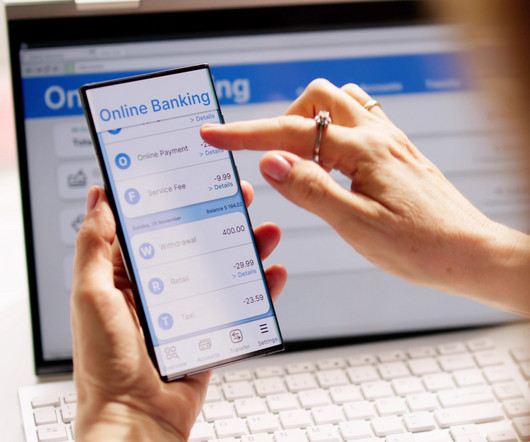

Digital Vs. A Live Agent

SWBC's LenderHub

NOVEMBER 12, 2024

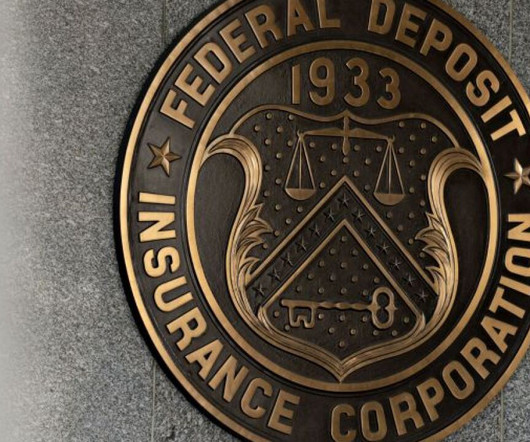

The financial services industry is continuously evolving, and it is essential to optimize collections strategies to maintain liquidity and minimize risk. One of the most critical choices for credit unions is whether to use a digital approach or live agents for their collections processes. Both approaches have distinct advantages and considerations. This article will explore key points to consider when making this crucial decision.

Let's personalize your content