3 Technology Predictions from the Magic 8 Ball

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

APRIL 22, 2024

Recent dynamics of the small business lending market A deep understanding of the small business lending landscape and potential efficiencies can help banks and credit unions grow their portfolios. You might also like this guide for smarter, faster small business lending. DOWNLOAD Takeaway 1 Financing plays a crucial role in small business survival and success.

South State Correspondent

APRIL 22, 2024

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

APRIL 22, 2024

JPMorgan Chase is an early user of Codat’s Supplier Enablement product, which launched this week.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

APRIL 22, 2024

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

American Banker

APRIL 22, 2024

Banks reported nearly $27 billion had been tied up in scams or theft against elderly people in a recent 12-month period, according to a report from the U.S. Treasury.

BankInovation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

American Banker

APRIL 22, 2024

The bank will use biometric authentication to streamline checkout in stores starting in 2025. It has already completed internal and external pilots of the technology.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

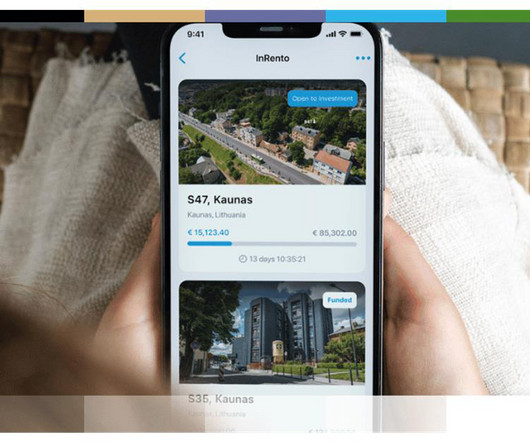

The Paypers

APRIL 22, 2024

Lithuania-based fintech Paysera has incorporated in its app the ability to directly invest in crowdfunded real estate rental projects on the InRento platform.

American Banker

APRIL 22, 2024

With financial crime surging worldwide, it is critical that the public and private sectors align on a shared vision to collectively focus on combating bad actors and to eliminate their ability to launder the proceeds of criminal activity.

The Paypers

APRIL 22, 2024

The UK’s Metropolitan Police has announced that it infiltrated LabHost, a fraud website leveraged by criminals to scam individuals into handing over their personal data.

American Banker

APRIL 22, 2024

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

APRIL 22, 2024

US-based digital asset exchange Kraken has bought TradeStation Crypto to expand its regulatory licensing in the US.

American Banker

APRIL 22, 2024

While banks with less than $10 billion of total assets would not be forced to comply with the $14 cap, many would adopt it or make other changes to stay competitive with larger banks, survey finds.

The Paypers

APRIL 22, 2024

Nigeria-based blockchain payments startup Ivorypay has formed a partnership with stablecoin issuer Tether to offer digital transactions to more consumers across Africa.

American Banker

APRIL 22, 2024

The Federal Deposit Insurance Corp. says it's ready to wind down the global systemically important banks. But until that happens, many in the banking industry are skeptical that regulators have actually developed a workable strategy to end "too big to fail.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

APRIL 22, 2024

Money movement platform TabaPay has announced that it will acquire the assets of Synapse Financial Technologies , as part of its product expansion strategy.

American Banker

APRIL 22, 2024

While the deal price is expected to be immaterial, it's another piece of the consumer empire Goldman once dreamed of that the bank is now scaling back.

The Paypers

APRIL 22, 2024

Brankas has been licenced for Account Information Services (AInS) after the company secured Payment Service Provider (PJP) Category 2 license by Bank Indonesia (BI).

American Banker

APRIL 22, 2024

Two Securities and Exchange Commission lawyers stepped down this month after a federal judge sanctioned and sharply rebuked the Wall Street regulator for "gross abuse" of power in a crypto case.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

APRIL 22, 2024

The Central Bank of Azerbaijan has announced its partnership with Visa in order to drive payment sector optimisation and modernisation.

American Banker

APRIL 22, 2024

The Federal Reserve's Office of the Inspector General says the Fed has yet to fulfill 65 recommendations, and also identified 18 outstanding issues at the Consumer Financial Protection Bureau.

The Paypers

APRIL 22, 2024

US-based expense splitting software Splitwise has entered a collaboration with Tink in a bid to provide the latter’s Pay by Bank service to its users.

The Financial Brand

APRIL 22, 2024

This article Why Banks Risk Data Chaos by Rushing Into AI for CRM appeared first on The Financial Brand. Poorly trained AI-driven CRM could lead to unchecked inaccuracies due to hallucinations, leaks of sensitive customer data, and create unintended discriminatory behavior. This article Why Banks Risk Data Chaos by Rushing Into AI for CRM appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content