Hurricane Helene aftermath prompts card, cash troubles

Payments Dive

OCTOBER 3, 2024

After the storm ripped through the southeastern U.S., consumers and merchants have been left grappling with card network outages and cash shortages.

Payments Dive

OCTOBER 3, 2024

After the storm ripped through the southeastern U.S., consumers and merchants have been left grappling with card network outages and cash shortages.

South State Correspondent

OCTOBER 3, 2024

You oversee pricing your checking accounts and you are trying to decide between $10.00 per month, $9.99, or $9.95. Which one do you choose? In a prior article where we tested “charm” account pricing, where we showed that conversion rates were almost twice as high when we used a $1.99 price point for a product compared to $2.00 ( HERE ). In this article, we go a level deep in pricing deposit accounts and look at various tactics around “pricing syntax” or “end price.” Pricing Tactics for Dep

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

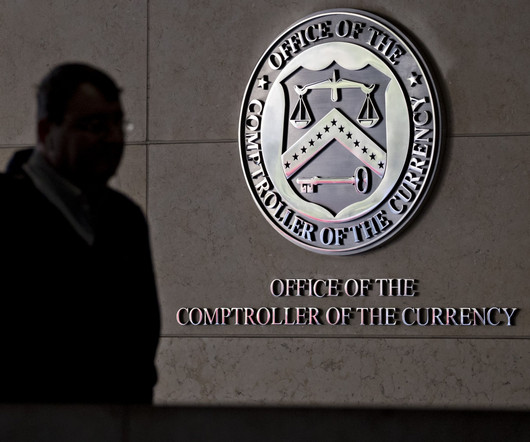

Payments Dive

OCTOBER 3, 2024

The Office of the Comptroller of the Currency blasted an Illinois law that prohibits credit and debit card interchange fees on tips and excise taxes.

BankInovation

OCTOBER 3, 2024

Credits unions tapping Dublin-based fintech Pulsate for mobile solutions see a return on investment with a major uptick in funded loans, engagement and transactions. It is imperative that “community financial institutions [are equipped with] the tools they need to not just survive in this digital-first world, but be competitive,” Sarah Martin, chief executive of mobile […] The post Mobile solutions offer competitive edge for credit unions appeared first on Bank Automation News.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

OCTOBER 3, 2024

The card network may bend to emboldened fintech rivals and more assertive merchants following the Justice Department’s antitrust lawsuit.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

OCTOBER 3, 2024

The Federal Deposit Insurance Corp. wants to remove an exemption that allows index funds to invest freely in bank stocks. The result will be damaging to the investors who have come to rely on the funds' steady returns.

Gonzobanker

OCTOBER 3, 2024

Bankers are finally realizing that their first-generation approach to data analytics won’t serve them for long. Bluntly speaking, the banking industry is falling behind when it comes to leveraging and monetizing data strategically. With all the customer, transaction, credit, delivery channel and market data that banks hold, it’s ironic to hear executives lament, “We don’t have our arms around data yet, and we’re not using it to drive the business.

American Banker

OCTOBER 3, 2024

The top five credit unions on this list have more than $36 billion in unsecured card loans and lines of credit.

BankUnderground

OCTOBER 3, 2024

Ioana Neamțu, Umang Khetan, Jian Li and Ishita Sen What do the 2023 Silicon Valley Bank collapse and the 2022 UK pension fund crisis have in common? Interest rate risk. Several sectors in the economy run significant asset-liability mismatch that makes them vulnerable to rapid interest rate changes: pension funds and insurers have short-term cash flows and long-term liabilities, while banks follow a lend-long-borrow-short approach.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

OCTOBER 3, 2024

Recent advancements in transaction processing aim to improve visibility into cash flow, which can be thrown into chaos with uncertain shipments.

The Paypers

OCTOBER 3, 2024

Alkami , a provider of cloud-based digital banking solutions has announced its partnership with Intrepid Credit Union to launch a new digital banking platform.

American Banker

OCTOBER 3, 2024

The Federal Reserve issued two enforcement actions, one against a bank in Montana, the other against a former information technology employee in Wyoming.

The Paypers

OCTOBER 3, 2024

Hastings Direct Loans has announced its collaboration with IDVerse Identity to automate personalised journeys and improve its growth strategies.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

ABA Community Banking

OCTOBER 3, 2024

Miami is often described as the northernmost city in Latin America, or sometimes as Latin America's business capital. Banesco USA Cali Garcia-Velez discusses how he and his team are growing a Latino banking franchise in South Florida. The post Podcast: How a Latin American banking franchise is growing in South Florida appeared first on ABA Banking Journal.

The Paypers

OCTOBER 3, 2024

Sygnum has introduced a web3 wallet recovery module built on Safe, leveraging the capabilities of the Safe{RecoveryHub} ecosystem.

Realwired Appraisal Management Blog

OCTOBER 3, 2024

People think that cynicism is a sign of intelligence. It’s not. We often think of cynics as realists, those who see the world for what it truly is. They don’t. 85% of people think a cynic will be a better lie detector than a non-cynic. They’re wrong.

The Paypers

OCTOBER 3, 2024

A new Finch Capital report has revealed that the UK has solidified its position in Europe’s fintech industry, accounting for around two-thirds of the total deals made in the region.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

ABA Community Banking

OCTOBER 3, 2024

ABA announced that James Ryan has been named chair of ABA’s American Bankers Council for the 2024-2025 membership year. The post Old National Bank CEO appointed chair of ABA’s American Bankers Council appeared first on ABA Banking Journal.

American Banker

OCTOBER 3, 2024

Coordinated strikes by dock workers along the Eastern Seaboard and the Gulf Coast could cause issues for banks that provide credit to foreign shipping groups and domestic trucking companies.

The Paypers

OCTOBER 3, 2024

UK-based financial services provider HSBC has announced the launch of its new jointly-owned Embedded Finance venture, SemFi by HSBC, intending to provide optimised solutions to business clients.

American Banker

OCTOBER 3, 2024

OneAZ Credit Union in Phoenix said it would acquire 1st Bank Yuma in the record-setting 17th deal of 2024 involving a credit union buying a bank.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

OCTOBER 3, 2024

Ireland-based developer of software solutions for the financial services industry Aryza Group has announced the acquisition of NTI , aiming to solidify its presence in the insolvency sector.

American Banker

OCTOBER 3, 2024

The OCC has filed a legal brief backing the banking industry's challenge to Illinois' Interchange Fee Prohibition Act, arguing the law would interfere with national banks' federal authority, fragment the national payment system and force banks to halt credit card usage in the state.

The Paypers

OCTOBER 3, 2024

Global technology company EBANX has revealed as part of its research that India is set to expand consumer spending by 2034, substantially surpassing the US.

The Financial Brand

OCTOBER 3, 2024

This article Why is Bank Loyalty Dying? Listen to the Folks Around My Dinner Table appeared first on The Financial Brand. Want to know what’s eroding banking institutions’ moat? My evening spent defending banking's deposit products at Sunday dinner provided valuable and concerning perspectives. This article Why is Bank Loyalty Dying? Listen to the Folks Around My Dinner Table appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content