Fed official makes a case for the dollar’s hegemony

Payments Dive

FEBRUARY 27, 2024

Can the dollar’s reign as the world’s reserve currency persist? This Fed official makes a strong case, but digital doubts may remain.

Payments Dive

FEBRUARY 27, 2024

Can the dollar’s reign as the world’s reserve currency persist? This Fed official makes a strong case, but digital doubts may remain.

Perficient

FEBRUARY 27, 2024

This blog was co-authored by Perficient’s Insurance Principal and expert: Brian Bell As we step into 2024, the insurance industry faces significant transformations driven by technological advancements and evolving customer expectations. Let’s explore the key trends reshaping the insurance landscape and how they are set to redefine the industry’s future.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 27, 2024

The blockbuster deal is set “to trigger a bunch of rethinking across the industry,” said Erin McCune, a partner at consulting firm Bain & Company.

South State Correspondent

FEBRUARY 27, 2024

Community bankers need to practice realistic loan pricing discipline. However, we need to understand the meaning of pricing discipline and its effect on community bank performance. In this article, we would like to define loan pricing discipline and cover bid, why it matters, and demonstrate how most community banks currently are not using loan pricing discipline.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Payments Dive

FEBRUARY 27, 2024

The senator urged regulators to block the deal and took the OCC to task for its approval record. Meanwhile, JPMorgan CEO Jamie Dimon advocated for Capital One to get a fair shake.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

FEBRUARY 27, 2024

Erik Hoag, a long-time FIS executive who stepped down from the CFO seat in August after just one year, was named chief integration officer.

American Banker

FEBRUARY 27, 2024

American Banker's Most Influential Women in Payments share their views on artificial intelligence, hybrid offices, real-time payments and more.

Payments Dive

FEBRUARY 27, 2024

The tech giant’s smart shopping carts, designed to speed up the checkout process, are now available for use in a California Whole Foods store.

Ublocal

FEBRUARY 27, 2024

Effectively integrating all aspects of your financial picture—from retirement goals to philanthropic wishes—into your estate planning process isn’t always easy. This is especially true when you have accounts and investments at multiple financial institutions, as well as real estate and other assets. Wealth management is an integral part of successful estate planning, helping you locate and catalog your assets while maintaining and growing your wealth—so you can secure your legacy and provide for

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

ATM Marketplace

FEBRUARY 27, 2024

ATM fees can be a major point of contention for consumers. No one likes to pay for a service that they are used to receiving for free by using their bank's ATM. However, surcharge ATMs run by independent operators can still be a lucrative business.

American Banker

FEBRUARY 27, 2024

Helping programmers become more productive, modernizing legacy systems and conducting compliance assessments are among the hundreds of gen AI use cases in production or in the pipeline for Shadman Zafar, co-CIO for Citi and lead for the bank's generative AI work.

CFPB Monitor

FEBRUARY 27, 2024

The U.S. Department of Housing and Urban Development (HUD) recently announced a Payment Supplement loss mitigation program for Federal Housing Administration (FHA) insured Title 2 mortgage loans, the details of which are set forth in Mortgagee Letter 2024-02. Mortgage servicers may begin implementing the Payment Supplement on May 1, 2024, but must implement the solution for all eligible borrowers by January 1, 2025.

American Banker

FEBRUARY 27, 2024

Honorees from 2024's Most Influential Women in Payments, representing companies such as MoneyGram, Walmart, Segpay and more, share insights into how how artificial intelligence is changing their companies and their industry.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

William Mills

FEBRUARY 27, 2024

Imagine your fintech wants to announce a new product, partnership, or award. You might think a press release is your best option, but this isn’t always the case.

American Banker

FEBRUARY 27, 2024

CEO Charlie Scharf has added another former JPMorgan Chase colleague to his leadership team as his shake-up of Wells Fargo continues. The hire of veteran investment banker Doug Braunstein comes as Scharf makes progress on his efforts to grow Wells' investment bank.

