Fed to review debit card fee cap next week

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

ATM Marketplace

OCTOBER 20, 2023

How should banks use AI? Will it replace employees?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 20, 2023

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

American Banker

OCTOBER 20, 2023

Consumer Financial Protection Bureau director Rohit Chopra said Friday that a recently proposed data-access rule will provide a competitive edge to small banks, leveling the playing field between them and their larger competitors.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

OCTOBER 20, 2023

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

OCTOBER 20, 2023

As the company’s marketing spending dipped in the third quarter, Amex acquired fewer new cards than it has in recent quarters.

American Banker

OCTOBER 20, 2023

The National Community Reinvestment Coalition and the American Bankers Association have sent dueling letters to the Federal Reserve over whether NCRC advocates pressured ABA member banks to denounce the ABA's litigation against the Consumer Financial Protection Bureau.

CFPB Monitor

OCTOBER 20, 2023

On October 5, the CFPB published the list of new members appointed to serve on the Consumer Advisory Board and each Council group. As background, Dodd-Frank requires the CFPB to maintain and work with a Consumer Advisory Board, comprised of industry leaders who are recommended by the presidents of each Federal Reserve Bank across the country.

American Banker

OCTOBER 20, 2023

"We'll be taking steps to offset expense pressures," CEO Curtis Farmer told analysts after the company reported an 11% year-over-year jump in costs and falling profits.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

BankInovation

OCTOBER 20, 2023

Huntington Bancshares remained steadfast in its commitment to control expenses during the third quarter, allowing it to maximize efficiency. “This focus on sustained efficiencies — including Operation Accelerate business process, offshoring and the other actions — will yield multiyear benefits,” Chief Financial Officer Zach Wasserman said during today’s earnings call.

The Paypers

OCTOBER 20, 2023

Australia-based fintech has Data Zoo expanded to the North American Market by leveraging a US patent to deliver digital identity solutions for banks and prevents identity theft.

BankInovation

OCTOBER 20, 2023

KeyBank remained focused on expense management and improving its technology to stay competitive in the third quarter. The Cleveland-based bank’s noninterest expense increased to $1.1 billion in the quarter, up by 0.4% year over year, driven by an increase of $12 million in tech spend, according to its quarterly earnings report.

American Banker

OCTOBER 20, 2023

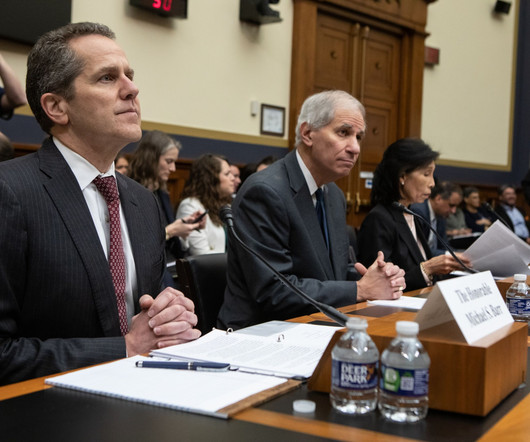

Regulators will now accept feedback until Jan 16, 2024 — a six-week extension — concurrent with a Federal Reserve effort to gather additional information about the potential implications of the proposed capital changes.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

OCTOBER 20, 2023

AI and data services provider Centific has partnered with Prove Identity to improve the digital security landscape and enhance customer experiences.

American Banker

OCTOBER 20, 2023

Acting Comptroller of the Currency Michael Hsu said Friday morning that regulators' forthcoming Community Reinvestment Act implementation final rule "has to be better and it's got to be faster" than the status quo.

The Paypers

OCTOBER 20, 2023

UNO Digital Bank has partnered with Collabera Digital to expand and increase its user base by developing and integrating a mini-app in Philippines-based GCash.

American Banker

OCTOBER 20, 2023

Mergers may be shrinking the overall number of credit unions, but they have provided valuable scale to those that remain.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

OCTOBER 20, 2023

The Consumer Financial Protection Bureau (CFPB) has proposed a Personal Financial Data Rights rule set to expedite the shift to Open Banking in the US and jumpstart competition.

American Banker

OCTOBER 20, 2023

The Federal Reserve released its semiannual financial stability report highlighting elevated asset values, funding issues and pockets of leverage as top concerns.

The Paypers

OCTOBER 20, 2023

Mastercard has announced its partnership with Remitly in order to expand access to cross-border payments and remittances to the latter’s US-based clients.

American Banker

OCTOBER 20, 2023

The global clearinghouse inked the deal with Securrency as part of its push to expand the use of the emerging technology in capital markets.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

OCTOBER 20, 2023

UK-based communications services company BT has launched Network-as-a-Service solution Global Fabric to connect multiple clouds businesses have and boost productivity.

American Banker

OCTOBER 20, 2023

Other regional banks are vowing to cut costs, but Huntington Bancshares CEO Steve Steinour says the Columbus, Ohio-based lender is well positioned to "play offense" in 2024.

The Paypers

OCTOBER 20, 2023

Sift , a digital trust and safety solution provider, has announced new reseller and integration partnerships to expand its reach and enable complete customer journey protection.

American Banker

OCTOBER 20, 2023

An advocate for retail merchants takes issue with a BankThink article criticizing the Credit Card Competition Act.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content