Some implications of climate policy for monetary policy

BankUnderground

NOVEMBER 26, 2024

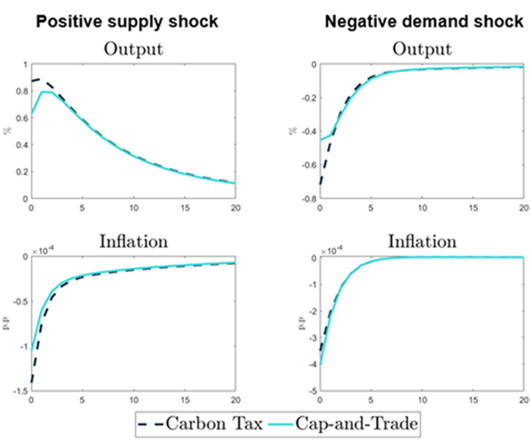

Francesca Diluiso, Boromeus Wanengkirtyo and Jenny Chan. This post examines key aspects of climate mitigation policies that could matter for monetary policy, using insights from structural climate macroeconomic models ( Environmental Dynamic Stochastic General Equilibrium ). Three main findings emerge: first, mitigation policies – like carbon pricing – can be a direct source of shocks, creating potential trade-offs for monetary policy ( Carney (2017) ).

Let's personalize your content