From Spreadsheet Chaos to Data Strategy Triumph with Perficient

Perficient

APRIL 24, 2024

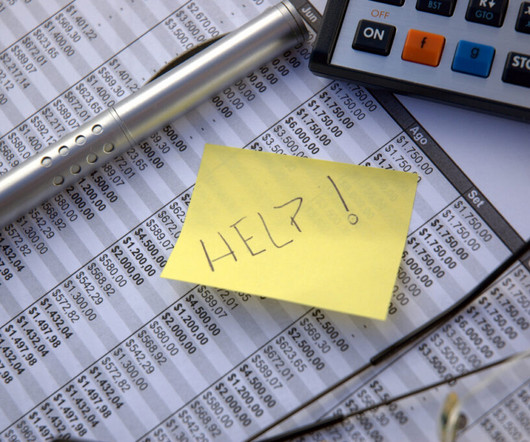

Uncovering the Challenge: Relying on Spreadsheets for Portfolio Analysis A leading wealth and asset management firm recently sought our financial services expertise for a critical challenge. Relying on complex spreadsheets for portfolio analysis, the firm faced operational hurdles due to immense computing demands. The Perficient Approach: Transforming Operations through Strategic Consulting Our team embraced the challenge, conducting a meticulous two-week analysis to uncover the root issue: a cu

Let's personalize your content