Visa, Western Union partner on cross-border payments

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

Payments Dive

MARCH 6, 2024

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

American Banker

MARCH 6, 2024

The troubled bank saw its stock rebound on Wednesday after former Trump administration officials Steven Mnuchin and Joseph Otting announced a major investment. Otting is expected to serve as CEO, and Mnuchin will have a board seat.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MARCH 6, 2024

Healthcare providers have reported significant challenges to their day-to-day operations, including problems receiving payment from patients and insurers.

TheGuardian

MARCH 6, 2024

Coalition of advocacy groups warn that deal would ‘further concentrate risk’ in the financial system and ‘must be stopped’ Regulators have been urged to block Capital One’s $35bn takeover of Discover by campaigners who say the blockbuster deal is “dangerous, illegal, and must be stopped”. Urging the Federal Reserve and Department of Justice to intervene, a coalition of more than a dozen advocacy groups cautioned that combining two of the largest credit card companies in the US would damage compe

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Payments Dive

MARCH 6, 2024

The issuing-processing fintech sees a bigger opportunity in regions outside the U.S. to sell its core banking services, founder and CEO Amir Wain said.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MARCH 6, 2024

The convenience retailer is the latest to add this capability as it seeks to win over more business from corporate accounts and professional drivers.

American Banker

MARCH 6, 2024

The letter, which was sent to bank regulators, represents a further escalation of lawmaker criticism of the Basel III endgame proposal, and comes just as Federal Reserve Chairman Jerome Powell is set to testify in the House Financial Services Committee.

Payments Dive

MARCH 6, 2024

The c-store and fuel giant will overhaul its BPme platform as it looks to create an enhanced purchasing experience, a spokesperson said.

BankInovation

MARCH 6, 2024

James Dean, global generative AI specialist and financial services industry lead at Google Cloud, will speak at Bank Automation Summit U.S. 2024 on Monday, March 18, at 3:15 p.m. CT.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

Payments Dive

MARCH 6, 2024

The tech giant said it will expand in-app payments options in the EU, while cracking down on apps in India that it said refused to pay its fees.

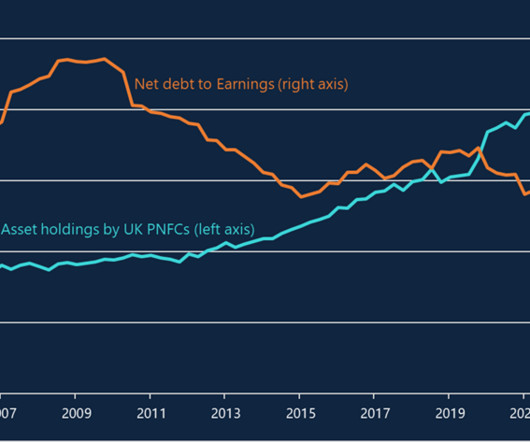

BankUnderground

MARCH 6, 2024

Laura Achiro and Neha Bora Central banks in most advanced economies have tightened monetary policy by raising interest rates. Tighter financing conditions may make it harder for some businesses to refinance their debt or could mean they face less favourable terms when they do. This blog explores the extent to which bond maturities could crystallise these refinancing risks.

American Banker

MARCH 6, 2024

Orlando-based Cogent Bancorp's Brandon Ghee, a former NFL player, has launched a business line focused on providing banking services to professional athletes and the growing number of college standouts earning six- and seven-figure incomes.

