Top payments trends for 2024

BankInovation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow.

BankInovation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow.

South State Correspondent

JANUARY 2, 2024

Many economists and analysts predict that the Federal Reserve and other central banks will start easing monetary policy in 2024. Many bankers and borrowers are convinced that a recession is imminent despite no clear evidence for such a conclusion. How should lenders discuss interest rates in 2024, and what advice should relationship managers provide their clients about banking products?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ATM Marketplace

JANUARY 2, 2024

2024 will be another major year of change and challenge for retail banks.

American Banker

JANUARY 2, 2024

A new law will make Colorado a much more difficult place for cash-strapped citizens to get credit. Other states should avoid following in its footsteps.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

BankInovation

JANUARY 2, 2024

Valley Bank is exploring generative AI, expanding machine learning operations and paying keen attention to data throughout the bank’s operations. Chief Data and Analytics Officer Sanjay Sidhwani joined the $61 billion, Morristown, N.J.-based bank in April in the new position.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JANUARY 2, 2024

HSBC Holdings Plc is set to debut an international payments app aimed at directly challenging the dominance of fintechs like Revolut and Wise Plc that have gathered tens of millions of retail customers by offering cheap foreign exchange.

American Banker

JANUARY 2, 2024

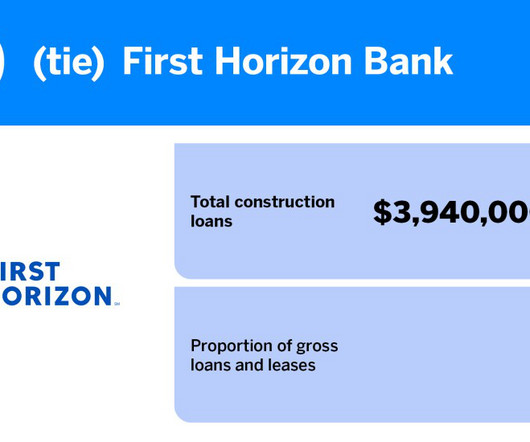

The top five banks have combined construction loans of more than $71 billion.

The Financial Brand

JANUARY 2, 2024

This article Trends 2024: Is Record-Breaking Pace of Bank Branch Closures Easing? appeared first on The Financial Brand. In 2024, bank closures will be well off their pandemic highs – mainly because there are few locations left for banks to feasibly cut. This article Trends 2024: Is Record-Breaking Pace of Bank Branch Closures Easing? appeared first on The Financial Brand.

American Banker

JANUARY 2, 2024

The fintech revolution has been more successful at working with banks than at trying to replace them, points out Gene Ludwig, former Comptroller of the Currency, chair of the Ludwig Institute for Shared Economic Prosperity, and co-founder of Canapi Ventures. Those with "must have" products will fare far better in 2024 than those with "nice to have" tools, he says.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

The Financial Brand

JANUARY 2, 2024

This article Banking 2030, Part 2: The Seismic Forces Shaping the Industry appeared first on The Financial Brand. Special Report: In the second of a four-part series on the long-term future of the banking industry, we examine the four major industry transformations currently underway. This article Banking 2030, Part 2: The Seismic Forces Shaping the Industry appeared first on The Financial Brand.

American Banker

JANUARY 2, 2024

The bank's cross-border transaction service opens a new lane for customer acquisition in an increasingly competitive niche.

The Financial Brand

JANUARY 2, 2024

This article An Inside Look at Ally Bank’s Measured Roll-Out of GenAI appeared first on The Financial Brand. How can banks harness AI's emergent capabilities before public opinion or regulatory sentiment turns? Ally's responsible and inclusive approach is a good start. This article An Inside Look at Ally Bank’s Measured Roll-Out of GenAI appeared first on The Financial Brand.

American Banker

JANUARY 2, 2024

Brighton Bank entered a consent agreement with the regulator regarding violations of anti-money laundering laws.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Financial Brand

JANUARY 2, 2024

This article Banking 2030, Part 3: Banking Innovation is Paramount Even as Regulatory and Competitive Pressures Mount appeared first on The Financial Brand. Special Report: Why a challenging environment cannot distract banks and credit unions from the imperative to innovate. This article Banking 2030, Part 3: Banking Innovation is Paramount Even as Regulatory and Competitive Pressures Mount appeared first on The Financial Brand.

American Banker

JANUARY 2, 2024

Co-workers remember a considerate boss who worked to create newsroom opportunities for women and minorities

American Banker

JANUARY 2, 2024

The Treasury's Financial Crimes Enforcement Network launched its new database identifying U.S. business owners pursuant to the 2021 Corporate Transparency Act Monday, giving existing companies one year to file reports on their true owners and new companies 90 days after their creation to comply.

American Banker

JANUARY 2, 2024

Bank investors hope they can party like it's 1995, when the U.S. economy stayed healthy even after aggressive Federal Reserve rate hikes. But a few analysts are a bit more cautious over whether banks' loan books will hold up as well this time.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

JANUARY 2, 2024

Eugene Ludwig, former Comptroller of the Currency and current co-founder of Canapi Ventures, a fintech VC, reflects on how 2023 treated fintechs, how far the fintech movement has come and what banks and their regulators need to look out for in 2024.

Let's personalize your content