Cross-border payments startup Keeta snags $17M

Payments Dive

JUNE 7, 2023

Former Google CEO Eric Schmidt is among the investors in Keeta, which enters a competitive cross-border market.

Payments Dive

JUNE 7, 2023

Former Google CEO Eric Schmidt is among the investors in Keeta, which enters a competitive cross-border market.

Perficient

JUNE 7, 2023

On May 31, the Federal Deposit Insurance Corporation (FDIC) reported to the public what many banks already knew and had been experiencing for the past year – that deposits are declining in the American banking sector. There has almost been $1.2 Trillion removed from the banking system over the past year. In addition, the recent banking stress, which resulted in several large bank failures, has amplified the outflow of deposits from the banking system, causing total deposits to decline for the fo

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

JUNE 7, 2023

Yours might be the case of the emperor lacking clothes. While many banks are helping their clients with employee retention credits (ERC) (If you are not, see HERE ), many banks with 500 employees or less still need to collect their OWN ERC rebates. During the pandemic, most banks retained their employees and suffered higher costs, lower customer interactions, less branch traffic, and a revenue drop in many business lines.

Payments Dive

JUNE 7, 2023

“As the CFPB prepares to release new regulatory guidance on BNPL providers, it is important that any new regulations do not stifle the industry's growth and limit its availability,” writes one checkout services CEO.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Gonzobanker

JUNE 7, 2023

The launch of Charlie points to an underserved niche in banking: older adults. Well, it happened. At last. In mid-May, a digital bank account for the 62+ crowd debuted in the United States. It’s called Charlie , and its appeal is emotional. “You’ve been the everything to everyone. Now it’s your turn” reads the tagline on its website. At first glance, the account resembles plenty of others – free ATM access at thousands of locations, no monthly fees and no minimum account balances.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

JUNE 7, 2023

Barclay family have lost control of crown jewel media assets in bitter row with newspaper group’s lender Business live – latest updates The Daily and Sunday Telegraph are to be put up for sale in an auction after the Barclay family lost control of their crown jewel media assets in a bitter row with the newspaper group’s lender. Lloyds Banking Group is understood to have appointed AlixPartners as the official receiver to seize the shares owned by the Barclay family in the holding company that ult

American Banker

JUNE 7, 2023

The measure will prevent banks chartered elsewhere from charging interest rates above Colorado's 36% rate cap. If additional states take the same approach, it could hamper the business model for high-cost consumer lenders that partner with banks.

TheGuardian

JUNE 7, 2023

A survey of the last 100 years of financial disasters shows that they’re a fact of life – but there are lessons to be learned For those who pay close attention to the business pages, recent weeks have made for nervous reading. One after another, regional US banks with billions of dollars on their books have collapsed. European banking stalwart CreditSuisse was bought in a fire sale.

American Banker

JUNE 7, 2023

This week in global news: JPMorgan Chase works on blockchain in India, U.K. reps want faster crypto regs and more.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

BankInovation

JUNE 7, 2023

Financial institutions must consider the efficiencies and limitations of artificial intelligence when deploying chatbots as client adoption grows and regulators address pain points of the technology. According to the Consumer Financial Protection Bureau’s (CFPB) “Chatbots in Consumer Finance” report, released yesterday, adoption of bank chatbots is expected to hit 110.9 million users by 2026.

American Banker

JUNE 7, 2023

Widespread adoption of a central bank digital currency would utterly transform the financial services sector by reducing access to loans and raising prices for consumers.

BankInovation

JUNE 7, 2023

Capital One acquired luxury concierge service Velocity Black in a deal announced June 1 as the credit card giant seeks to bolster the perks offered to its customers. Terms of the deal were not made public.

American Banker

JUNE 7, 2023

Sen. Dick Durbin, D-Ill., has reintroduced a plan to reduce merchants' credit card acceptance costs, with more backing from bipartisan lawmakers.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

The Paypers

JUNE 7, 2023

Netherlands-based payment service provider Sprinque has secured EUR 20 million that will be channelled into supporting European B2B ecommerce merchants.

American Banker

JUNE 7, 2023

After shares dropped in the aftermath of recent failures, most banks demonstrated resilience and investors started to buy back into the sector.

The Paypers

JUNE 7, 2023

India-based payments provider PayU has launched, in collaboration with Visa and Yes Bank , the Business Payment Solution Provider programme.

American Banker

JUNE 7, 2023

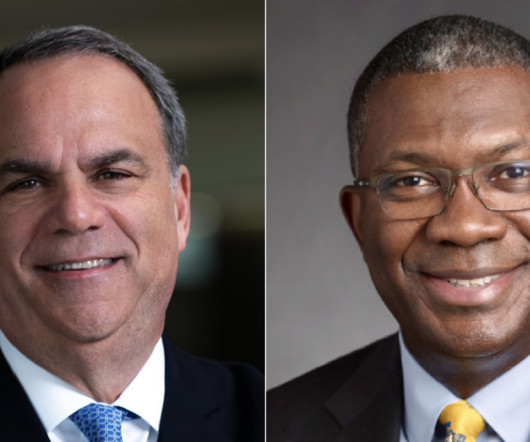

Robert Trunzo, who has led TruState since 2014, will retire in October. The company, previously called CUNA Mutual Group, hired Terrance Williams to replace him.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

The Paypers

JUNE 7, 2023

UAE-based B2B fintech solutions provider FOO has launched a prepaid travel card and white label digital wallet that addresses the needs of travellers.

American Banker

JUNE 7, 2023

The Providence, R.I.-based bank has been scaling down its indirect auto lending program since last year.

The Paypers

JUNE 7, 2023

Global software applications provider Finastra has partnered with S and P Global Market Intelligence to offer improved services in corporate and syndicated lending.

American Banker

JUNE 7, 2023

The interagency report recommends practices for financial institutions to manage relationships with fintechs and other third parties.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

The Paypers

JUNE 7, 2023

Nigeria-based fintech Flutterwave has opened up African merchants to buyers from the EU and the UK through a partnership with A2A payment provider Token.io.

American Banker

JUNE 7, 2023

Citigroup Chief Executive Officer Jane Fraser visited Beijing this week, joining other Wall Street executives to travel to China despite growing geopolitical tensions with the United States.

The Paypers

JUNE 7, 2023

Sweden-based Buy Now, Pay Later provider Klarna has launched in Romania with its ‘Pay in 3’ service and shopping app.

American Banker

JUNE 7, 2023

Addressing the Bloomberg Invest conference in New York on Wednesday, Fitzpatrick said mortgage-backed securities present a uniquely interesting investing opportunity.

Advertisement

Download the latest edition of GoDocs' "The Lender's Guide to Automating the Complex Loan." This comprehensive guide offers financial institutions valuable insights into document automation for complex commercial loans. It unpacks the intricacies of complex loans and showcases how an automation platform like GoDocs — the leading commercial loan closing platform — delivers impressive benefits and ROI to any FI.

Let's personalize your content