Visa to boost credit card fees next year

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

Cisco

NOVEMBER 25, 2024

Learn how financial institutions can address ransomware and software and patch requirements to address public vulnerabilities.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 25, 2024

U.S. fraud losses due to push payment scams are rising, partly because of more real-time payments, according to a report from the payments company ACI Worldwide.

American Banker

NOVEMBER 25, 2024

The top five community banks averaged a return on average assets of 6.27% as of June 30.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Cisco

NOVEMBER 25, 2024

Learn how financial institutions can address ransomware and software and patch requirements to address public vulnerabilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

NOVEMBER 25, 2024

Stripe, a US-based payment processing company, has announced its intention to purchase back its shares at a nearly USD 70 billion valuation.

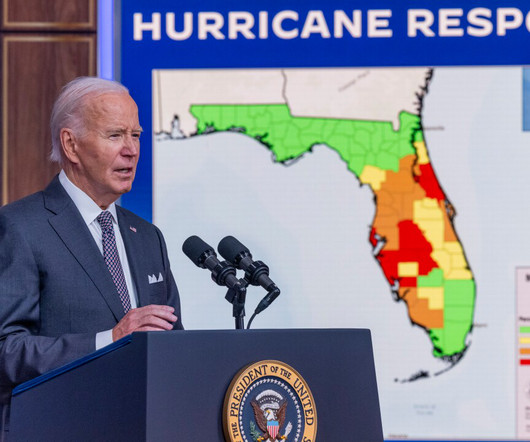

American Banker

NOVEMBER 25, 2024

Natural disasters are becoming more frequent and more severe, and victims will always require support from their banks. A plan for delivering that support needs to be in place before disaster strikes.

TheGuardian

NOVEMBER 25, 2024

Bank’s shares fall as it disputes FCA finding it should have disclosed more about deal during financial crisis Business live – latest updates Barclays will pay a fine of £40m for “reckless” failures to disclose a fundraising deal with Qatar at the height of the financial crisis, after the British bank agreed to withdraw a legal challenge against it.

The Paypers

NOVEMBER 25, 2024

Hong Kong-based virtual bank ZA Bank has introduced a new service allowing retail users to directly buy and sell Bitcoin and Ethereum with fiat currency.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

ABA Community Banking

NOVEMBER 25, 2024

Advertising jingles: corny or clever? We take a look at the power of bank jingles, past and present. The post Podcast: Memory, nostalgia and the power of sonic branding appeared first on ABA Banking Journal.

The Paypers

NOVEMBER 25, 2024

TBC Bank Uzbekistan , a mobile-only bank, has announced that it obtained a USD 10 million loan from the European Bank for Reconstruction and Development ( EBRD ).

TheGuardian

NOVEMBER 25, 2024

Bank still does not accept FCA finding that payments of £322m to Qatari entities should have been disclosed A regulatory ruling that your conduct was “reckless and lacked integrity” is meant to be a highly serious matter for a bank. Thus it was understandable two years ago that Barclays decided to appeal against a £50m fine imposed by the Financial Conduct Authority that related to the disclosure of controversial payments to Qatari investors as part of a 2008 fund raising during the depths of th

American Banker

NOVEMBER 25, 2024

St. Paul, Minnesota-based Bremer Financial agreed to sell for $1.4 billion in cash and stock. It followed a years-long legal battle between the bank and its largest shareholder that ended with a settlement this year.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

NOVEMBER 25, 2024

HSBC has stopped processing payments from Russia and Belarus for personal banking customers, following its exit from business banking in Russia.

American Banker

NOVEMBER 25, 2024

While companies tend to amp up warnings to consumers about fraud and scams during the holidays, institutions may also need to bulk up their defenses.

The Paypers

NOVEMBER 25, 2024

Full stack payment processor Finix has introduced Advanced Fraud Monitoring, a capability powered by Sift , an AI-driven fraud prevention company, to increase transaction safety for businesses.

American Banker

NOVEMBER 25, 2024

Industry observers say the U.S. securities industry's migration to next-day settlement in May 2024 was a technology success story, which has encouraged the U.K. and the EU to follow suit.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

NOVEMBER 25, 2024

Arab Financial Services (AFS) has announced a strategic collaboration with PayTic aimed at further improving and optimising card programme management.

American Banker

NOVEMBER 25, 2024

California Department of Financial Protection and Innovation Clothilde "Cloey" Hewlett will step down Dec. 30.

The Paypers

NOVEMBER 25, 2024

The Banking Industry Architecture Network ( BIAN ) has unveiled a new series of tools designed to simplify the adoption of its frameworks.

American Banker

NOVEMBER 25, 2024

Andy Sieg, head of Citi's wealth business, says retention bonuses are part of his growth strategy.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

NOVEMBER 25, 2024

Comera Financial Holdings, part of Royal Group, has introduced Comera Pay, an all-inclusive suite of digital payments, in the UAE.

American Banker

NOVEMBER 25, 2024

Reps. Andy Barr, R-Ky., and French Hill, R-Ark., leading Republicans on the House Financial Services Committee, pushed back against Federal Deposit Insurance Corp. chair Martin Gruenberg's characterization of the Synapse collapse in his July brokered deposits proposal.

The Paypers

NOVEMBER 25, 2024

Unzer , a provider of payment and software solutions, has chosen Mastercard as its strategic Open Banking partner in Germany, Austria, and Denmark.

The Financial Brand

NOVEMBER 25, 2024

This article Missed Payments, Broken Systems: Federal Studies Detail Student Loan Quagmire appeared first on The Financial Brand. Two recent CFPB reports reveal unprecedented challenges in the student loan system, with new data showing widespread servicing failures and borrower hardships. This article Missed Payments, Broken Systems: Federal Studies Detail Student Loan Quagmire appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content