Clearing House’s ACH growth rate outstrips Fed

Payments Dive

MARCH 19, 2024

Automated payments volume processed by The Clearing House grew at a faster rate than at the Federal Reserve last year.

Payments Dive

MARCH 19, 2024

Automated payments volume processed by The Clearing House grew at a faster rate than at the Federal Reserve last year.

South State Correspondent

MARCH 19, 2024

In two previous articles ( here and here ) we discussed how loan size and loan term affect the profitability of commercial loans. We continue this theme of major drivers of loan and bank profitability and discuss the importance of cross-selling and upselling, and its impact on bank performance. In this article, we consider the common features of upselling and cross-selling.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 19, 2024

“With respect to transaction monitoring for fraud, it would no longer be acceptable to do nothing,” Nacha Executive Vice President Michael Herd said.

ATM Marketplace

MARCH 19, 2024

What's the roadmap for ATM regulations look like for 2024?

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 19, 2024

The card giant said the expanded partnership will let the Chinese digital wallet company’s 1 billion users send payments to 180 markets.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 19, 2024

The level of debt may surpass the all-time record this year, even when adjusted for inflation, some analysts say.

American Banker

MARCH 19, 2024

The payments industry is evolving, driven by innovative technologies and a new class of leaders and executives eager to embrace change. Here's what they're prioritizing.

BankInovation

MARCH 19, 2024

NASHVILLE, Tenn. — Wells Fargo is amping up its artificial intelligence project pipeline. The bank has 191 AI, machine learning and natural language processing features in the pipeline, with nearly half already in production, Steve Hagerman, chief information officer of consumer technology at Wells Fargo, said at Bank Automation Summit 2024 on March 18.

American Banker

MARCH 19, 2024

For the second straight year, Goldman Sachs shareholders have filed a proposal calling for more details on racial and gender pay gaps. The request comes as the investment banking giant faces scrutiny over its lack of high-ranking women leaders.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

The Paypers

MARCH 19, 2024

Cooperative Bank of Oromia has launched CoopApp and CoopApp Alhuda on Temenos Digital (Infinity) for a digitalised conventional and Islamic banking experience.

BankInovation

MARCH 19, 2024

NASHVILLE, Tenn. — BankUnited has deployed an AI chatbot to help employees search for information and procedures internally. The deployment was disclosed March 18 by Michael Lehmbeck, chief technology officer for Miami Lakes, Fl.-based BankUnited, at Bank Automation Summit 2024, presented by Bank Automation News.

American Banker

MARCH 19, 2024

Industry veterans are wary of prospective borrowers who can't pay for agents, and of compensation guidelines clashing with government mortgage lending programs.

ABA Community Banking

MARCH 19, 2024

The new routing mandate would reduce the revenue that banks receive for processing credit card transactions, forcing banks to reduce the popular rewards and benefits that revenue supports. The post The Points Guy on the Credit Card Competition Act: ‘It’s ridiculous’ appeared first on ABA Banking Journal.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

MARCH 19, 2024

Thomas Halpin, who heads global cash management for North America, talks about real-time processing, generative AI, central bank digital currencies and why the ISO 20022 messaging standard is cool.

The Paypers

MARCH 19, 2024

Global financial technology company FIS has announced its collaboration with Stratyfy , aiming to improve its SecurLOCK card fraud management solution.

American Banker

MARCH 19, 2024

Judicial review of bad rulemaking is a right that all regulated industries enjoy. But some industries avail themselves more than others, and the ones that rely on it the most tend to get worse policies. Banks should take notice.

The Paypers

MARCH 19, 2024

UK-based fintech company Revolut has launched a Point-of-Sale iPad app to support businesses in the hospitality industry.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

MARCH 19, 2024

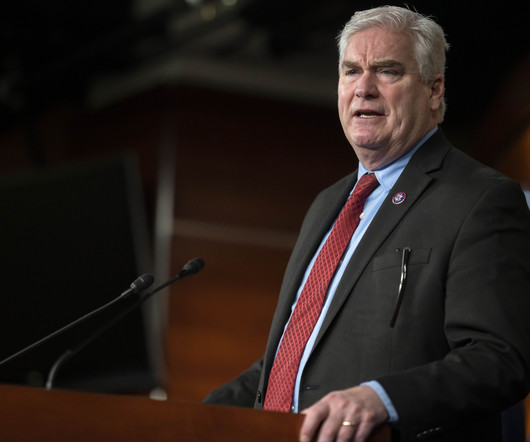

Rep. Tom Emmer, R-Minn., majority whip of the U.S. House, says Financial Services Committee Chairman Patrick McHenry's digital market structure bill could be ready for a vote in the full chamber.

The Paypers

MARCH 19, 2024

Several banks in the UK have come under pressure to provide millions of pounds in interim funding for Open Banking Limited (OBL).

American Banker

MARCH 19, 2024

A Texas judge ordered the U.S. Chamber of Commerce to explain why it sued the Consumer Financial Protection Bureau in Texas to halt the bureau's $8 credit card late fee rule after the bureau filed a motion accusing the trade group of "forum shopping.

The Paypers

MARCH 19, 2024

Ant Group Digital Technologies has partnered with Bank CenterCredit (BCC) to explore digital solutions and deliver faster and more reliable services to end users.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Financial Brand

MARCH 19, 2024

This article Hacking Customer Attention: Leveraging Social Media for Insurance and Finance appeared first on The Financial Brand. Dr. Robin Kiera shares strategies for financial institutions to boost engagement and sales through utilizing behavioral economics and social media. This article Hacking Customer Attention: Leveraging Social Media for Insurance and Finance appeared first on The Financial Brand.

The Paypers

MARCH 19, 2024

US-based payment technology corporation Mastercard has announced the expansion of its cross-border payment solutions by connecting to China-based Alipay.

American Banker

MARCH 19, 2024

The average annual cash bonus fell 2% to $176,500 in 2023, the lowest since 2019. The drop was far less dramatic than it was in 2022, when the average bonus slumped 25%.

The Paypers

MARCH 19, 2024

Credit information provider CRIF has partnered with BMW Financial Services to provide Open Banking-based credit checks and lending services to automotive retailers.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content