How FedNow may affect businesses

Payments Dive

JULY 24, 2023

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

Payments Dive

JULY 24, 2023

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

South State Correspondent

JULY 24, 2023

Maybe you saw Oppenheimer over the weekend, maybe it was Barbie , or perhaps you did the “Barbenheimer” thing and did both. Maybe you opted for Mission Impossible – Dead Reckoning, Part I. No matter your choice, there was a clear winner: Barbie. Film quality aside, there have been few movies in the history of the World that have done a better job at marketing than Barbie.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 24, 2023

Despite a flurry of payments acquisitions recently, deal activity was slow in the first half of the year and some factors are still suppressing M&A.

BankInovation

JULY 24, 2023

Discover Financial Services is making its machine learning research publicly available to peers in an effort to help the industry reach common standards with the technology.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Payments Dive

JULY 24, 2023

Venture capital interest in payments startups plunged in the second quarter, according to a CB Insights report.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

JULY 24, 2023

A complaint filed on July 20, 2023 in Minnesota federal court seeks declaratory and injunctive relief under the Administrative Procedures Act (APA) against defendants Federal Deposit Insurance Corporation (FDIC) and Chairman Martin J. Gruenberg for the FDIC’s issuance of supervisory guidance to banks under its supervision (i.e., state-chartered banks that are not members of the Federal Reserve System) prohibiting them from charging multiple non-sufficient funds (NSF) fees for the same item.

American Banker

JULY 24, 2023

Valarie Ivester, assistant vice president of indirect strategy and development for Greater Texas Credit Union, has helped update strategy from the start of the pandemic through the recent chip shortage.

CFPB Monitor

JULY 24, 2023

In an unusual move, Laura Akahoshi, former Rabobank (the “Bank”) Chief Compliance Officer (“CCO”), filed on July 6, 2023 an opposition to the Office of the Comptroller of the Currency’s (“OCC”) dismissal of its own administrative enforcement proceeding against her. Akahoshi filed her petition in the U.S. Ninth Circuit Court of Appeals, arguing in part that the Administrative Procedures Act and 18 U.S.C.

American Banker

JULY 24, 2023

Credit metrics are deteriorating as more cardholders fall behind on their payments. But bank CEOs detect few causes for alarm, saying they plan to stay in growth mode since most consumers have stayed current.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

CFPB Monitor

JULY 24, 2023

Last Friday, July 21, 2023, marked the CFPB’s twelfth anniversary. To publicize the occasion, the CFPB published a blog post on July 20 in which it touted its achievements and ongoing initiatives. July 21 also marked the twelfth anniversary of our award-winning blog, Consumer Finance Monitor. Originally named CFPB Monitor, we launched our blog to coincide with the CFPB’s first day. .

The Paypers

JULY 24, 2023

UK-based credit provider TotallyMoney has chosen data intelligence platform Bud Financial (Bud) to enable customers to manage finances with the support of AI.

CFPB Monitor

JULY 24, 2023

Minnesota recently enacted the Commerce Omnibus Finance Bill , which includes amendments to several provisions of Minnesota law related to consumer loans and financial institutions. Interest Rate Caps on Consumer Small Loans and Short-Term Loans Minnesota laws related to consumer small loans and consumer short-term loans (as those terms are defined under Minnesota law) are amended to define the annual percentage rate (APR) for the covered loans to be an all-in rate including all fees and charge

American Banker

JULY 24, 2023

One security researcher said the total number of consumers who had data stolen in MoveIt breaches exceeds 20 million, and more are expected to be reported.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

TheGuardian

JULY 24, 2023

Corporation admits information in story and headline about former Ukip leader ‘turned out not to be accurate’ UK politics live – latest updates The BBC has written to Nigel Farage to apologise for its reporting of the closure of the former Ukip leader’s Coutts bank account. The broadcaster reported earlier this month that the private bank had closed the account because he was no longer sufficiently wealthy to hold one.

American Banker

JULY 24, 2023

One security researcher said the total number of consumers who had data stolen in MoveIt breaches exceeds 20 million, and more are expected to be reported.

BankInovation

JULY 24, 2023

Financial institutions looked to automation in the second quarter to reduce costs and create more efficient operations. The $3.2 trillion Bank of America, for one, saw its Q2 noninterest expenses increase by 5% year over year to $16 billion. U.S.

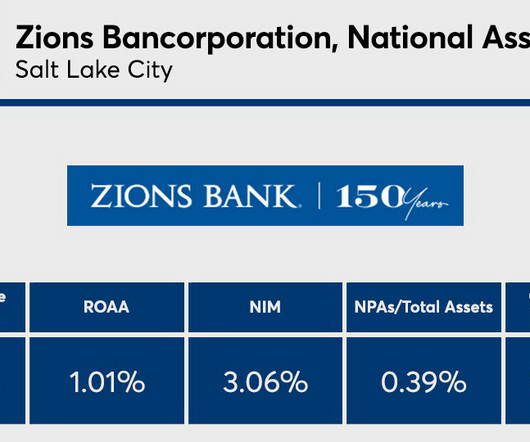

American Banker

JULY 24, 2023

American Banker's annual list reviews the financial results for the best-performing large institutions.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

The Paypers

JULY 24, 2023

Global financial super app Revolut has announced the launch of its Joint Accounts product in the UK, following the successful April feature release to European markets.

American Banker

JULY 24, 2023

Bankers say it isn't a crazy notion for a bank to charge multiple NSF fees on the same transaction because merchants often resubmit transactions for payment a second time, and the bank has no way of knowing if or when that happens.

The Paypers

JULY 24, 2023

Netspend has announced the launch of its new X World Wallet, designed to provide clients with a multi-currency account for payments and services accepted globally.

American Banker

JULY 24, 2023

The license allows New York-based Citigroup to separate the institutional and private bank businesses from its consumer, small-business and middle-market operations in Mexico.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

JULY 24, 2023

India-based fintech PhonePe has announced the launch of an income tax payment feature developed in partnership with digital B2B payments service provider PayMate.

American Banker

JULY 24, 2023

Nearly three out of five respondents to a Bloomberg survey said they would most like to work for the CEO of JPMorgan Chase. That was enough to make Dimon the most popular choice out of a list of the leaders of six big banks.

The Paypers

JULY 24, 2023

US-based financial services firm JP Morgan has announced its plan to expand its online bank Chase to Germany and other countries from the European Union.

American Banker

JULY 24, 2023

The card brand participated in a $72 million funding round in Thunes, expanding both an existing collaboration and a larger initiative to support mobile money networks.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content