Cash App exec hints at Square integration

Payments Dive

JUNE 3, 2024

Block is working to make its peer-to-peer payments tool, Cash App, a consumer app for interacting with merchants using its Square point-of-sale software.

Payments Dive

JUNE 3, 2024

Block is working to make its peer-to-peer payments tool, Cash App, a consumer app for interacting with merchants using its Square point-of-sale software.

TheGuardian

JUNE 3, 2024

Insistence on investment purity misses the point and will only lead to a decline in arts sponsorship In a ranking of climate villains in the fund management industry, Baillie Gifford would surely come a long way down most people’s list. The Edinburgh-based firm preaches long-termism and its specialism is backing technology companies, especially those with kit to accelerate the transition to cleaner energy and transport.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 3, 2024

Customers have multiple ways to access your products and brand, but do those experiences work together for their benefit—and yours?

Commercial Lending USA

JUNE 3, 2024

Business progress depends on commercial loans.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

JUNE 3, 2024

Consumer payments are becoming more embedded, and commercial payments are slowly moving away from checks, says a top payments executive at Accenture.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

JUNE 3, 2024

In this month's roundup of top banking news: a Supreme Court ruling on CFPB funding, TD Bank's money laundering woes, an FDIC workplace probe reveals a culture of misconduct and more.

BankInovation

JUNE 3, 2024

The highly anticipated 2024 Jack Henry™ Strategy Benchmark results are in! Jack Henry’s sixth annual study uncovers key insights and valuable takeaways from bank and credit union CEOs to help you capitalize on market shifts and new opportunities, refine your strategic plan, and compete successfully in 2024 and 2025.

American Banker

JUNE 3, 2024

Trading halts caused by an error affected 40 stocks Monday morning, including BMO Bank and Banco Santander-Chile.

BankInovation

JUNE 3, 2024

U.S. Bank is realizing gains from the $8 billion it has invested in technology since 2019 as it remains focused on developing its payments technology.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

JUNE 3, 2024

The Consumer Financial Protection Bureau Monday completed its rule establishing a nationwide database for a wide swath of financial companies — including payments companies, debt collectors, auto lenders — that have faced regulatory or legal penalties for consumer-related infractions.

The Paypers

JUNE 3, 2024

Self-custody Web3 wallet Trust Wallet has unveiled a partnership with global payments infrastructure provider Mercuryo.

American Banker

JUNE 3, 2024

The technology is adept at working with partial account numbers and other shreds of data to alert banks of ongoing and potential crime, the network contends.

The Paypers

JUNE 3, 2024

Singapore-based Thunes , in collaboration with Visa , has launched a survey which highlights conflicted opinions among Europe-based companies on cross-border payment interoperability.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

JUNE 3, 2024

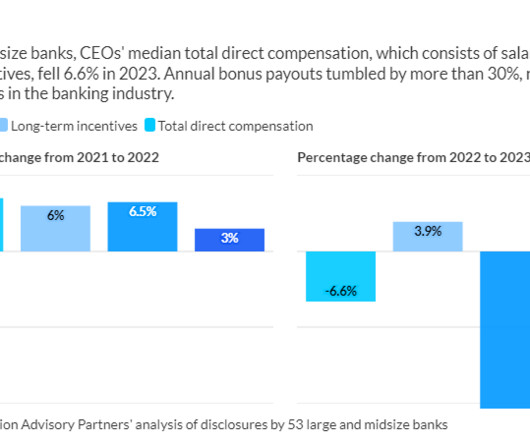

Total direct compensation for the CEOs of large and midsize banks declined by 6.6% in 2023, and annual bonus payouts tumbled by 30%. The decreases came as banks grappled with the fallout from last spring's banking crisis.

The Paypers

JUNE 3, 2024

US-based ticket sales and distribution company Ticketmaster has confirmed that its global database was hacked, which could expose customers’ personal information.

American Banker

JUNE 3, 2024

In this month's roundup of top tech news: A firsthand look at the impact of Zelle fraud, the Supreme Court upholds the Consumer Financial Protection Bureau's funding, Walmart's split from Capital One and more.

The Paypers

JUNE 3, 2024

The Philippines Government Service Insurance System (GSIS) has launched the GSIS Digital ID to augment identity authentication, security, and efficiency for registered users.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

JUNE 3, 2024

Traditional financial institutions have much to gain from collaboration with digital asset natives — and vice versa. It's time to realize that potential.

The Paypers

JUNE 3, 2024

US-based multinational financial services corporation Western Union has partnered with financial services company Plaid.

American Banker

JUNE 3, 2024

Though Jenius Bank hasn't reached breakeven, it's evidencing solid progress gathering deposits and making loans as it gets ready to celebrate its first birthday.

The Paypers

JUNE 3, 2024

Ant Group , Mastercard , and 12 overseas payment partners of Alipay+ and other card organizations, have initiated the International Consumer Friendly Zones program in Shanghai.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

JUNE 3, 2024

The National Rifle Association bagged a key victory in a case against a former top New York state official. The high court's ruling could make it harder for regulators to discourage financial institutions from doing business with specific industries.

The Paypers

JUNE 3, 2024

Central Bank of UAE (CBUAE) has issued the Open Finance Regulation, set to establish a comprehensive framework to regulate licensing, supervision, and operation of Open Finance.

American Banker

JUNE 3, 2024

In this edition of the American Banker news quiz, test yourself on topics such as Visa and Mastercard's shift away from relying on interchange, the Federal Reserve's efforts for balance sheet reduction, which financial services sector consumers trust the most and more.

The Paypers

JUNE 3, 2024

Viva.com has integrated Poland-based mobile payment platform BLIK to boost merchant support and user convenience.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content