Mastercard preps for China business

Payments Dive

FEBRUARY 1, 2024

The card network is readying to offer Chinese consumers its card services domestically after winning approval last year for a joint venture in that country.

Payments Dive

FEBRUARY 1, 2024

The card network is readying to offer Chinese consumers its card services domestically after winning approval last year for a joint venture in that country.

TheGuardian

FEBRUARY 1, 2024

Out-of-court settlement reached with law firm acting for customers who have been left owing big sums One of Britain’s biggest high street banks has agreed a payout to settle a case involving “unfair” mortgages – giving hope to thousands of people who have been left owing huge sums. On the eve of a trial set to last six weeks, Bank of Scotland – part of Lloyds Banking Group – and a law firm representing 160 current and former customers reached an out-of-court settlement that means the bank will n

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 1, 2024

Acquiring the digital rewards startup will bolster Blackhawk Network’s rewards platform, the gift card company said.

TheGuardian

FEBRUARY 1, 2024

Shadow chancellor is warned that decision will be unpopular with voters, including those in ‘red wall’ seats Senior Labour figures have been left annoyed and perplexed by Rachel Reeves’s surprise announcement that the party will not reinstate a cap on bankers’ bonuses if it wins the next election. The shadow chancellor said on Wednesday that she had “no intention” of bringing back the cap , introduced after the 2008 financial crisis to limit annual payouts to twice a banker’s salary, saying she

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Jeff For Banks

FEBRUARY 1, 2024

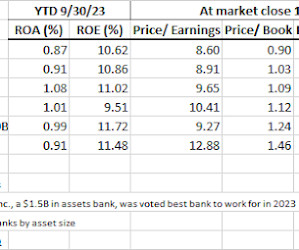

Now that the debate is turning from Fed tightening to when the Fed will start dropping rates, we took a look at how financial institutions fared during the tightening cycle, using the quarter ended December 31, 2021 as the base period. The Fed began tightening at its March 17, 2022 meeting with a 25 basis points increase in the Fed Funds Rate and ended July 26, 2023.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

FEBRUARY 1, 2024

Experts explain which features customers expect, which they love and where banks are creating a competitive edge with their apps.

TheGuardian

FEBRUARY 1, 2024

Shadow chancellor Rachel Reeves unveils raft of measures at business summit aimed at boosting investment, productivity and certainty Labour will not raise corporation tax above its current rate of 25% during the next parliament, the party has pledged, in an attempt to offer businesses greater certainty. Shadow chancellor Rachel Reeves said the tax pledge included maintaining full expensing, which allows businesses that invest in IT equipment and machinery to claim back up to 100% of the cost of

Gonzobanker

FEBRUARY 1, 2024

Turn up “Whole Lotta Love” and let the pure adrenalin rush of Jimmy Page’s intro accompany this year’s Acquire or Be Acquired recap … In the ever-evolving world of banking, Bank Director’s Acquire or Be Acquired Conference remains a constant. Early this week, the conference was the epicenter of discussions, where 2,000 attendees descended upon Arizona to strategize and set the tone for our great industry’s future.

TheGuardian

FEBRUARY 1, 2024

Toxic Tories have run themselves out as Starmer brings out the big hitters for a day at the Oval It was the hottest gig in town. Within hours of the event being announced all the £1,000 a head tickets had gone. Thank God for those uncapped bonuses. Anyone who was anyone in the business world was here. Executives from Goldman Sachs, Google, Mastercard, HSBC and countless more besides.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

American Banker

FEBRUARY 1, 2024

A day after the regional bank's stock tumbled on tough fourth-quarter results and some austerity moves, observers debated whether management just needs time to build enough capital to catch up with growth or if it is still too overexposed in multifamily lending.

CFPB Monitor

FEBRUARY 1, 2024

In October 2023, the CFPB issued a groundbreaking proposal on personal financial data. This episode, which repurposes a webinar, begins with a review of the background of the rulemaking. We then discuss key provisions of the proposal, including the entities, data, and financial products and services that would be covered, the obligations that would be imposed on covered entities, and exceptions to the proposal’s requirements. .

American Banker

FEBRUARY 1, 2024

With tougher capital requirements looming, a number of regionals including U.S. Bancorp, Huntington and Santander are using these new instruments to share risk with nonbank investors and lighten their capital load. Experts point out the pros and cons.

TheGuardian

FEBRUARY 1, 2024

German bank becomes latest global lender to target staff in post-pandemic cost reductions Deutsche Bank is to cut 3,500 jobs, making it the latest global lender to target employees as part of post-pandemic cost reductions, amid a drop in profits. The German bank said that while it had made progress on a €2.5bn (£2.1bn) cost-cutting programme that it first announced in 2022, it still needed to save €1.6bn of that total, meaning thousands of staff had to go.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

FEBRUARY 1, 2024

The embattled bank said it reviewed and then turned down a $3.25-per-share bid from Dream Chasers Capital. Carver called the offer "unrealistically low" given the bank's "intrinsic value.

BankInovation

FEBRUARY 1, 2024

Deutsche Bank is reducing costs bankwide through automation and technology efforts. The $578 billion, Germany-based bank is using simplified workflows and automation on the front end and application decommissioning and operation model improvements on the back end, Chief Executive Christian Sewing said during today’s Q4 earnings call.

American Banker

FEBRUARY 1, 2024

Banks can choose to only receive transactions instantly, and it's the most popular choice. Simply preferring to get paid faster isn't the reason.

BankInovation

FEBRUARY 1, 2024

ING Bank invested in its digital infrastructure in 2023 and expects to reap the benefits of those tech advancements in 2024 as the bank plans to spend less on technology this year.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

TheGuardian

FEBRUARY 1, 2024

The shadow chancellor, Rachel Reeves, says Labour would not reinstate a cap on bankers' bonuses, to ensure stability for businesses operating in the UK. Reeves said the former chancellor Kwasi Kwarteng's decision to lift the measure – introduced after the 2008 financial crisis – was the wrong priority, but she defended her party's U-turn. 'The last thing we need is more chopping and changing,' she told a London audience Frustration in Labour ranks over Reeves’s refusal to reinstate bankers’ bonu

BankInovation

FEBRUARY 1, 2024

BNP Paribas is looking to use AI and gen AI for revenue generation and cost optimization. “In 2023, we continued to invest in technology and in artificial intelligence,” Chief Executive Jean-Laurent Bonnafe said during the company’s fourth-quarter earnings call today.

American Banker

FEBRUARY 1, 2024

The Birmingham, Alabama bank cut down its workforce across divisions as higher interest rates put pressure on its business.

The Paypers

FEBRUARY 1, 2024

Branded payment technologies firm Blackhawk Network (BHN) has announced that it entered a definitive agreement to acquire Tango Card.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

FEBRUARY 1, 2024

The Treasury Department's Financial Crimes Enforcement Network fined a New York credit union employee $100,000 Wednesday in connection with a scheme to launder $1 billion using armored trucks and the credit union's Fed master account.

The Paypers

FEBRUARY 1, 2024

Real-time payments platform Volt has announced its partnership with Bumper in order to provide Open Banking services to major car dealerships in the UK and Europe.

The Financial Brand

FEBRUARY 1, 2024

This article Why Did Fintech Stumble? appeared first on The Financial Brand. For all its meteoric growth, fintech was beset by five critical weaknesses. The winners in the next round must overcome them all. This article Why Did Fintech Stumble? appeared first on The Financial Brand.

The Paypers

FEBRUARY 1, 2024

Wirex has introduced early access to WPay, a decentralised payment network, leveraging the Wirex platform's capabilities.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content