Fiserv rises on international, government sales

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

South State Correspondent

APRIL 23, 2024

The “Three-Body Problem,” currently made popular by our new favorite author, Cixin Liu, is the concept of instability when three similar-sized celestial objects interact. The problem is currently unsolvable. Banking has a similar physics problem when management juggles strategy, risk/profitability, and customer behavior. This article will discuss the challenge of managing three potentially opposing forces and look towards physics to help us solve the mystery.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 23, 2024

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

ATM Marketplace

APRIL 23, 2024

The Bank Customer Experience Summit 2024's first early bird deadline is coming up on May 3rd.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

APRIL 23, 2024

The Swedish BNPL pioneer said it has formed new partnerships with the ride-share company, as well as the travel firm Expedia Group.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

APRIL 23, 2024

Institutions and their investors are facing pressure from climate activists, cautiously awaiting interest rate cuts and adjusting to new Federal Reserve and FDIC policies.

BankInovation

APRIL 23, 2024

Goldman Sachs Group Inc. is closing down its automated-investing business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

American Banker

APRIL 23, 2024

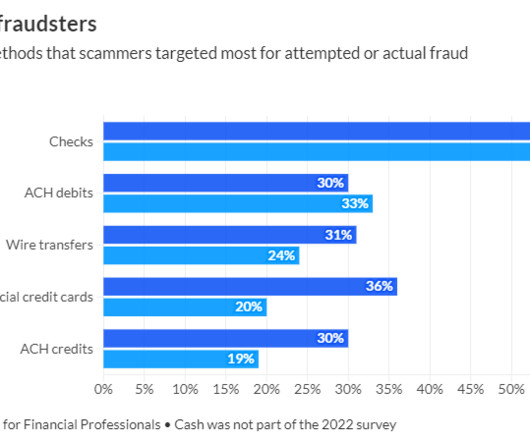

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

BankBazaar

APRIL 23, 2024

Let’s face it, talking about money isn’t always sunshine and rainbows. We all dream of financial freedom, but the road there can be paved with some pretty epic stumbles. From the infamous “bottomless cocktail brunch” every Sunday that mysteriously drained your savings account to the “surely-I’ll-win-the-lottery” mentality, personal finance fails are a universal experience.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

APRIL 23, 2024

In a letter to Treasury Secretary Janet Yellen last week, the Massachusetts senator highlighted the growing use of cryptocurrencies by malicious organizations abroad and underscored the need for anti-money-laundering and counterterrorism provisions in future proposals.

BankInovation

APRIL 23, 2024

Uplinq, a credit decisioning support platform for small business lenders, named former Wells Fargo leader Derek Ellington as its strategic adviser.

American Banker

APRIL 23, 2024

Many legal experts think the Supreme Court will rule in favor of the Consumer Financial Protection Bureau in a case challenging its funding. Such a ruling would unleash a flurry of litigation that has been on hold pending the outcome of the constitutional challenge.

The Paypers

APRIL 23, 2024

UAE-based du has announced the launch of du Pay to boost UAE’s transition toward a cashless economy and support the national digitalisation agenda.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

BankInovation

APRIL 23, 2024

Financial services technology provider Fiserv is deploying AI to drive productivity and sees growth opportunities in the point-of-sale and real-time payments segments.

American Banker

APRIL 23, 2024

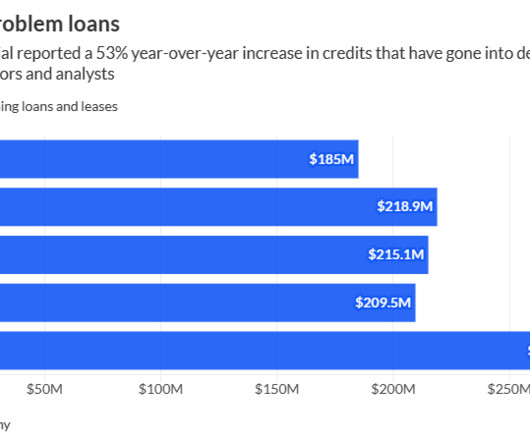

The Connecticut bank —a regional traditionally regarded as a cautious lender — said nonperforming loans and leases rose 53% year-over-year. The uptick was in mostly the commercial-and-industrial loan space, although there was one nonperforming commercial real estate loan, executives said.

The Paypers

APRIL 23, 2024

US-based payments provider Nium has partnered with Indonesia-based payment infrastructure company Artajasa to augment cross-border transfers for Indonesians.

American Banker

APRIL 23, 2024

Brendon Falconer, finance chief of the Indiana company since 2019, faces felony child molestation charges. But CEO James Ryan says management is focused on the CapStar integration and organic growth.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

APRIL 23, 2024

South Africa’s central bank (SARB) has revealed a roadmap that would improve the country’s adoption of digital payment technologies.

American Banker

APRIL 23, 2024

The banking-as-a-service middleware provider will be acquired by TabaPay. Other middleware providers may be forced to evolve or face the same fate.

The Paypers

APRIL 23, 2024

UK-based local payments platform PPRO has expanded its local payments offering to the US.

American Banker

APRIL 23, 2024

The two regional banks are anticipating that borrower demand will increase in the back half of the year. High interest rates and economic uncertainty have been muting the appetite for borrowing.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

APRIL 23, 2024

France-based SaaS platform for finance teams, Payflows has announced the rise of EUR 25 million in a Series A funding round, aimed at its expansion strategy.

American Banker

APRIL 23, 2024

Congress passes laws all the time requiring agencies to issue rules on tough problems. But in many cases — and for many reasons — agencies sometimes just don't do it. Taking those responsibilities away and giving them to another agency might keep agencies on track.

The Paypers

APRIL 23, 2024

Sopra Banking Software has announced its partnership with Paymentology in order to optimise global card issuing services for customers and clients.

The Financial Brand

APRIL 23, 2024

This article On A High-Rate Plateau, Getting Personal Is Key To Getting Deposits appeared first on The Financial Brand. Bankers face a Catch-22: Pay more to retain balances and, in doing so, shrink margins and alienate investors — or pay less to maximize margins and risk shrinking your deposit base. This article On A High-Rate Plateau, Getting Personal Is Key To Getting Deposits appeared first on The Financial Brand.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content