Why on-demand pay lures employees

Payments Dive

AUGUST 31, 2023

Employers can better compete for gig workers, and other employees, by offering instant payment of wages, one fintech president argues.

Payments Dive

AUGUST 31, 2023

Employers can better compete for gig workers, and other employees, by offering instant payment of wages, one fintech president argues.

Abrigo

AUGUST 31, 2023

Teaching staff these KYC tips to make clients feel more comfortable In 2023, KYC procedures must both support CDD compliance and make sure your institution is a welcoming place for all customers. You might also like this resource, "Customer due diligence checklist." DOWNLOAD Takeaway 1 Front-line teams are the eyes and ears of the financial institution and must update their KYC procedures for the times.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 31, 2023

"We look forward to working closely with other OWF members to advocate for solutions that ensure we’re building a privacy-forward wallet for everyone,” Google Wallet Vice President Jenny Cheng said.

CFPB Monitor

AUGUST 31, 2023

A group of trade associations has sent a letter to CFPB Director Chopra urging the CFPB to address the disparity that has resulted from the order entered by the Texas federal district court in the lawsuit challenging the CFPB’s small business lending rule that granted preliminary injunctive relief only to the plaintiffs and their members. .

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

AUGUST 31, 2023

The Swedish BNPL company, which was last profitable in 2018, recorded a small profit for one month during the second quarter.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

AUGUST 31, 2023

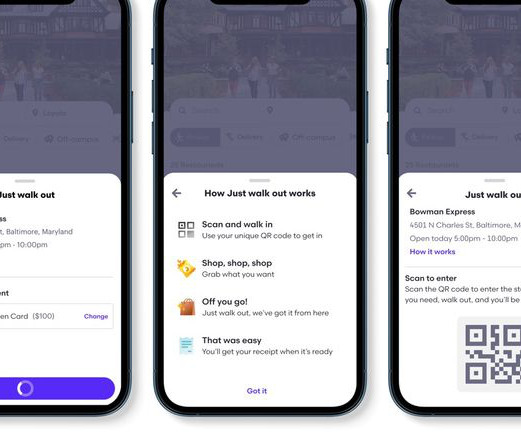

Students at the Loyola University Maryland store will scan a QR code in the food delivery app to enter the frictionless shop and pay for items.

BankInovation

AUGUST 31, 2023

Financial institutions can treat AI as a team member in need of training rather than a tool that needs monitoring.

American Banker

AUGUST 31, 2023

Bank customers who overdraw their accounts now face an average fee of $26.61, which is down from a peak of $33.58 in 2021. Consumer advocates contend that tougher regulations are needed to sustain the momentum, while industry groups argue that bank-led innovations are working.

CFPB Monitor

AUGUST 31, 2023

The Department of Justice (DOJ) announced that it has entered into a settlement with American Bank of Oklahoma (ABOK) to resolve allegations that ABOK engaged in unlawful redlining in Tulsa, Oklahoma. The DOJ opened its investigation of ABOK after receiving a referral from the FDIC. In its complaint , the DOJ alleged that from 2017 through at least 2021: All of ABOK’s branches and loan production offices were located in majority-white neighborhoods; For purposes of the CRA, ABOK designated its

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

AUGUST 31, 2023

Southwest Financial Credit Union, which led American Banker's Best Credit Unions to Work For, says employees are taking up to 400 hours more off than before its unlimited PTO policy took effect — but they are happier, and so are the members of the branchless credit union.

CFPB Monitor

AUGUST 31, 2023

The CFPB announced this week that it has entered into a proposed settlement of a lawsuit it filed in 2019 in Utah federal district court against a group of defendants who constitute the largest credit repair organizations in the United States. Rather than targeting the quality or effectiveness of the credit repair services actually provided by the defendants, the lawsuit targeted the marketing methods allegedly used by the defendants to obtain referrals of consumers.

American Banker

AUGUST 31, 2023

Rent gateway Pinata and marketing app Shopmium are trying to lure consumers with incentives that don't accumulate balances as consumer debt increases.

CFPB Monitor

AUGUST 31, 2023

Section 5 of the FTC Act, which prohibits unfair or deceptive acts or practices, does not include a private right of action. Our special guest, Professor Myriam E. Gilles of Cardozo Law School, has written a law review article in which she makes the case for adding a private right of action to Section 5. .

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

AUGUST 31, 2023

Financial institutions in several Southeastern states had braced for impact of the Category 3 hurricane. Bank and credit union executives in Florida and Georgia say their facilities generally weathered the storm but that some communities they serve face substantial recovery efforts.

CFPB Monitor

AUGUST 31, 2023

Yet another unopposed emergency motion for leave to intervene has been filed in the Texas lawsuit challenging the CFPB’s final small business lending rule (Rule). The latest proposed intervenors are XL Funding, LLC d/b/a Axle Funding, LLC (Axle) and the Equipment Leasing and Finance Association (ELFA) (collectively, the Proposed ELFA Intervenors).

American Banker

AUGUST 31, 2023

In August's roundup of American Banker favorites: The true cause of Heartland Tri-State Bank's failure, increased industry-wide frugality among banks, two prominent credit union trade groups announce plans to combine and more.

The Paypers

AUGUST 31, 2023

US-based Zil Money has announced the launch of its payroll funding credit card facility, in order to improve the cash flow of small businesses and enterprises.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

BankInovation

AUGUST 31, 2023

Klarna Bank AB’s losses narrowed in the first half of the year as its growing customer base continued to pay back their buy-now-pay-later debts in the face of inflation pressures. The Stockholm-based fintech reported an adjusted operating loss of about 2 billion Swedish kronor ($185 million) for the six months through June, down from 6.

The Paypers

AUGUST 31, 2023

Elavon , a wholly owned subsidiary of U.S. Bank, has launched the next generation of talech software aiming to help small business owners run their businesses efficiently.

American Banker

AUGUST 31, 2023

When the prices of U.S. goods and services soar, the Federal Reserve tends to raise its benchmark interest rate, and commercial banks are pinched in several fundamental parts of their business.

The Paypers

AUGUST 31, 2023

Financial messaging system Swift has released the results of its blockchain experiments to showcase its tokenisation potential.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

AUGUST 31, 2023

If capital requirements are increased, they must be constructed in a way that doesn't unduly burden smaller banks and their fintech partners.

The Paypers

AUGUST 31, 2023

Google has expanded the reach of Google Wallet to Colombia by securing an integration with Nu ’s Moradita Credit cards.

American Banker

AUGUST 31, 2023

In the aftermath of last year's racially motivated mass shooting in a predominantly Black community in Buffalo, New York, American Banker reporter Allissa Kline explores what responsibility banks have to help segregated, impoverished communities that were shaped in part by past discriminatory lending practices.

The Paypers

AUGUST 31, 2023

Financial infrastructure platform Stripe has published a report that shows nearly half of Australian businesses plan to invest in digital payments in the next 12 months.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content