Card debt climbs to record $1.13 trillion

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

Payments Dive

FEBRUARY 7, 2024

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

BankUnderground

FEBRUARY 7, 2024

Daniel Norris, Elio Cucullo and Vasilis Jacovides When borrowers enter a fixed-rate mortgage, lenders test whether they could continue to afford their mortgage if interest rates were to increase by the time it comes to re-fix. This ‘stressing’ is designed to create additional resilience for borrowers and the financial system. Over the last two years, mortgage rates have increased by over four percentage points, raising the cost of repayments for those re-fixing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 7, 2024

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

Ublocal

FEBRUARY 7, 2024

Welcome to Union Bank’s exciting journey into the world of investments! We’re delighted to bring our Northern Vermont and New Hampshire communities a simple, yet powerful way to grow your money. Through our UB2Go digital banking platform , we’re introducing an easy-to-use digital investment app. You can start investing with as little as $10, joining the ranks of savvy investors right from your phone or computer.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

CFPB Monitor

FEBRUARY 7, 2024

Several national and Texas banking and business trade groups have filed a lawsuit in the U.S. District Court for the Northern District of Texas challenging the final regulations (Final Rules) implementing the Community Reinvestment Act of 1977 (CRA) that were jointly adopted in October 2023 by the Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and Federal Reserve Board (Agencies). .

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

FEBRUARY 7, 2024

Maria Mason, enterprise product manager at Citizens Bank, will speak at Bank Automation Summit U.S. 2024 about strategies for automating real-time payments (RTP). Bank Automation Summit U.S. 2024 takes place March 18-19 at the Omni Nashville in Nashville, Tenn., and brings together industry experts to discuss innovation in real-time payments, AI, RPA and more.

American Banker

FEBRUARY 7, 2024

Virgin Money has cut about 150 jobs and 39 branches thus far in 2024, the Central Bank of Nepal has hired ACI Worldwide to build a payment switch to enable interoperable card payments for merchants, and more.

TheGuardian

FEBRUARY 7, 2024

Alessandro DiNello, new executive chairman of regional US lender, acknowledges ‘serious situation’ as stock at lowest level in decades Shares in New York Community Bancorp (NYCB) continued to fall on Wednesday, heightening unease about the US’s regional banking sector. The bank’s stock has fallen by more than 60% to its lowest level in decades in recent days despite a scramble by the mid-sized lender to reassure investors of its financial strength.

BankInovation

FEBRUARY 7, 2024

Jack Henry updated its tech modernization strategy during its fiscal second quarter, the technology provider announced during its earnings call today.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

American Banker

FEBRUARY 7, 2024

Anne Clarke Wolff, a longtime Most Powerful Women in Banking honoree, on why she left big banking to start her own investment bank advisory firm.

BankInovation

FEBRUARY 7, 2024

BNY Mellon has expanded its use of Microsoft for cloud services and AI models, according to a Feb. 5 release from the bank.

American Banker

FEBRUARY 7, 2024

The San Francisco-based electronic signature company's chief executive Allan Thygesen announced Tuesday that roughly 400 employees across the company were being let go as part of restructuring for the 2025 fiscal year.

BankInovation

FEBRUARY 7, 2024

Jack Henry updated its tech modernization strategy during its fiscal second quarter, the technology provider announced during its earnings call today.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

American Banker

FEBRUARY 7, 2024

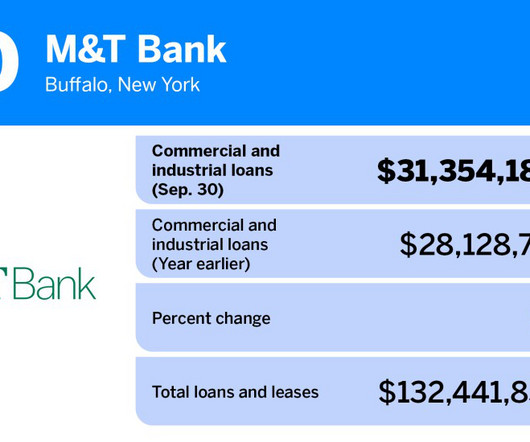

The top five banks and thrifts have more than $1 trillion in combined commercial and industrial loans as of September 30, 2023.

The Paypers

FEBRUARY 7, 2024

UK-based financial services provider Ebury has launched a new solution for direct transactions between the Brazilian real and the Chinese yuan.

American Banker

FEBRUARY 7, 2024

Financial institutions' fintech partnerships are facing higher levels of scrutiny. More consistent and direct monitoring of their partners can put them in a better position.

The Paypers

FEBRUARY 7, 2024

Payment network UnionPay International has partnered with Spring Airlines to allow the latter’s website to accept UnionPay cards for tourists and business travellers.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

American Banker

FEBRUARY 7, 2024

Just weeks ago, prospects seemed strong for bank stocks to regain ground after a volatile 2023. But renewed credit concerns stemming from issues at New York Community Bancorp, and the increasing odds that interest rates will remain high for months, have dampened that outlook.

The Paypers

FEBRUARY 7, 2024

UK-based embedded finance partner for brands, Aro has announced its collaboration with Equifax in order to deliver a new data-driven marketplace.

American Banker

FEBRUARY 7, 2024

As virtual assistants become central to banking, financial institutions of all sizes must embrace and leverage this transformation to redefine the customer experience.

The Paypers

FEBRUARY 7, 2024

Germany-based Commerzbank AG has announced its partnership with Surecomp to deploy its DOKA-NG tool for back-office trade finance processing across several entities.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

American Banker

FEBRUARY 7, 2024

The regional bank announced a leadership shakeup on Wednesday, capping a tumultuous week in which shareholders became spooked about its exposure to the commercial real estate sector.

The Paypers

FEBRUARY 7, 2024

Allevo has announced its decision to provide 17 banks and financial institutions with access to its new ReGIS system, operated by the National Bank of Romania.

American Banker

FEBRUARY 7, 2024

Banks historically have been averse to challenging their regulators in court, but a suit over the recently finalized Community Reinvestment Act implementation rules is a signal that the times have changed.

The Paypers

FEBRUARY 7, 2024

US-based bank Wells Fargo has partnered with Setpoint , a financial services provider, to enable the latter to expand its payment disbursement capabilities.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Let's personalize your content