Why the CFPB’s recent EWA rule is wrong

Payments Dive

AUGUST 14, 2024

The Consumer Financial Protection Bureau’s earned wage access rule “could outright deny EWA to the wage earners who need it the most,” writes a trade group CEO.

Payments Dive

AUGUST 14, 2024

The Consumer Financial Protection Bureau’s earned wage access rule “could outright deny EWA to the wage earners who need it the most,” writes a trade group CEO.

South State Correspondent

AUGUST 14, 2024

If managing loan pricing is a college-level course, deposit pricing is a master’s. Given the complexity, managing analyzed checking, however, is a PhD. level effort. There are all the dynamics of traditional accounts plus often two different interest rates, the ability to offset fees, and a variety of adjustments. We covered the basics of account analysis in Part 1 ( HERE ), and in this article, we highlight best practices for managing an analyzed transaction account.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 14, 2024

The bank and credit card issuer told regulators in a letter that competition will require it to keep its products fairly priced.

South State Correspondent

AUGUST 14, 2024

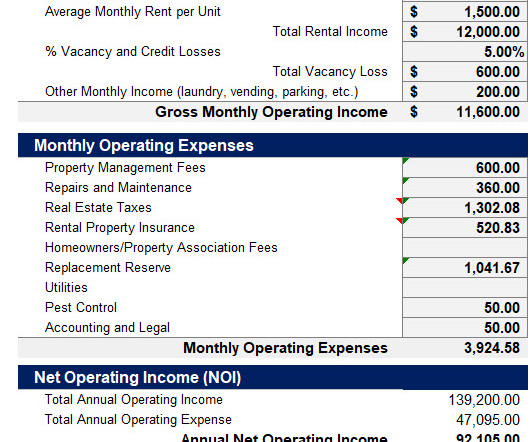

Commercial lending is more competitive than ever. To effectively differentiate their services, commercial lenders will need to be thought leaders, understand their market and industries, and provide more insightful advisory services. Commercial lenders can differentiate themselves by running return on investment (ROI) scenarios for their borrowers to help them make better financing decisions – especially when comparing buy vs. rent decisions.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Jeff For Banks

AUGUST 14, 2024

So often we struggle with the noise surrounding the banking industry. “Change or die!” “Get bigger or get out!” “If you don’t have an AI strategy you’re already behind!” How do we create a financial institution that embraces change without chasing shiny objects? I have ideas in the below video.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

AUGUST 14, 2024

Joanna McLafferty, Kirstine McMillan and Joseph Smart On 7 May 2024 the SONIA rate, the UK’s risk-free reference rate, printed at exactly 5.2000% and has remained there to the end of July 2024 (the time of writing). Flatlining of SONIA is not a phenomenon we see often. Prior to this, over the past six years SONIA had been ‘flat’ for only four consecutive days, on two occasions.

Commercial Lending USA

AUGUST 14, 2024

Get clear, simple advice on commercial property loans. Compare rates and find the best options to help you secure the perfect deal for your business.

American Banker

AUGUST 14, 2024

Krish Swamy, Dan Jermyn and others on a just-released AI 100 list say they expect investment in AI to keep increasing.

BankBazaar

AUGUST 14, 2024

This Independence Day, we want you to pave your way towards a financially independent life. And to be financially independent you need to have a good credit history, therefore, a great Credit Score! It’s a great feeling to be independent. It’s a liberating experience. This Independence Day, we want to equip you with the liberty of being in charge of your finances.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

AUGUST 14, 2024

The Chicago-area bank closed the fifth-largest deal announced this year in a matter of months. It may bode well for M&A, as several big transactions have been announced in 2024.

BankInovation

AUGUST 14, 2024

Vantage Bank has selected digital banking service provider Unit to improve its core digital banking offerings and provide embedded finance capabilities. Community banks don’t have the resources to execute rapid, high-quality digital transformations which has seen their share of the U.S.

Jack Henry

AUGUST 14, 2024

Support small business banking needs through connection and community. Click to learn more about the smb market and how to optimize your small business banking strategy.

BankInovation

AUGUST 14, 2024

London-based Barclays bank and Amazon have come together to launch a co-branded card in the United Kingdom: Amazon Barclaycard. “We’ve launched this card for anyone who loves to shop at Amazon and wants to be rewarded for doing so on their everyday spend,” a Barclays spokesperson told Bank Automation News.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

AUGUST 14, 2024

The card brand adds to partnerships that enable data sharing and cross-selling; the U.K. bank is lowering fees based on clients meeting metrics for sustainability; and more.

BankInovation

AUGUST 14, 2024

TD Bank will launch a data-driven small-business insights dashboard in October. Built with insights engine Monit, the dashboard will enable small-business customers to connect their accounting platforms within their banking portal with cash flow forecast insights, Paul Margarites, head of commercial digital platforms at TD Bank, told Bank Automation News.

American Banker

AUGUST 14, 2024

A Northwest credit union announced plans this week to buy a community bank, lifting the 2024 total of such deals to 13 and putting the year on track to set a record. The all-time annual high of 16 was set in 2022.

BankInovation

AUGUST 14, 2024

AI-based financier Pagaya Technologies plans to expand its new relationship with subprime auto lender OneMain Financial to an enterprise agreement as Pagaya eyes continued growth and gears up to add counteroffers and refinance options for consumers.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

AUGUST 14, 2024

A Northwest credit union announced plans this week to buy a community bank, lifting the 2024 total of such deals to 13 and putting the year on track to set a record. The all-time annual high of 16 was set in 2022.

The Paypers

AUGUST 14, 2024

Bank payment provider GoCardless has joined the SEPA Payment Account Access (SPAA) scheme and calls on banks to sign up to drive European payments innovation.

The Financial Brand

AUGUST 14, 2024

This article The New Fintech Playbook for a $1.5 Trillion Market in 2024 and Beyond appeared first on The Financial Brand. The fintech hype has cooled. But by balancing innovation with profitability, the industry can adapt to its new reality and prepare for a $1.5 trillion future. This article The New Fintech Playbook for a $1.5 Trillion Market in 2024 and Beyond appeared first on The Financial Brand.

The Paypers

AUGUST 14, 2024

Tekmetric has announced its partnership with the payment network Affirm in order to bring flexible payment options and methods to auto repair shops.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Financial Brand

AUGUST 14, 2024

This article Millennials Are At a Financial Crossroads And Banks Must Understand Their Mindset appeared first on The Financial Brand. To engage with millennials, financial institutions must understand their unique needs, leverage technology and offer tailored advice and products. This article Millennials Are At a Financial Crossroads And Banks Must Understand Their Mindset appeared first on The Financial Brand.

The Paypers

AUGUST 14, 2024

Mastercard has partnered with Argyle to advance its Open Banking for Lending initiative and enhance consumers’ control over their financial information.

American Banker

AUGUST 14, 2024

Thanh Roettele will help guide the Canadian bank's growth in the mortgage warehouse space in one of its latest moves aimed at the U.S. market.

The Paypers

AUGUST 14, 2024

Alchemy Pay has partnered with Mesh in order to enable direct crypto payments at online and offline merchants using crypto funds from exchanges and wallets.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content