CFPB Monitor

FEBRUARY 27, 2024

On February 22, 2024, California Attorney General Rob Bonta issued letters (the “AG Letter”) to California’s 197 state-chartered banks and credit unions warning that overdraft and returned deposited item fees may violate California’s Unfair Competition Law (UCL) and the federal Consumer Financial Protection Act (CFPA). The AG Letter encourages the institutions to review their practices and policies regarding: “(1) surprise overdraft fees, which are assessed even when a consumer cannot reasonably

BankInovation

FEBRUARY 27, 2024

LONDON — ING Bank saw increased adoption of its video-based customer service options in 2023, specifically for mortgage applications. “Almost 50% of customers use digital channels for purchasing banking products,” Lukasz Parzyk, expert lead at ING, said at FinovateEurope 2024 today.

Advertiser: ZoomInfo

In today’s ultra-competitive markets, it’s no longer enough to wait for buyers to show obvious signs of interest. Instead, sales teams must be proactive, identifying and acting on nuanced buyer behaviors — often before prospects are fully ready to make a purchase. In this eBook from ZoomInfo & Sell Better, learn 10 actionable ways to use these buyer signals to transform your sales strategy and close deals faster.

American Banker

FEBRUARY 27, 2024

The Toronto-based company wrung out $800 million USD in cost savings in connection with last year's acquisition of Bank of the West, a bright spot in an otherwise tough quarter across most business segments.

BankInovation

FEBRUARY 27, 2024

Subprime lender Arivo Acceptance Chief Executive Landon Starr will continue to embrace technology while making structural adjustments to the company’s operations in his new role. Starr aims to create a structure that facilitates “more empathy, collaboration and integration of technology,” he told Auto Finance News, a sister publication to Bank Automation News.

American Banker

FEBRUARY 27, 2024

Luis Valdich, managing director of Citi Ventures, and Alex Sion, managing partner of private equity firm Motive Partners, explain how they envision advanced AI changing work in financial services.

BankInovation

FEBRUARY 27, 2024

Artificial intelligence is likely to replace or at least lend a hand in tasks that take up almost three-quarters of the time bank employees now spend working. That’s the conclusion of a new analysis by consultancy Accenture, which said banking has the potential to benefit more from the technology than any other industry.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

American Banker

FEBRUARY 27, 2024

Many banks could benefit greatly from overhauling their internal culture when it comes to meetings. Both performance and morale stand to benefit.

BankInovation

FEBRUARY 27, 2024

Artificial Intelligence (AI) is a game-changer in financial services, particularly in detecting and preventing fraud. It is proving its efficacy in identifying bank statement fraud, by leveraging the concept of fraud knowledge graphs. Fraud manifests in various ways. A common pattern is the replication of identical content across multiple bank statements.

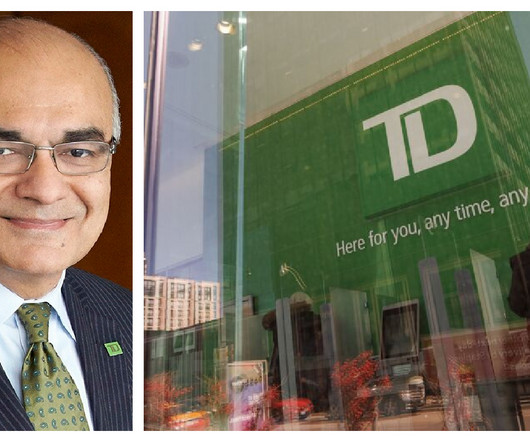

American Banker

FEBRUARY 27, 2024

Bharat Masrani has spent a decade as the Canadian bank's top executive and is pushing 70. But as the bank undergoes a U.S. Justice Department probe, it's unclear when he'll step down or who's next in line.

The Paypers

FEBRUARY 27, 2024

MENA-based Buy Now, Pay Later platform Tabby has announced the launch of Tabby+, a monthly subscription service in the UAE.

Advertiser: ZoomInfo

As prospects define their problem, search for solutions, and even change jobs, they are generating high-value signals that the best go-to-market teams can leverage to close more deals. This is where signal-based selling comes into play. ZoomInfo CEO Henry Schuck recently broke down specific ways to put four key buying signals into action with the experts from 30 Minutes to President’s Club.

Let's personalize your content