Visa, Western Union partner on cross-border payments

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

TheGuardian

MARCH 6, 2024

Coalition of advocacy groups warn that deal would ‘further concentrate risk’ in the financial system and ‘must be stopped’ Regulators have been urged to block Capital One’s $35bn takeover of Discover by campaigners who say the blockbuster deal is “dangerous, illegal, and must be stopped”. Urging the Federal Reserve and Department of Justice to intervene, a coalition of more than a dozen advocacy groups cautioned that combining two of the largest credit card companies in the US would damage compe

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 6, 2024

Healthcare providers have reported significant challenges to their day-to-day operations, including problems receiving payment from patients and insurers.

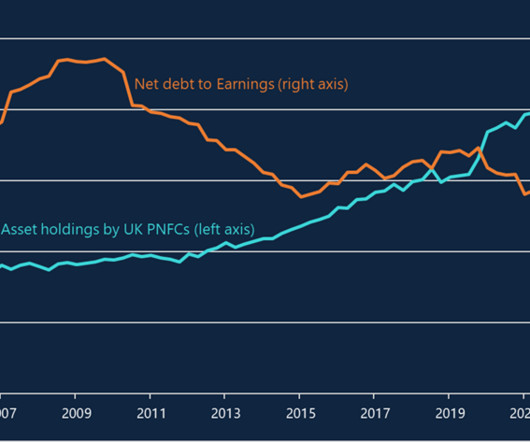

BankUnderground

MARCH 6, 2024

Laura Achiro and Neha Bora Central banks in most advanced economies have tightened monetary policy by raising interest rates. Tighter financing conditions may make it harder for some businesses to refinance their debt or could mean they face less favourable terms when they do. This blog explores the extent to which bond maturities could crystallise these refinancing risks.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

MARCH 6, 2024

The issuing-processing fintech sees a bigger opportunity in regions outside the U.S. to sell its core banking services, founder and CEO Amir Wain said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 6, 2024

The convenience retailer is the latest to add this capability as it seeks to win over more business from corporate accounts and professional drivers.

American Banker

MARCH 6, 2024

In 2023, the Biden administration pledged to reduce "junk fees." Ahead of this year's State of the Union, we revisit what progress has been made.

Payments Dive

MARCH 6, 2024

The c-store and fuel giant will overhaul its BPme platform as it looks to create an enhanced purchasing experience, a spokesperson said.

American Banker

MARCH 6, 2024

Monzo raises a $430 million investment to accelerate its expansion in the U.S.; Stripe adds support for Tap to Pay on iPhone; and more in this week's global payments news roundup.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

MARCH 6, 2024

The tech giant said it will expand in-app payments options in the EU, while cracking down on apps in India that it said refused to pay its fees.

The Paypers

MARCH 6, 2024

Turkey-based financial technology company Papara has announced the acquisition of T-bank for an undisclosed amount, with the deal awaiting regulatory approval.

American Banker

MARCH 6, 2024

Orlando-based Cogent Bancorp's Brandon Ghee, a former NFL player, has launched a business line focused on providing banking services to professional athletes and the growing number of college standouts earning six- and seven-figure incomes.

BankInovation

MARCH 6, 2024

James Dean, global generative AI specialist and financial services industry lead at Google Cloud, will speak at Bank Automation Summit U.S. 2024 on Monday, March 18, at 3:15 p.m. CT.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

MARCH 6, 2024

As the head of enterprise technology and security, Guild tries to stay ahead of fraudsters and other bad actors.

BankInovation

MARCH 6, 2024

JPMorgan subsidiary Neovest Holdings has acquired investment management company LayerOne Financial for an undisclosed sum. Neovest, a fintech for brokers and dealers, will now be able to help clients monitor portfolios, conduct risk assessments and send orders to their brokers, it stated in a March 1 release.

ABA Community Banking

MARCH 6, 2024

The company's technology is designed to align with the U.S. financial sector's push to diversify loan portfolios—particularly highlighted by risks exposed by the bank failures of the past year. The post Fintech startup focused on asset risk builds bank advisory board, gets Citi Ventures funding appeared first on ABA Banking Journal.

The Paypers

MARCH 6, 2024

BRICS has made efforts to create payment system based on digital currencies and blockchain to reduce reliance on US dollars in settlement.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

ATM Marketplace

MARCH 6, 2024

ATM attacks may differ in methods and intensity across regions, but many common global attack patterns exist. Some of these attacks are escalating at an alarming rate and becoming worldwide concerns. Criminal groups are now highly organized, specialized, and targeting specific attack vectors, particularly on ATMs.

The Paypers

MARCH 6, 2024

The European Union has agreed on the 13th package of sanctions against the Russian Federation following two years of aggression in Ukraine.

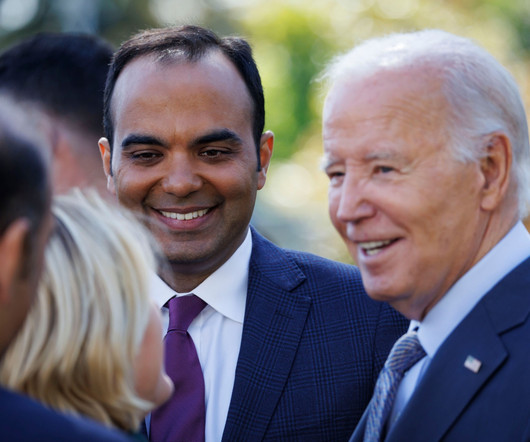

American Banker

MARCH 6, 2024

President Joe Biden is expected to lean in on banking issues such as credit card late fees and overdraft fees Thursday evening in his annual address to Congress. However, he likely will avoid the topic of financial-sector stability, even amid a private-sector rescue of New York Community Bancorp.

BankInovation

MARCH 6, 2024

JPMorgan subsidiary Neovest Holdings has acquired investment management company LayerOne Financial for an undisclosed sum. Neovest, a fintech for brokers and dealers, will now be able to help clients monitor portfolios, conduct risk assessments and send orders to their brokers, it stated in a March 1 release.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

MARCH 6, 2024

Brazil's Pix network, at just three years old, now accounts for 15% of all global real-time payments — and its success is inspiring projects in other countries.

The Paypers

MARCH 6, 2024

Global payment orchestration platform Yuno has announced that it secured USD 25 million from a consortium of investors, aiming to leverage it to advance operations.

American Banker

MARCH 6, 2024

The Securities and Exchange Commission finalized a pared-down version of rules governing climate-risk disclosure by public companies first proposed in March 2022. Experts say even the weakened rule will likely face challenges in Congress and the courtroom.

The Paypers

MARCH 6, 2024

Eurojust has aided a multinational investigation on EUR 2 billion money laundering scheme, implicating 3 main suspects across Italy, Latvia, and Lithuania.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content