3 pieces of modern infrastructure needed to manage tech-disrupted finance flows

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

CFPB Monitor

MARCH 18, 2024

Following a year of new DOJ policies and guidance designed to incentivize companies to self-report misconduct and to cooperate with government investigations, the DOJ has added a new pilot whistleblower rewards program. In their remarks at the American Bar Association’s 39 th Annual National Institute on White Collar Crime, Deputy Attorney General Lisa Monaco and Acting Assistant Attorney General Nicole Argentieri both explained that the new whistleblower policy is designed to incent

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 18, 2024

The company, which provides point-of-sale payments and other technology services to merchants, isn’t interested in handling acquiring, said President Chris Kronenthal.

American Banker

MARCH 18, 2024

False information, job losses, diminishing skills and human interaction, among other concerns, have bankers worried about deploying both generative artificial intelligence, like ChatGPT, and more long-accepted forms of AI like machine learning, according to a new survey of American Banker readers.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 18, 2024

The Canadian payments company confirmed it’s in talks about a potential transaction with a third party, noting the committee will explore possibilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 18, 2024

The Block-owned buy now, pay later provider said its expansion is a response to younger consumers looking for new tools to manage inflation.

BankInovation

MARCH 18, 2024

NASHVILLE, Tenn. — Wells Fargo has created a generative AI council within the organization to study implementation, development and deployment of gen AI.

Payments Dive

MARCH 18, 2024

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

BankInovation

MARCH 18, 2024

Nashville, Tenn. — Arc Technologies charted a 12X increase in loan originations year over year in 2023, as it gained customers and deposits when businesses looked to pivot to new banking partners after the collapse of Silicon Valley Bank.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

MARCH 18, 2024

Soon, all payments will begin and end with software. Which innovations should companies prioritize now?

BankInovation

MARCH 18, 2024

AI has landed for the consumer. It’s no longer a topic for data scientists and IT alone. But what is Generative AI? Equally as mystifying is Process Intelligence – a complex subject, frequently hidden behind the process expert wisdom.

American Banker

MARCH 18, 2024

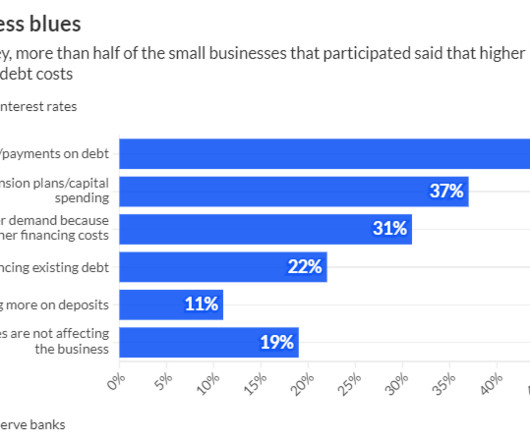

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

BankInovation

MARCH 18, 2024

NASHVILLE — Bank Automation Summit U.S. 2024 kicks off today with panelists from BankUnited, Fifth Third Bank and Wells Fargo taking the stage to discuss today’s AI revolution in banking at the Omni Nashville in Nashville, Tenn.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

MARCH 18, 2024

Despite fresh waves of online fraud and scams, czars of social media platforms, peer-to-peer networks and blockchain products have renewed ambitions to marry financial services with social apps.

BankInovation

MARCH 18, 2024

Fintech valuations and funding rounds had a tough year in 2023 as high interest rates pushed investors into capital conservation mode. In 2023, “VCs were just trying to protect their own portfolios and be cautious with their investments,” Robin Scher, head of fintech investment at Lloyds Bank, said at FinovateEurope last month.

The Paypers

MARCH 18, 2024

Australia-based HeirWealth has announced its integration with US-based financial technology firm Envestnet | Yodlee , aiming to incorporate Open Banking data sharing technology.

American Banker

MARCH 18, 2024

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

MARCH 18, 2024

India-based cybersecurity company Ensurity has integrated biometric technologies from Fingerprint Cards (Fingerprints) for its new FIDO2 biometric security key.

American Banker

MARCH 18, 2024

The head of the Consumer Financial Protection Bureau summarized his findings from a year-long probe into the Appraisal Foundation. He says the "lawmaking body" is not accountable to the public or market forces.

The Paypers

MARCH 18, 2024

UK-based mobile business account ANNA has announced that it acquired Australia-based GetCape , a fintech company that functions as a business spend management platform.

American Banker

MARCH 18, 2024

Orders on the NASDAQ exchange were unable to execute early Monday morning because of an error with the exchange's price discovery tool. The error has since been resolved.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

MARCH 18, 2024

France-based digital payments company Worldline has entered a strategic partnership with payment firm Opn to solidify its presence in the Asian ecommerce market.

The Financial Brand

MARCH 18, 2024

This article Intelligent Banks Do More with Less appeared first on The Financial Brand. As they face growing headwinds in 2024, banks and credit unions must double down on optimization and efficiency. This article Intelligent Banks Do More with Less appeared first on The Financial Brand.

The Paypers

MARCH 18, 2024

The Open Finance Association (OFA) has released its statement regarding the Centre for Finance, Innovation, and Technology ’s (CFIT) Open Finance Blueprint Report.

American Banker

MARCH 18, 2024

Increased federalization of the U.S. banking industry would be a disservice to consumers and the economy. The court must act to protect the vibrancy of the dual-banking system.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content