financial institutions’ (FIs) success, but what such a transformation entails has shifted in recent years. Ensuring that customers can access fast and secure services is critical and one of the many reasons legacy and challenger banks alike are shifting how they view many processes.

Perficient

OCTOBER 19, 2020

Digital Banking : Demand for digital banking has accelerated over the last 6+ months and should be a top priority for financial institutions. COVID-19 has changed both customer behavior and expectations, leaving them no choice but to use digital and contactless for their financial interactions.

Bank Innovation

MARCH 12, 2018

BNP Paribas Fortis will integrate Tink’s Aggregation, Personal Finance Management (PFM) and Payment Initiation technology into its mobile banking applications. The first step will be to roll out Tink to BNP's mobile-first digital bank, Hello.Read More.

PYMNTS

NOVEMBER 20, 2020

Studies have shown that CUs must personalize their in-branch and digital offerings with products and services tailored to individual members’ needs to stay competitive. Getting the customer service angle right is so crucial to CUs’ success that many CUs are investing in emerging technologies to help them better hit their marks.

PYMNTS

FEBRUARY 25, 2020

with early adopters willing to pay high rates per minute to use a mobile device. It wasn’t until a few years into the 21st century that many people thought about mobile as the great disruption to the market. The Moving Mobile Picture . Though cell phones were picking up traction, there were only about 55 million in the U.S.,

PYMNTS

APRIL 23, 2020

Branch visits are vital to customers’ financial lifestyles, despite mobile and online banking’s growing popularity. We don’t think about digital just as a client-facing tablet,” Warder explained. “We’re Adapting to Social Distancing . These developments come with new expectations from customers, however. .

PYMNTS

FEBRUARY 2, 2021

In Pakistan, and elsewhere, the stars are aligning for greater use of digital banking and payments to improve financial inclusion. told PYMNTS CEO Karen Webster in an interview that the pandemic and the rise of mobile infrastructure have set the stage to bring people living in developing and emerging economies into the digital realm.

PYMNTS

AUGUST 22, 2019

Banks are not just competing for customer engagement and retention — they are also vying for funding and resources as they overhaul their infrastructure and banking tools. The latest Digital Banking Tracker examines how legacy institutions stay competitive with challenger banks. Competition Can Lead to Innovation.

Bobsguide

APRIL 15, 2021

The pandemic has accelerated digital transformation in banking, leading banks to faster adopt new digital delivery models. The rise of neo and digital banking became the new normal, with an emphasis on mobile banking services. Industry analysts predict the pandemic will only help these new,

PYMNTS

SEPTEMBER 17, 2019

Impending 5G technology holds a great deal of promise for many industries, especially for financial institutions. A 5G network could markedly improve mobile banking apps’ speed, security and ease of use. Mobile banking apps have already enjoyed mass adoption, but what are consumers using them for? Nearly all (93.1

PYMNTS

SEPTEMBER 24, 2020

In the great digital shift , the mobile device is the point of sale — especially in Asia’s fast-growing markets. The conversation came against a backdrop where online transaction volumes and mobile wallet adoption are increasing. Donlea noted that mobile wallets are designed for consumer and brand loyalty.

PYMNTS

NOVEMBER 24, 2020

South African digital identity firm Entersekt is partnering with African FinTech Cellulant to bring enhanced cybersecurity to mobile banking and digital payments. . The two companies are collaborating to integrate Entersekt’s mobile software development kit with Cellulant’s product stack. .

PYMNTS

FEBRUARY 26, 2019

In the banking world, amid the continued shift to digital services, the mobile device might just be the fulcrum. According to Sherif Samy, senior vice president of North America at Entersekt , banks have an inherent advantage in place when seeking to bring new features and services to clients: trust.

PYMNTS

NOVEMBER 9, 2020

The Tracker also examines how mobile and instant disbursement tools could be essential to making sure these individuals are still able to participate and transact within the digital banking world. Another FDIC report found that 31 percent of American consumers are now using peer-to-peer (P2P) mobile wallet apps, for example.

Perficient

APRIL 20, 2023

The Landscape According to Forbes Advisor: 2022 Digital Banking Survey , as of 2022, 78% of adults in the U.S. prefer to bank via a mobile app or website. And those consumers desire digital experiences that are personalized and meaningful.

Perficient

MAY 28, 2020

While it’s true that 5G has the potential to profoundly change the banking industry and be a more significant transformation for mobile technology than earlier generations, it’s also true that potential use cases, from connected payments to augmented reality, are unlikely to take place immediately. Dust Off Those Old App Ideas.

Bank Innovation

APRIL 18, 2017

Bank of America’s mobile customers are fast embracing P2P. “We We remain a leader in digital banking and continue to see strong digital growth,” said Paul Donofrio, Bank of America’s chief financial officer, during the company’s earnings call this morning.

PYMNTS

JUNE 29, 2020

Consumers are leaning heavily on digital banking tools during the pandemic, and studies suggest that they will continue to do so in its wake. Fifty-seven percent of consumers now prefer internet banking solutions, compared to the 49 percent who said the same prior to the pandemic. Mobile Customers Need Mobile Infrastructure.

PYMNTS

MARCH 2, 2020

To provide its digital banking experience to more financial institutions, Clinc is teaming with Visa in a partnership that brings artificial intelligence (AI) technology to payments and banking customers. This kind of capability and cutting-edge AI wouldn’t otherwise be accessible without Visa.”.

PYMNTS

JUNE 10, 2020

In one of the signs of where we are and where we are headed in the warp-speed transformation of digital banking, consider the internet meme that poses a multiple-choice question and series of answers. Who led the digital transformation of your company? A) CEO B) CFO C) COVID-19.”.

Bank Innovation

JANUARY 11, 2019

Distributed ledger technology will be crucial to innovation in digital banking this year, according to a poll conducted by Bank Innovation. For the December poll, Bank Innovation asked readers to name a technology, aside from the obvious - artificial intelligence, that would be most prominent in 2019.

PYMNTS

OCTOBER 30, 2018

A consumer’s sense of security and trust can be a funny, even unpredictable thing, especially when it comes to payments, banking and commerce. Maybe it’s the reputation of a brand that lowers the mental resistance to inputting payment and personal details on a mobile device to complete a transaction. Trust Advantage.

PYMNTS

MARCH 13, 2019

As the financial services space focuses on digitizing offerings for their small business customers, much of these efforts are targeting online banking portals accessed via desktop. One of the biggest impacts of mobile-based services will be the shift from weekly or monthly processes to operating in real time.

Bank Innovation

JUNE 21, 2018

PREMIUM – Every year Bank Innovation assembles a list of 44 innovators that caught our attention in digital banking and fintech. These are the people Bank Innovation believes to be this year’s movers and shakers in the industry, paving the way with forward-thinking technologies and ideas.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content