Juniper Research sees digital banking poised for growth

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

MARCH 6, 2020

Digital banking is poised to take off as incumbent banks move much of their business to mobile channels to compete against a new generation of digital-only startups.

Payments Dive

DECEMBER 20, 2019

The growing phenomenon of direct, digital banking and Silicon Valley's entry into the payments business are posing a series of challenges to traditional banking institutions. NCR's Doug Brown explores the landscape for 2020 to determine how these trends will impact the global banking business moving forward.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accenture: Banking

JANUARY 26, 2022

Each new day in 2022 takes us further into this new era of banking. Today’s banks are more intentional that reactive, more likely to challenge conventions than respect…. The post 10 trends shaping post-digital banking innovation appeared first on Accenture Banking Blog.

Perficient

FEBRUARY 27, 2025

See Also : Transforming Industries, Powering Innovation Banking Trend #2: Adapting to Regulatory Shifts As the banking landscape evolves, staying compliant with regulatory requirements becomes increasingly challenging, especially with the rise of open banking, AI, and data privacy concerns.

Bank Innovation

MARCH 12, 2020

Fintech startups looking to upend how Americans do their banking are facing their first major test as interest rates fall and fearful consumers seek safety at traditional banks. mobile payments companies founded after the 2008 financial crisis, and digital banks including Chime Inc. Square Inc. and Stripe Inc.,

Chris Skinner

APRIL 3, 2018

BTW, I’ve also heard a lot of people have been frustrated that Amazon cancelled their pre-orders of the new … The post Digital banks are 35+ times more productive than traditional banks appeared first on Chris Skinner's blog. If you would like to get a signed copy of the book, just register here.

Bank Innovation

JANUARY 22, 2020

The race to create a challenger bank just got more competitive with a ready-made solution from core provider Temenos that can help brands stand up a digital bank in as few as 90 days. The Switzerland-based banking technology provider launched its digital banking software-as-a-service solution in the U.S.

Payments Dive

MARCH 10, 2020

Amid rapid changes in the cash economy and the rise in digital payments, the ATM is likewise facing challenges that have led to an evolution that will meet the demands of a new generation of customers.

PYMNTS

DECEMBER 29, 2020

In an interview with PYMNTS, Lilia Metodieva, managing director at Monneo , said virtual international bank account numbers (IBANs) can help firms gain scale internationally, and customize payments to serve the needs of their end customers. Platforms and single access points help bridge the gap between traditional banks and eCommerce.

Payments Dive

SEPTEMBER 26, 2019

Marbue Brown, the head of customer experience at JPMorgan Chase, told attendees at the annual BCX summit that millions of people want a combination of the speed and sophistication of digital banking along with the human interaction and financial wellness provided by a physical bank branch.

Bank Innovation

FEBRUARY 16, 2020

Digital bank Stori, which is based in Mexico City, aims to reach customers with minimal access to financial services. Recent research highlights the problems the bank is attempting to solve.

Payments Dive

SEPTEMBER 3, 2019

Digital banking is growing rapidly in the U.K., as challenger banks are gaining share among non-millennnial users and winning over customers with strong customer service. The report warns, however, that few of these upstart banks are actually turning a profit and the pace of growth cannot continue at the same pace forever.

Bank Innovation

JANUARY 10, 2020

Thailand is laying the foundations for standalone digital banks as it strives to catch up with other Asian markets that are allowing such changes, according to its central bank governor. “At

Payments Dive

DECEMBER 9, 2022

“Rather than basic capabilities, consumers want a complete digital banking experience,” a payments firm professional writes. “They want access to all of the buzzworthy features.”

Accenture: Banking

AUGUST 8, 2021

They didn’t want to think about the payment…. The post Delight customers with easy and invisible payment experiences appeared first on Accenture Banking Blog. The way they made their regular purchases changed too—for example, getting their groceries delivered to their door or picking them up curbside.

Chris Skinner

SEPTEMBER 16, 2019

I was recently asked by Volante Technologies to consider what being a digital bank means, specifically for a commercial bank and, even more specifically, the bank’s payments and treasury services. appeared first on Chris Skinner's blog.

Bank Innovation

FEBRUARY 9, 2020

Core providers are rolling out digital bank toolkits that can launch a new offering within 90 days, and Jack Henry is the latest contender to join that race with BankAnywhere, a cloud-based system for community banks. Jack Henry is not the first core provider to roll out a “digital bank in a box” product for […].

Payments Dive

MAY 8, 2020

The world of banking continues to change and evolve.

Bank Innovation

JANUARY 5, 2020

Two more consortiums said they submitted bids for digital banking licenses in Singapore as companies, ranging from a massage chair maker to a property giant and Chinese fintech firms, joined forces to go for the sought-after permits. Beyond Consortium, led by one of Asia’s largest massage chair makers, V3 Group Ltd.

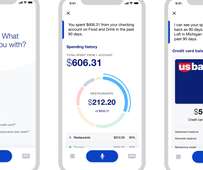

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

PYMNTS

APRIL 23, 2020

More banks are therefore moving away from legacy core systems to embrace cloud-native architectures to power automation and meet the speed expected by consumers, securely. The bank is working with technology giants Google and Microsoft to create new cloud-based tools that will use their cloud computing software. About The Tracker.

PYMNTS

APRIL 28, 2020

These shifts have made digital banking and debit transactions more important than ever. Consumers are also avoiding cash out of concern that the virus could linger on physical object and are thus favoring virtual and contactless payment cards instead. Pandemic Puts Digital Banking in the Spotlight.

