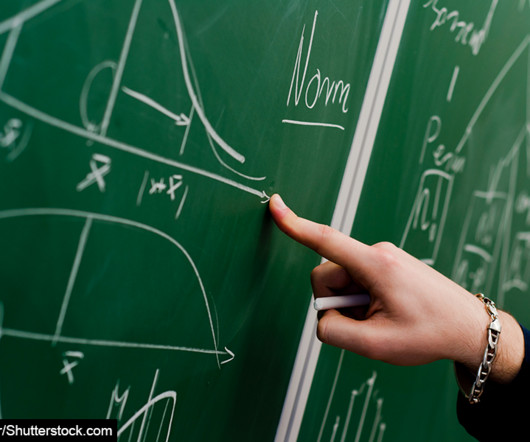

Shaping inflation expectations: the effects of monetary policy

BankUnderground

JANUARY 14, 2025

Natalie Burr In economic theory, expectations of future inflation are an important determinant of inflation, making them a key variable of interest for monetary policy makers. But is there empirical evidence to suggest monetary policy can help determine inflation expectations? I answer this question in a recent paper by applying a Bayesian proxy vector autoregression (BVAR) model to summary measures of inflation expectations for households, firms, professional forecasters and financial markets,

Let's personalize your content