Instant payments to buoy cross-border flow

Payments Dive

JANUARY 11, 2024

The latest cross-border input from the U.S. Faster Payments Council suggests it’s not too early to assess how real-time payments will shape international transactions.

Payments Dive

JANUARY 11, 2024

The latest cross-border input from the U.S. Faster Payments Council suggests it’s not too early to assess how real-time payments will shape international transactions.

Jack Henry

JANUARY 11, 2024

Avoid phishing scams with a secure messaging and communication platform. Discover how Banno Business™ can help your financial institution.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 11, 2024

The restaurant point-of-sale provider may give clients a choice when it makes price adjustments, following a fee flub last year.

Gonzobanker

JANUARY 11, 2024

Tomorrow’s Smarter Bank leaders will cultivate managed chaos, inspire creative thinking and encourage results-driven action. “The only thing that ever sat its way to success is a hen.” – Sarah Brown For some time, Cornerstone has been talking about the “Smarter Bank,” focusing on how our clients must use new skills, knowledge, technology and information to complete the long and tough transformation to the future delivery model.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Payments Dive

JANUARY 11, 2024

After opening automated stores on college campuses and sports stadiums, the tech giant is moving into healthcare facilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JANUARY 11, 2024

The Salt Lake City-based convenience store retailer joins Yesway and Pilot in implementing Relay’s contactless purchasing platform.

CFPB Monitor

JANUARY 11, 2024

We discuss various issues faced by lenders and servicers when attempting to foreclose on “zombie” mortgages, meaning second mortgages on which the borrower has not made a payment for a considerable period of time and the lender or servicer has not previously taken action to foreclose. First, we look at the CFPB’s May 2023 advisory guidance on the enforcement of time-barred mortgage loans. .

TheGuardian

JANUARY 11, 2024

FCA to examine whether consumers have been charged inflated loan rates on new and secondhand cars What is the FCA looking into and will people get money back? Millions of drivers could be in line for a payout, it has been claimed, after the UK financial watchdog opened an investigation into whether consumers had been unfairly charged inflated prices for loans on new and secondhand cars.

BankUnderground

JANUARY 11, 2024

Julia Giese and Charlotte Grace In response to the global financial crisis, the Bank of England (BoE) began using Product-Mix Auctions (PMA) to provide liquidity insurance to financial institutions. The PMA, designed by Paul Klemperer , allows the quantity of funds lent against different types of collateral to react flexibly to the economic environment and market stress.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

TheGuardian

JANUARY 11, 2024

Chief executive of Wyelands Bank, part of steel magnate Sanjeev Gupta’s empire, found to have committed ‘serious’ rule breaches • Business live – latest updates The former boss of a bank linked to steel magnate Sanjeev Gupta has been fined nearly £120,000 for not managing the troubled lender’s exposure properly. Iain Mark Hunter, the former chief executive of Wyelands Bank, will pay a fine of £118,808 for failing to ensure the lender had adequate systems and controls, the Bank of England said on

American Banker

JANUARY 11, 2024

The card networks are expanding their development of accelerators for women and minority-owned businesses, improving these entrepreneurs' access to venture capital.

BankInovation

JANUARY 11, 2024

Grasshopper Bank is working with account origination solution provider Mantl to make credit more easily available to the bank’s small business clients. The New York-based digital bank’s clients asked for a simpler way to access credit in “a more efficient, technology-oriented way,” Grasshopper Bank Chief Executive Mike Butler told Bank Automation News.

TheGuardian

JANUARY 11, 2024

Ian Dodd says in high court claim he developed heart problems and depression that made him suicidal The former head of recruitment at Goldman Sachs is suing the investment bank for more than £1m alleging that demanding him to be “working unreasonable and excessive hours” led to “physical and psychiatric injuries” and “wanting to take his own life”. Ian Dodd, 55, who was Goldman’s global head of recruiting in London between 2018 and 2021, says in a personal injury claim at the high court that he

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

BankInovation

JANUARY 11, 2024

The financial services industry is investing in AI and generative AI as uses for both technologies expand. Ninety-seven percent of FIs plan to increase investment in AI to identify uses, optimize workflows and enhance their infrastructures, according to chip-making behemoth Nvidia’s “State of AI in Financial Services: 2024 Trends” report, published today.

The Paypers

JANUARY 11, 2024

Walmart has announced new AI-powered tools to help shoppers quickly search for products and automate the process of re-ordering frequently ordered items.

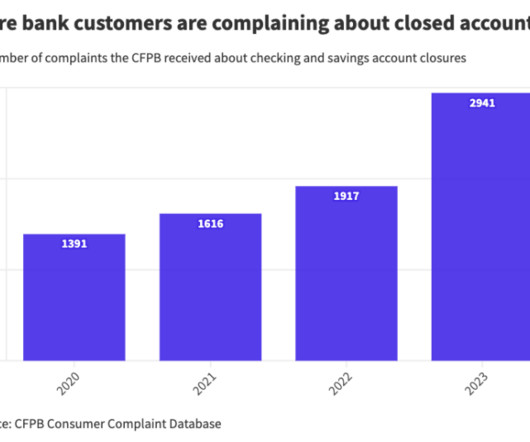

American Banker

JANUARY 11, 2024

The anti-money-laundering systems that are automatically kicking customers out of their accounts need to be tempered with rich customer data, human involvement and perhaps quick requests for information from customers.

Bussman Advisory

JANUARY 11, 2024

This week’s must-know stories in the FinTech, AI and Digital Asset space: OpenAI launches its own GPT Store SEC approves 11 spot Bitcoin ETFs HSBC reportedly eyeing Tesco Bank acquisition Plus, 12 more exclusive stories to help you stay ahead of the curve! The latest edition of the FinTech Ecosystem Newsletter is here : Join our Community Join our community of 52,000+ subscribers and stay informed on the latest trends and news in the FinTech & AI world with the weekly newsletter pro

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

American Banker

JANUARY 11, 2024

When big banks kick off earnings season on Friday, industry observers will be paying close attention to loan growth, deposit growth, expense growth, credit quality and capital ratios. All five areas will offer clues about the industry's trajectory in 2024.

The Paypers

JANUARY 11, 2024

The European Central Bank has announced plans to allocate up to EUR 1.2 billion to contractors to develop features facilitating offline payments for a retail digital euro.

American Banker

JANUARY 11, 2024

The decision could make bitcoin a major part of more investing portfolios. But after bitcoin, the SEC is likely to move slowly on approving other crypto-tied ETFs.

The Paypers

JANUARY 11, 2024

Real-time payments software ACI Worldwide has announced that Co-op migrated its full stack of payments and fraud prevention software into its cloud platform.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

JANUARY 11, 2024

The internal watchdog called for new standards for staff handling of controlled unclassified information.

The Paypers

JANUARY 11, 2024

Financial infrastructure and integration tech company PortX and data network powering the digital financial ecosystem Plaid have partnered to expedite data access and innovation for financial institutions.

American Banker

JANUARY 11, 2024

The deal by the $11.8 billion-asset Global (formerly AlaskaUSA) to acquire First Financial Northwest Bank is one of the largest bank deals ever struck by a credit union.

The Paypers

JANUARY 11, 2024

UK–based wearable payments tech provider DIGISEQ , has closed a partnership with the TAP2 marketplace to provide customers access to their chosen range of wearables.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content