ABA Community Banking

MARCH 6, 2024

The company's technology is designed to align with the U.S. financial sector's push to diversify loan portfolios—particularly highlighted by risks exposed by the bank failures of the past year. The post Fintech startup focused on asset risk builds bank advisory board, gets Citi Ventures funding appeared first on ABA Banking Journal.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

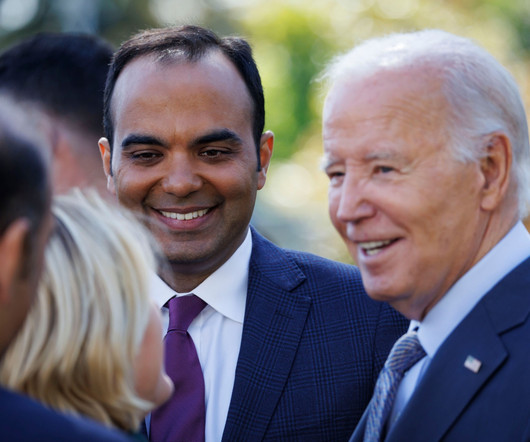

American Banker

MARCH 6, 2024

In 2023, the Biden administration pledged to reduce "junk fees." Ahead of this year's State of the Union, we revisit what progress has been made.

BankInovation

MARCH 6, 2024

JPMorgan subsidiary Neovest Holdings has acquired investment management company LayerOne Financial for an undisclosed sum. Neovest, a fintech for brokers and dealers, will now be able to help clients monitor portfolios, conduct risk assessments and send orders to their brokers, it stated in a March 1 release.

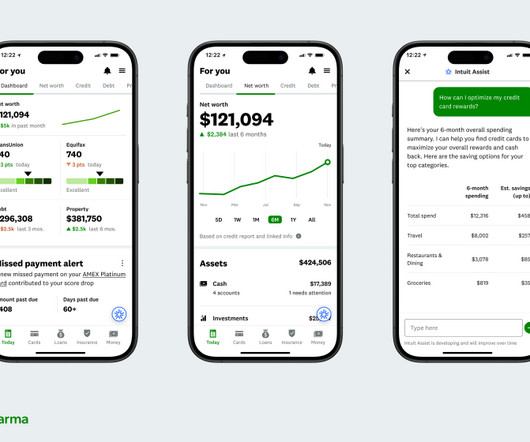

American Banker

MARCH 6, 2024

The personal finance site is rolling out changes to its app that incorporate AI-powered chat and explanatory articles customized to each user.

The Paypers

MARCH 6, 2024

Turkey-based financial technology company Papara has announced the acquisition of T-bank for an undisclosed amount, with the deal awaiting regulatory approval.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

MARCH 6, 2024

ATM attacks may differ in methods and intensity across regions, but many common global attack patterns exist. Some of these attacks are escalating at an alarming rate and becoming worldwide concerns. Criminal groups are now highly organized, specialized, and targeting specific attack vectors, particularly on ATMs.

The Paypers

MARCH 6, 2024

BRICS has made efforts to create payment system based on digital currencies and blockchain to reduce reliance on US dollars in settlement.

BankInovation

MARCH 6, 2024

JPMorgan subsidiary Neovest Holdings has acquired investment management company LayerOne Financial for an undisclosed sum. Neovest, a fintech for brokers and dealers, will now be able to help clients monitor portfolios, conduct risk assessments and send orders to their brokers, it stated in a March 1 release.

The Paypers

MARCH 6, 2024

The European Union has agreed on the 13th package of sanctions against the Russian Federation following two years of aggression in Ukraine.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

MARCH 6, 2024

As the head of enterprise technology and security, Guild tries to stay ahead of fraudsters and other bad actors.

The Paypers

MARCH 6, 2024

Global payment orchestration platform Yuno has announced that it secured USD 25 million from a consortium of investors, aiming to leverage it to advance operations.

American Banker

MARCH 6, 2024

President Joe Biden is expected to lean in on banking issues such as credit card late fees and overdraft fees Thursday evening in his annual address to Congress. However, he likely will avoid the topic of financial-sector stability, even amid a private-sector rescue of New York Community Bancorp.

The Paypers

MARCH 6, 2024

US-based Wasabi Technologies has announced the launch of its White Label OEM Program, aiming to deliver predictably priced, reliable and scalable cloud storage to users globally.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content