Benefits of Leveraging Technology for Document Preparation

Abrigo

JUNE 9, 2020

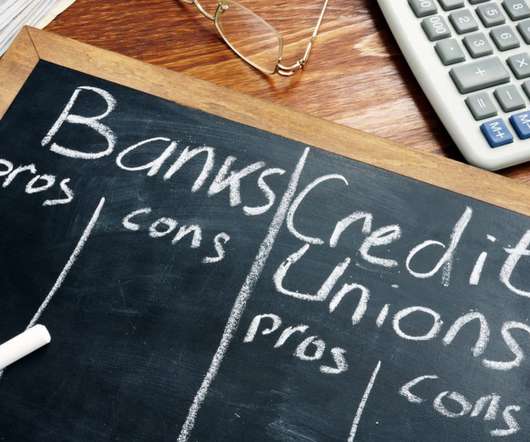

Technology has enabled financial institutions to operate more quickly and efficiently, creating a better experience for customers. Financial institutions are looking for a solution to increase efficiency, decrease risk, and provide complete, defensible documentation for loan types. Learn more.

Let's personalize your content