Payments Dive

NOVEMBER 14, 2019

The blockbuster agreement for Citi to integrate its Google Pay wallet with Citi and Stanford Federal Credit Union's mobile checking accounts represents an evolution of Big Tech and traditional banking to offer a mutually beneficial expansion of their digital banking and payments businesses.

PYMNTS

FEBRUARY 23, 2020

JPMorgan Chase is taking steps to open a digital bank in the U.K. The banking firm has been talking with London regulators about the idea, according to The Financial Times on Saturday (Feb. bank Goldman Sachs launched a digital bank called Marcus in the U.K. by the end of the year.

PYMNTS

APRIL 27, 2020

The number of online banking customers is growing worldwide, and FIs’ consumers are coming to expect seamless digital experiences as a result. One study recently determined that the number of digital banking users is expected to exceed 3.6 Starting at the Core. Forty-three percent of U.S.

Payments Dive

OCTOBER 19, 2018

Digital channels are being widely accepted by today's consumers, but with this adoption comes the increase in impersonal transactions through online and mobile banking, drastically impacting the traditional model of building relationships

Payments Dive

JANUARY 18, 2019

Fintech companies, mobile banks and others are granting waivers, extended payments and other services to help workers impacted by the government shutdown.

PYMNTS

AUGUST 4, 2020

The writing has been on the wall: PYMNTS research has found that though most people are satisfied with their in-place relationships with banks, only about 40 percent of people would be “extremely” or “very” likely to bring their banking relationships to Big Tech or FinTechs.

PYMNTS

DECEMBER 4, 2020

JAXFCU set out to find a digital services provider that would fully integrate with other offerings, and it found an ideal solution in Lumin Digital, which provides "seamless integration" that enables members of the CU to utilize both mobile and web channels.

Accenture: Banking

OCTOBER 5, 2021

The pace of change in payments right now might seem overwhelming. The pandemic has supercharged the trend towards contactless, online and instant payments. Contactless payments, for instance, grew 150% from March 2019. This is just the start. In the next 10 years, almost 2.7 In the next 10 years, almost 2.7

PYMNTS

OCTOBER 6, 2020

Dimon’s comments come at a time of aggressive growth and gains by numerous digitally native startups that have modernized and streamlined online banking and payments for the masses. We've got to do more of it.”.

Bank Innovation

DECEMBER 29, 2019

to apply for a full digital banking license, jumping aboard a Singapore government initiative to attract technology firms into its financial sector. A Grab entity will own a 60% stake in the consortium that will apply for the bank license in Singapore, while the telco known […]. Grab Holdings Inc.

Payments Dive

FEBRUARY 19, 2020

In 2020 and beyond, it will critical for banks and credit unions to reevaluate their digital strategies.

Payments Dive

SEPTEMBER 13, 2018

Suresh Ramamurthi, chairman and CTO of CBW Bank, opened the annual Bank Customer Experience conference with a keynote speech detailing his financial institution's unique journey.

PYMNTS

NOVEMBER 24, 2020

The pandemic is reshaping banking. Generationally, we’re seeing individuals who maybe weren’t accessing their card accounts or their banking accounts on a regular basis through digital,” he said. Getting Customers Used To More Self-Service.

PYMNTS

NOVEMBER 11, 2020

Digital banking and payment processing firm i2c has partnered with Purewrist , a FinTech working in end-to-end contactless payment solutions and wearables, according to a press release. They're more likely to use digital payments and have been choosing where to shop based on what digital payments options are available.

Gonzobanker

JUNE 20, 2024

According to Cornerstone’s Digital Banking Performance Metrics study, the percentage of new accounts opened in digital channels dropped for the second straight year. That’s not what’s happening with digital banks and fintech firms. Some digital banks in the U.K., Nor is it a winning strategy.

Payments Dive

JANUARY 2, 2020

payments, the rise of digital banking, the transition to PSD2 in Europe and the growing crisis in cash access. The top 10 most-read articles of 2019 addressed a range of issues, including the wave of merger activity in U.S.

PYMNTS

AUGUST 5, 2020

In retail technology, Yotpo is helping brands capture the digital shift by making a compressed marketing stack for online shopping. 40%: Approximate share of people who would be “extremely” or “very” likely to bring their banking relationships to Big Tech or FinTechs. All this, Today in Data.

Payments Dive

OCTOBER 22, 2019

Chime Bank is recovering from its third system outage since July, and this most recent incident is serving as a wake-up call for many in the industry about the vulnerabilities of managing critical financial services in a digital-only environment.

PYMNTS

APRIL 13, 2020

Earlier this month, the Bank of International Settlements (BIS), which has more than 600 member financial institutions and central banks spanning 60 countries, took note of changing consumer attitudes toward cash in a report titled “COVID-19, Cash and the Future of Payments.”

Payments Dive

FEBRUARY 27, 2023

The Seattle-based remittance fintech launched Passbook in 2020. The product, however, hasn’t garnered significant overlap with existing customers, Remitly CEO Matt Oppenheimer said.

Payments Dive

OCTOBER 4, 2019

The successful transition to mobile banking requires a seamless, intuitive user experience built into a mobile app. But the evolution from bricks-and-mortar to digital requires so much more in terms of how you deal with legacy systems, how you listen to customers and how you deal with the challenges of modern day neobanks.

PYMNTS

OCTOBER 1, 2020

The pandemic has exposed the pain points of all verticals when it comes to payments, and especially when it comes to transacting in person, in a tactile environment, with cash, and where banking conduits are limited. Banks have been inching into the space; cash still remains a hallmark.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content