The heterogenous effects of carbon pricing: macro and micro evidence

BankUnderground

NOVEMBER 27, 2024

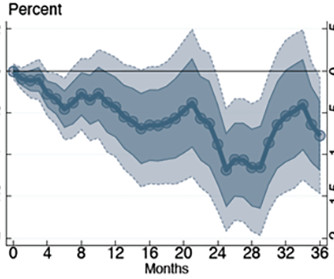

Ambrogio Cesa-Bianchi, Alex Haberis, Federico Di Pace and Brendan Berthold To achieve the Paris Agreement objectives, governments around the world are introducing a range of climate change mitigation policies. Cap-and-trade schemes, such as the EU Emissions Trading System ( EU ETS ), which set limits on the emissions of greenhouse gases and allow their price to be determined by market forces, are an important part of the policy mix.

Let's personalize your content