South Carolina embraces new EWA law

Payments Dive

MAY 23, 2024

This week, South Carolina became the fifth state to enact a law regulating earned wage access providers, but it doesn’t subject them to lending laws.

Payments Dive

MAY 23, 2024

This week, South Carolina became the fifth state to enact a law regulating earned wage access providers, but it doesn’t subject them to lending laws.

BankUnderground

MAY 23, 2024

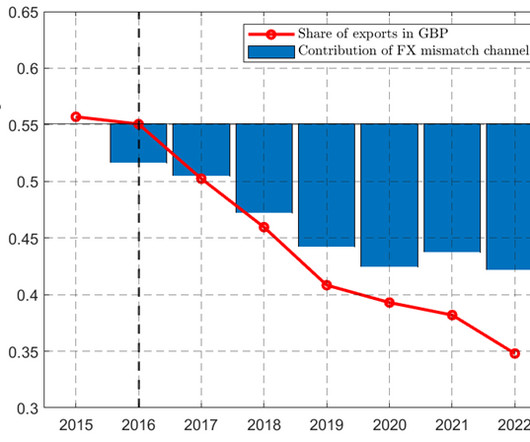

Marco Garofalo, Giovanni Rosso and Roger Vicquery Most international trade is denominated in dominant currencies such as the US dollar. What explains the adoption of dominant currency pricing and what are its macroeconomic implications? In a recent paper , we explore a rare instance of transition in aggregate export invoicing patterns. In the aftermath of the depreciation that followed the Brexit referendum in 2016, UK exporters progressively shifted to invoicing most of their exports in dollars

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 23, 2024

“All parties in the payments ecosystem would benefit greatly from state laws that provide clarity and consistency between jurisdictions,” write two legal professionals.

Gonzobanker

MAY 23, 2024

It’s “leave your emotions at the door” time when making a core system decision. Esteemed Gonzo readers, let’s get right to one of the core challenges in banking. Every financial institution needs to get real, tangible returns on every technology investment it makes, and core systems are a critical piece in increasing or hurting these returns.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

ABA Community Banking

MAY 23, 2024

Roughly 30% of military families cite low income and lack of stability as a “primary challenge” they face with their current financial products and services, according to a new survey by the Fort Leavenworth, Kansas-based Armed Forces Bank. The post Bank survey: Military families cite low income, inflation as financial product challenges appeared first on ABA Banking Journal.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

MAY 23, 2024

Trading and investment platform eToro has partnered with Arabesque AI to launch a new Sharia-compliant portfolio for users in the Middle East.

American Banker

MAY 23, 2024

New technology decoupling payment cards from the funding source of the transaction would stimulate competition between card issuers and networks — and raise prospects for Capital One's proposed $35 billion acquisition of Discover Financial Services.

BankInovation

MAY 23, 2024

Nvidia’s data center revenue skyrocketed during its fiscal first quarter 2025 as companies look to the chip-making giant for AI infrastructure. Data center revenue reached $22.6 billion, up 427% year over year, according to the company’s earnings report for the quarter ended April 28.

American Banker

MAY 23, 2024

In this week's edition of the American Banker news quiz, see how well you know current items about the Federal Deposit Insurance Corporation, mergers and acquisitions, the Consumer Financial Protection Bureau and more.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

BankInovation

MAY 23, 2024

Ally Financial is continuing to invest in technology and generative AI to offer improved car sale recommendations and inventory options for dealers.

American Banker

MAY 23, 2024

The SEC's pending requirement that securities trades settle within one day shouldn't be a problem for any modern financial firm. What we should be aiming for is real-time settlement.

The Paypers

MAY 23, 2024

Google Pay has announced the launch of three new features that aim to provide customers with an optimised and secure checkout experience.

American Banker

MAY 23, 2024

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

ABA Community Banking

MAY 23, 2024

The ABA Foundation announced that DeKalb, Mississippi-based Commercial Bank became the 1,000th bank to participate in its free financial education programs. The post ABA Foundation reaches financial education milestone with 1,000 participating banks appeared first on ABA Banking Journal.

Commercial Lending USA

MAY 23, 2024

Commercial Lending USA put together this detailed guide to help people who want to borrow money learn more about construction loan interest rates.

American Banker

MAY 23, 2024

Numisma Bank, a de novo bank backed by former Federal Reserve Vice Chair Randal Quarles, is the first bank without deposit insurance to be granted conditional approval under the Fed's new master account application framework.

The Paypers

MAY 23, 2024

Digital financial solutions provider UnaFinancial has partnered with JSCB Microcreditbank to deliver instalment loans to micro-entrepreneurs with 3, 6, and 9-month repayment terms.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

MAY 23, 2024

The outgoing CEO, now executive chairman of the Wall Street firm, told a conference at the Federal Reserve Bank of New York this week that cultural values are a critical element in any prospective merger or acquisition deal.

The Paypers

MAY 23, 2024

Sweden-based immigrant banking platform Majority has secured USD 20 million in funding to cater to the banking of migrants to the US.

American Banker

MAY 23, 2024

An agreement with the Office of the Comptroller of the Currency will require Dallas-based Comerica Bank to institute a list of corrective actions regarding a range of compliance issues, including wealth management, third-party risk and financial accounting.

The Paypers

MAY 23, 2024

US-based Banking-as-a-Service platform Synctera has announced the launch of the Bring Your Own Bank (BYOB) model, intending to improve the customer experience further.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

MAY 23, 2024

The bank plans to use artificial intelligence to make recommendations based not just on transaction analysis, but on shopper intent and behavioral data.

The Paypers

MAY 23, 2024

Prometeo has announced plans to expand its operations to Mexico, the United States, and Brazil between 2024 and 2025.

American Banker

MAY 23, 2024

House Financial Services Committee Chair Rep. Patrick McHenry, R-N.C., told Federal Deposit Insurance Corp. Chairman Martin Gruenberg to make himself available for a June 12 hearing on the agency's workplace culture.

The Paypers

MAY 23, 2024

Portugal-based fintech ebankIT has partnered with US-based Metropolitan Commercial Bank (MCB) to bring digital banking to consumers and businesses.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content