Credit card complaints jumped 38% last year: CFPB

Payments Dive

APRIL 3, 2024

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

Payments Dive

APRIL 3, 2024

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

Perficient

APRIL 3, 2024

Insurers are constantly striving to improve their operations, provide better experiences for customers, and minimize risks. Perficient insurance experts were interviewed for Forrester’s report, “ The Top Emerging Technologies In Insurance, 2024 ,” and discussed technologies expected to emerge in the insurance industry over the next five years, considering them now, and in the short-term, medium-term, and long-term future.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 3, 2024

The digital payments pioneer aims to increase pricing for its services to boost profitable growth under a new management team.

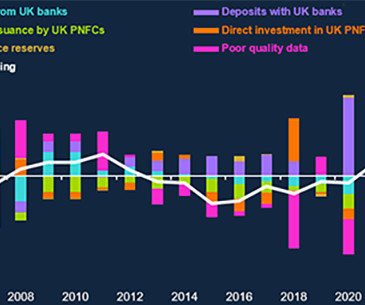

BankUnderground

APRIL 3, 2024

Laura Achiro, Gerry Gunner and Neha Bora A flow of funds framework is a way of understanding and tracking the movement of financial assets between different sectors of the economy. This blog specifically analyses UK corporate and household sectoral flows from 2000 to the present and highlights how this framework can reveal useful trends and signals for policymakers about the real economy.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

APRIL 3, 2024

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

APRIL 3, 2024

Citizens Bank is expanding its use of cloud-based banking platform Blend to offer bank customers easier access to credit through the tech provider’s credit card solution.

American Banker

APRIL 3, 2024

Letitia James, the New York state attorney general, sued Citigroup and argued it should be liable for fraud cases involving consumer wire transfers. But Citi said the AG's view would bring about a "sea change in banking law.

BankInovation

APRIL 3, 2024

Lending-as-a-Service platform Epic River has integrated Finastra’s loan documentation system LaserPro into its platform to give customers a place to send the additional borrower information being collected.

Jack Henry

APRIL 3, 2024

Credit unions of the past were laser-focused on their target market, quietly growing their base.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

APRIL 3, 2024

TD moved its automated trading service to the cloud, in the hopes of new levels of efficiency and computational power.

PopularBank

APRIL 3, 2024

As the youngest baby boomers approach retirement, the number of retirees in the United States keeps growing, with many of them retiring as middle-income seniors. A study from the University of Chicago found the number of retirees within that segment will nearly double in the next 10 years. More than half of them will not be able to afford the yearly costs of $60,000 for assisted living rent and other expenses.

Image Works Direct

APRIL 3, 2024

Welcome to the world of online everything! This is where your audience is, so this is where you go to be seen.

American Banker

APRIL 3, 2024

Federal Reserve Vice Chair Michael Barr Wednesday discussed regulators' ongoing concerns over banks' unrealized losses and commercial real estate values — particularly in the office sector.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Financial Brand

APRIL 3, 2024

This article Inside Capital One’s Auto Lending Innovation Machine appeared first on The Financial Brand. Putting Capital One auto loan power into a mobile app is just one of the ways Sanjiv Yajnik and his teams have shaken up banking. This article Inside Capital One’s Auto Lending Innovation Machine appeared first on The Financial Brand.

American Banker

APRIL 3, 2024

The federal agency's director said Wednesday that regulators were working to refocus bank merger evaluations on community impact.

The Financial Brand

APRIL 3, 2024

This article Washington, Banks & AI: Here’s How to Get Ready for More Scrutiny appeared first on The Financial Brand. If your bank is adopting more and more AI tools, don't put off developing and using an institution-wide policy to control usage and risks. This article Washington, Banks & AI: Here’s How to Get Ready for More Scrutiny appeared first on The Financial Brand.

Let's personalize your content