How Many Credit Cards Is Too Many?

BankBazaar

SEPTEMBER 3, 2024

The post How Many Credit Cards Is Too Many? appeared first on BankBazaar - The Definitive Word on Personal Finance.

BankBazaar

SEPTEMBER 3, 2024

The post How Many Credit Cards Is Too Many? appeared first on BankBazaar - The Definitive Word on Personal Finance.

Payments Dive

SEPTEMBER 3, 2024

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

SEPTEMBER 3, 2024

Most community bankers we talk believe they will get a boost to bank performance with declining short-term rates. The thinking is that a lower Fed Funds rate will mitigate credit risk, spur loan demand and potentially soften competition for deposits, leading to wider NIM and more profitability. Unfortunately, the empirical evidence shows otherwise.

Payments Dive

SEPTEMBER 3, 2024

The two firms are working together again as other payment giants collaborate on checkout enhancements.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

TheGuardian

SEPTEMBER 3, 2024

Regulator said to be planning cut to maximum amount available to victims from £415,000 to about £85,000 The UK is reportedly poised to slash the planned maximum amount that banks will have to refund to fraud victims – from £415,000 to about £85,000 – after strong lobbying from lenders, fintechs and some politicians. Fraud in the UK payments industry has soared in recent years, with a sharp rise in authorised push payment (APP) scams, which often involve email accounts being hacked to trick peopl

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

SEPTEMBER 3, 2024

As more women generate and steward great wealth, they must also strive to develop and maintain financial wellness. The wealth management industry has a vital role to play in helping dynamic women on their journey.

BankInovation

SEPTEMBER 3, 2024

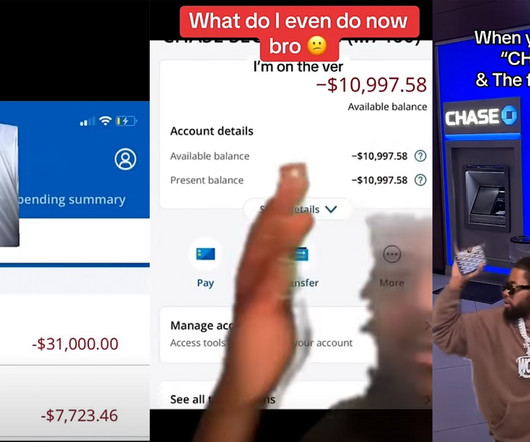

Chase customers claimed to have identified a glitch in Chase ATMs during Labor Day weekend, allowing them to deposit false checks and withdraw large sums of cash from accounts potentially without the funds to cover the withdrawals. This past weekend, Chase clients took to TikTok to share “the glitch” in the $3.8 trillion bank’s system. […] The post Chase check fraud not ‘a glitch,’ expert says appeared first on Bank Automation News.

American Banker

SEPTEMBER 3, 2024

Northwest Federal Credit Union in Herndon, Virginia, will follow FedEx as stadium-name partner for the Washington Commanders, gaining branding rights for which the logistics giant was paying nearly $8 million annually.

BankInovation

SEPTEMBER 3, 2024

U.S. Bank is developing AI and automation-driven solutions to improve productivity for its small and medium-sized business clients. Nearly 71% of U.S.-based SMBs think that digital solutions including AI and financial management tools can make their jobs easier, according to the U.S. Bank 2024 Small Business Perspective survey published on Aug. 26.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Tomorrow's Transactions

SEPTEMBER 3, 2024

Fime, a global leader in consulting, testing, and certification services, is excited to announce the acquisition of Consult Hyperion, a renowned consultancy firm with expertise across payments, smart mobility and digital identity. The acquisition augments and cements Fime’s ability to deliver comprehensive consulting and advisory services—from ideation to implementation and testing—across these key sectors.

The Paypers

SEPTEMBER 3, 2024

Australians have lost USD 122 million to crypto-related investment scams over the past year, according to a statement released by the Australian Federal Police.

American Banker

SEPTEMBER 3, 2024

People filmed themselves depositing bad checks, then quickly transferring or withdrawing the funds. Then they shared screenshots of their negative balances.

The Paypers

SEPTEMBER 3, 2024

The Federal Council has decided to adopt further measures of the EU’s 14th package of sanctions against Russia, in response to its ongoing military aggression against Ukraine.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

Realwired Appraisal Management Blog

SEPTEMBER 3, 2024

You know that feeling when you’re driving on the interstate, when suddenly, police lights flash and sirens blare behind you? That pit in your stomach feeling. Appraisers have that same feeling-petrified of making mistakes…almost every day. It’s the boogeyman hiding under every appraisal report.

The Paypers

SEPTEMBER 3, 2024

HDFC Bank has introduced new features for the Unified Payments Interface (UPI) and Central Bank Digital Currency (CBDC), developed in collaboration with various fintech partners.

American Banker

SEPTEMBER 3, 2024

Acting Comptroller of the Currency Michael Hsu called for a shift from rigid, process-driven supervision to a more risk-based approach, emphasizing the need for overseers to prioritize pressing supervisory issues and improve their agility in monitoring large banks.

ABA Community Banking

SEPTEMBER 3, 2024

The CDFI Fund’s revised application process will make it difficult for many mission-focused CDFI banks to achieve recertification unless further changes are made, according to a joint letter by ABA and two associations. The post ABA, associations: Revised application process will impede CDFI recertification appeared first on ABA Banking Journal.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

The Paypers

SEPTEMBER 3, 2024

MENA-based Buy Now, Pay Later (BNPL) platform Tabby has announced that it entered into a definitive agreement to purchase Tweeq , with the latter being set to continue to operate independently.

American Banker

SEPTEMBER 3, 2024

The Federal Reserve's independence in setting monetary policy is critical to global confidence in U.S. markets and the dollar's status as reserve currency of choice. Making those functions constitutionally separate from the executive branch is the best way to ensure that independence.

The Paypers

SEPTEMBER 3, 2024

Financial services company Income Group has entered into a collaboration with Griffin to expand its service offering by integrating the latter’s savings account into the IGsend platform.

Tomorrow's Transactions

SEPTEMBER 3, 2024

Fime, a global leader in consulting, testing, and certification services, is excited to announce the acquisition of Consult Hyperion, a renowned consultancy firm with expertise across payments, smart mobility and digital identity. The post Fime Acquires Consult Hyperion, Creating a Global Consulting Leader in Payments, Smart Mobility, and Digital Identity first appeared on Consult Hyperion.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

SEPTEMBER 3, 2024

End-to-end payments platform Ecommpay has announced the inclusion of three Italian Alternative Payment Methods (APMs), aiming to expand its global footprint.

American Banker

SEPTEMBER 3, 2024

The sale of the $318 million-asset portfolio comes five weeks after the Greenville, South Carolina-based company agreed to sell its investment advisory unit.

The Paypers

SEPTEMBER 3, 2024

UK-based fintech company Atlantic Money has announced the launch of Portals, a new solution that enables customers to make international transfers directly from their bank accounts.

American Banker

SEPTEMBER 3, 2024

The combined bank would have $150 million in assets, offer better service and more convenience, according to Pulaski Savings Bank and Mutual Federal Bank.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content