Will Toast raise prices this year?

Payments Dive

JANUARY 11, 2024

The restaurant point-of-sale provider may give clients a choice when it makes price adjustments, following a fee flub last year.

Payments Dive

JANUARY 11, 2024

The restaurant point-of-sale provider may give clients a choice when it makes price adjustments, following a fee flub last year.

Jack Henry

JANUARY 11, 2024

Avoid phishing scams with a secure messaging and communication platform. Discover how Banno Business™ can help your financial institution.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 11, 2024

The latest cross-border input from the U.S. Faster Payments Council suggests it’s not too early to assess how real-time payments will shape international transactions.

TheGuardian

JANUARY 11, 2024

FCA to examine whether consumers have been charged inflated loan rates on new and secondhand cars What is the FCA looking into and will people get money back? Millions of drivers could be in line for a payout, it has been claimed, after the UK financial watchdog opened an investigation into whether consumers had been unfairly charged inflated prices for loans on new and secondhand cars.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

JANUARY 11, 2024

After opening automated stores on college campuses and sports stadiums, the tech giant is moving into healthcare facilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JANUARY 11, 2024

The Salt Lake City-based convenience store retailer joins Yesway and Pilot in implementing Relay’s contactless purchasing platform.

TheGuardian

JANUARY 11, 2024

Chief executive of Wyelands Bank, part of steel magnate Sanjeev Gupta’s empire, found to have committed ‘serious’ rule breaches • Business live – latest updates The former boss of a bank linked to steel magnate Sanjeev Gupta has been fined nearly £120,000 for not managing the troubled lender’s exposure properly. Iain Mark Hunter, the former chief executive of Wyelands Bank, will pay a fine of £118,808 for failing to ensure the lender had adequate systems and controls, the Bank of England said on

The Paypers

JANUARY 11, 2024

Walmart has announced new AI-powered tools to help shoppers quickly search for products and automate the process of re-ordering frequently ordered items.

TheGuardian

JANUARY 11, 2024

Ian Dodd says in high court claim he developed heart problems and depression that made him suicidal The former head of recruitment at Goldman Sachs is suing the investment bank for more than £1m alleging that demanding him to be “working unreasonable and excessive hours” led to “physical and psychiatric injuries” and “wanting to take his own life”. Ian Dodd, 55, who was Goldman’s global head of recruiting in London between 2018 and 2021, says in a personal injury claim at the high court that he

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Gonzobanker

JANUARY 11, 2024

Tomorrow’s Smarter Bank leaders will cultivate managed chaos, inspire creative thinking and encourage results-driven action. “The only thing that ever sat its way to success is a hen.” – Sarah Brown For some time, Cornerstone has been talking about the “Smarter Bank,” focusing on how our clients must use new skills, knowledge, technology and information to complete the long and tough transformation to the future delivery model.

CFPB Monitor

JANUARY 11, 2024

On January 9 th , Michael Guerrero, Partner in Ballard Spahr’s Consumer Financial Services Group, presented at a program titled “Has the CFPB Offered Simpler Rules of the Road? Successes and Challenges with the CFPB’s Rulemaking and Non-Rulemaking Efforts During the Biden Administration”. Panelists discussed the CFPB’s rulemaking and non-rulemaking guidance after Director Rohit Chopra’s June 2022 blog post titled “Rethinking the Approach to Regulations” in which he shared the CFPB’s aspiration t

BankUnderground

JANUARY 11, 2024

Julia Giese and Charlotte Grace In response to the global financial crisis, the Bank of England (BoE) began using Product-Mix Auctions (PMA) to provide liquidity insurance to financial institutions. The PMA, designed by Paul Klemperer , allows the quantity of funds lent against different types of collateral to react flexibly to the economic environment and market stress.

CFPB Monitor

JANUARY 11, 2024

We discuss various issues faced by lenders and servicers when attempting to foreclose on “zombie” mortgages, meaning second mortgages on which the borrower has not made a payment for a considerable period of time and the lender or servicer has not previously taken action to foreclose. First, we look at the CFPB’s May 2023 advisory guidance on the enforcement of time-barred mortgage loans. .

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

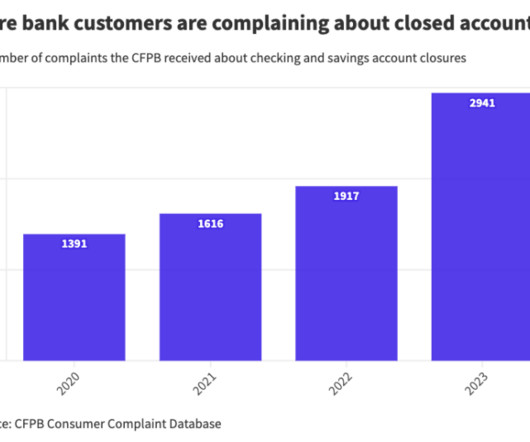

American Banker

JANUARY 11, 2024

The anti-money-laundering systems that are automatically kicking customers out of their accounts need to be tempered with rich customer data, human involvement and perhaps quick requests for information from customers.

BankInovation

JANUARY 11, 2024

Grasshopper Bank is working with account origination solution provider Mantl to make credit more easily available to the bank’s small business clients. The New York-based digital bank’s clients asked for a simpler way to access credit in “a more efficient, technology-oriented way,” Grasshopper Bank Chief Executive Mike Butler told Bank Automation News.

American Banker

JANUARY 11, 2024

The internal watchdog called for new standards for staff handling of controlled unclassified information.

BankInovation

JANUARY 11, 2024

The financial services industry is investing in AI and generative AI as uses for both technologies expand. Ninety-seven percent of FIs plan to increase investment in AI to identify uses, optimize workflows and enhance their infrastructures, according to chip-making behemoth Nvidia’s “State of AI in Financial Services: 2024 Trends” report, published today.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

JANUARY 11, 2024

When big banks kick off earnings season on Friday, industry observers will be paying close attention to loan growth, deposit growth, expense growth, credit quality and capital ratios. All five areas will offer clues about the industry's trajectory in 2024.

Bussman Advisory

JANUARY 11, 2024

This week’s must-know stories in the FinTech, AI and Digital Asset space: OpenAI launches its own GPT Store SEC approves 11 spot Bitcoin ETFs HSBC reportedly eyeing Tesco Bank acquisition Plus, 12 more exclusive stories to help you stay ahead of the curve! The latest edition of the FinTech Ecosystem Newsletter is here : Join our Community Join our community of 52,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter pro

American Banker

JANUARY 11, 2024

The decision could make bitcoin a major part of more investing portfolios. But after bitcoin, the SEC is likely to move slowly on approving other crypto-tied ETFs.

The Paypers

JANUARY 11, 2024

The European Central Bank has announced plans to allocate up to EUR 1.2 billion to contractors to develop features facilitating offline payments for a retail digital euro.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

JANUARY 11, 2024

The deal by the $11.8 billion-asset Global (formerly AlaskaUSA) to acquire First Financial Northwest Bank is one of the largest bank deals ever struck by a credit union.

The Paypers

JANUARY 11, 2024

Real-time payments software ACI Worldwide has announced that Co-op migrated its full stack of payments and fraud prevention software into its cloud platform.

American Banker

JANUARY 11, 2024

John Williams, who also serves as vice chair of the Federal Open Market Committee, does not expect the Federal Reserve to slow its balance sheet runoff anytime soon.

The Paypers

JANUARY 11, 2024

Solutions by Text has announced its partnership with Prodigal in order to optimise customer finance in the US with AI-powered intelligence.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content