Jack Dorsey faces full Square agenda

Payments Dive

SEPTEMBER 28, 2023

The billionaire co-founder is likely to focus on large clients, sales strategy and IT issues after he takes over the Block merchant unit next week, analysts predicted.

Payments Dive

SEPTEMBER 28, 2023

The billionaire co-founder is likely to focus on large clients, sales strategy and IT issues after he takes over the Block merchant unit next week, analysts predicted.

American Banker

SEPTEMBER 28, 2023

The Federal Reserve Inspector General's report on the failure of Silicon Valley Bank found that officials at the Federal Reserve Bank of San Francisco wanted to remove the CEO from its board before examiners downgraded SVB's supervisory ratings.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 28, 2023

“If we think you're making a payment related to crypto assets, we'll decline it,” Chase U.K. told customers in an email reported by CoinDesk.

American Banker

SEPTEMBER 28, 2023

When running a bank branch, there are certain employee behaviors that must be nonnegotiable. But that still leaves plenty of room for improvisation and creativity.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

SEPTEMBER 28, 2023

Though checks have been vital to its business, the company is venturing further into digital payments, with an assist from Aliaswire.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

SEPTEMBER 28, 2023

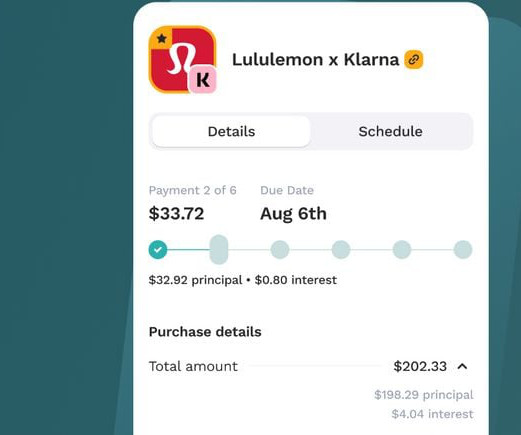

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to keep track of several BNPL loans at once, so he shifted his fintech’s focus to help others in the same boat.

American Banker

SEPTEMBER 28, 2023

To help those who may not get paid during a budget deadlock, credit unions are reviving past programs such as low-interest loans, payment deferrals and forms of relief.

BankBazaar

SEPTEMBER 28, 2023

Big purchases don’t mean BIG BILLS anymore! Convert your YES BANK-BankBazaar FinBooster Credit Card transactions into affordable EMIs and keep your spending tension-free! Enjoy instant EMI conversion with more than 80,000 merchant partners. View retail stores in your city View online partners Key Benefits Zero documentation Low processing fees Repayment options available from 3 months to 24 months Easy conversions of transactions from as low as Rs. 1,500 Attractive interest rates starting from 1

American Banker

SEPTEMBER 28, 2023

The combination of inflation and rising interest rates over the last 18 months has made it more difficult for Americans to stay on top of their loan payments, especially on credit cards and auto loans.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

CFPB Monitor

SEPTEMBER 28, 2023

In March 2022, the Consumer Financial Protection Bureau announced that it had revised its examination manual to instruct its examiners to apply the “unfairness” standard under the Consumer Financial Protection Act to conduct considered to be discriminatory, whether or not it is covered by the Equal Credit Opportunity Act. We first review the changes that the CFPB made to the manual, its rationale for the changes, and how those changes would allow the CFPB to target discrimination more broadly t

American Banker

SEPTEMBER 28, 2023

Two months after the mysterious failure of the Heartland Tri-State Bank in Elkhart, Kansas, a news article sheds light on its downfall. CEO Shan Hanes was involved in a cryptocurrency hoax involving a $12 million wire payment, according to the Bloomberg Businessweek report.

BankInovation

SEPTEMBER 28, 2023

BNP Paribas has identified hundreds of use cases for AI and is using the tech to enhance its virtual agent capabilities and automate data extraction, improving its ability to analyze unstructured data.

American Banker

SEPTEMBER 28, 2023

Lisa Rickert and Ruth McCord, who manage branches for Nicolet National Bank, share a passion for connecting with their customers and supporting their communities.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankInovation

SEPTEMBER 28, 2023

Ally Financial is exploring close to 200 use cases in-house for generative AI as it looks to increase efficiencies at the $197 billion bank. Ally is developing its generative AI in-house and launched beta testing in June, Sathish Muthukrishnan, chief information, data, and digital officer, told Bank Automation News.

The Paypers

SEPTEMBER 28, 2023

UK-based fintech, Curve , has partnered with PayPal , to integrate the latter into its wallet, with the objective of expanding PayPal's offline accessibility.

American Banker

SEPTEMBER 28, 2023

Camino Financial and Fundation, which are combining, serve distinct slices of the small business market. The deal's architects say it will enable the combined firm to provide more financing options to entrepreneurs, and they argue that now is a good time to lean into small business lending.

The Paypers

SEPTEMBER 28, 2023

Mexico-based neobank albo has announced the raise of USD 40 million in a Series C investment round in order to accelerate its development process.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

SEPTEMBER 28, 2023

Through its commitment of up to $4 billion in Anthropic, the e-commerce giant can bring advanced analysis, shopping and checkout tech closer to the point of sale — and farther away from traditional transaction processors.

The Paypers

SEPTEMBER 28, 2023

J.P. Morgan has announced that it has been designated by the US Treasury Department under a financial agency agreement to offer account validation services for federal government agencies.

American Banker

SEPTEMBER 28, 2023

The card network has teamed with Rochester Institute of Technology's Dubai satellite to foster local AI talent, and has several other AI efforts underway.

The Paypers

SEPTEMBER 28, 2023

The EY has agreed to close its partnership with Santander and refund GBP 15 million after alleged failings within its anti-financial crime project for the bank’s UK arm.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

SEPTEMBER 28, 2023

A proposed settlement between the Philadelphia-based community bank and an activist investor group that has waged a nearly two-year battle for control also calls for overhauling the board of directors.

The Paypers

SEPTEMBER 28, 2023

Global ed-tech company Great Learning has partnered with dLocal to enable local payment methods and instalments in Mexico, Brazil, and Colombia.

American Banker

SEPTEMBER 28, 2023

Peoples Financial Services has agreed to pay $129 million of stock for FNCB Bancorp. Peoples' CEO Craig Best would lead the combined company for a year after the merger closes, and then Gerard Champi, FNCB's current chief, would take over.

The Paypers

SEPTEMBER 28, 2023

UK-based Perenna has received USD 52 million in funding round to roll out fixed-rate mortgage products and improve the financial infrastructure of the region.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content