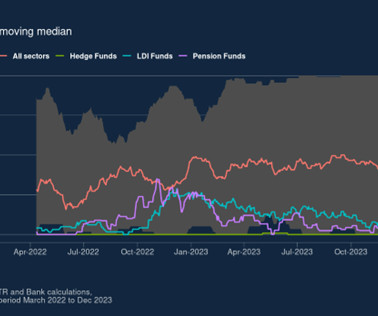

‘No one length fits all’ – haircuts in the repo market

BankUnderground

JULY 10, 2024

Miruna-Daniela Ivan, Joshua Lillis, Eduardo Maqui and Carlos Cañon Salazar Funding markets are crucial for healthy and active financial institutions, and consequently for everyone in the economy. The repurchase agreement (repo) market plays a key role in bank and non-bank financial institutions’ (NBFIs’) daily activities by facilitating short-term financing and risk hedging.

Let's personalize your content